Reinvesting in your business is one of the most important decisions you’ll make as an entrepreneur. Whether you run a small local shop or a burgeoning tech startup, the choice to reinvest profits can dictate the future growth and sustainability of your company. However, knowing how much should you reinvest in your business and when is not always straightforward, especially when operating in an economic environment.

This article will explore the key factors that influence reinvestment decisions, practical tips for determining how much of your profit should go back into your business, and how the economic landscape and regulations may impact this decision.

Why Reinvesting is Crucial

Think of a business like a tree. If you don’t water it, it stops growing. Reinvestment is that water, it keeps your business strong, competitive, and ready for new opportunities.

Every thriving company reinvests. Amazon started as a small online bookstore, but Jeff Bezos funneled profits into new products, faster shipping, and better infrastructure. That’s how it became an e-commerce giant. Whether you run a startup or a local shop, setting aside money for growth isn’t optional, it’s what separates businesses that scale from those that stall.

Reinvestment fuels everything from better marketing and new product lines to hiring skilled employees and upgrading technology. Without it, competitors will leave you behind. But here’s the catch, too much reinvestment without a plan can drain your cash flow and put you at risk. The key is balance.

Many business owners hesitate, thinking reinvestment is a luxury. It’s not. It’s the foundation of long-term success. The best part? You don’t need deep pockets just a smart strategy that aligns with your goals.

Here’s why reinvestment is essential:

- Sustains business growth – Without reinvestment, your business remains stagnant. Growth requires continuous improvement, whether in operations, products, or market reach.

- Strengthens competitive advantage – The business world moves fast. Reinvesting helps you stay ahead by improving efficiency, innovation, and customer satisfaction.

- Builds financial resilience – Companies that reinvest are better equipped to handle economic downturns and unexpected challenges, reducing long-term risks.

- Attracts and retains customers – Customers expect quality, speed, and innovation. A well-reinvested business delivers better products, services, and experiences.

- Increases long-term profitability – While reinvesting may reduce short-term profits, it builds a stronger foundation for sustained revenue and higher returns in the future.

“Now that we understand why reinvestment is vital, the next step is determining how much is appropriate. Several factors influence this decision, let’s explore them.

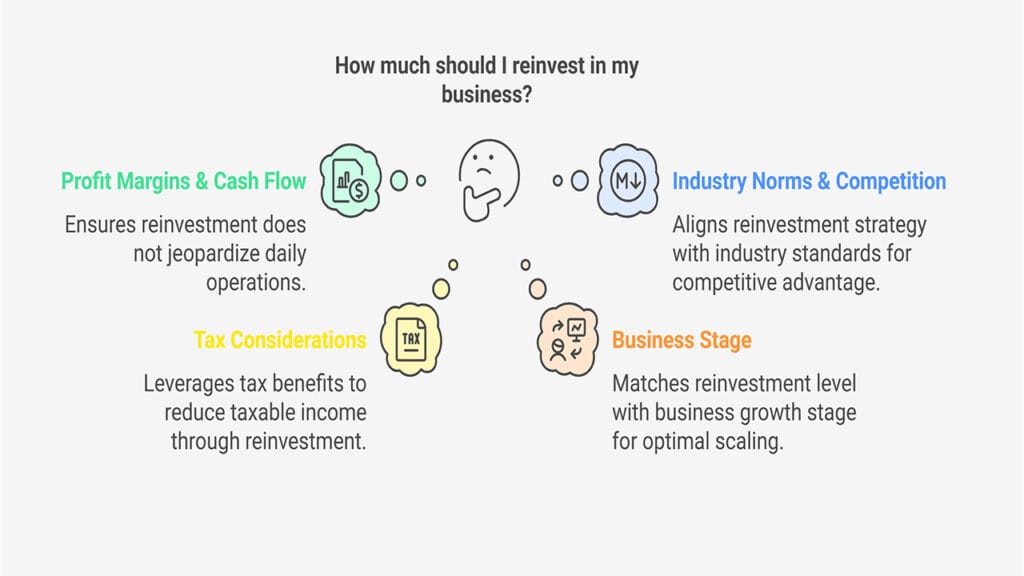

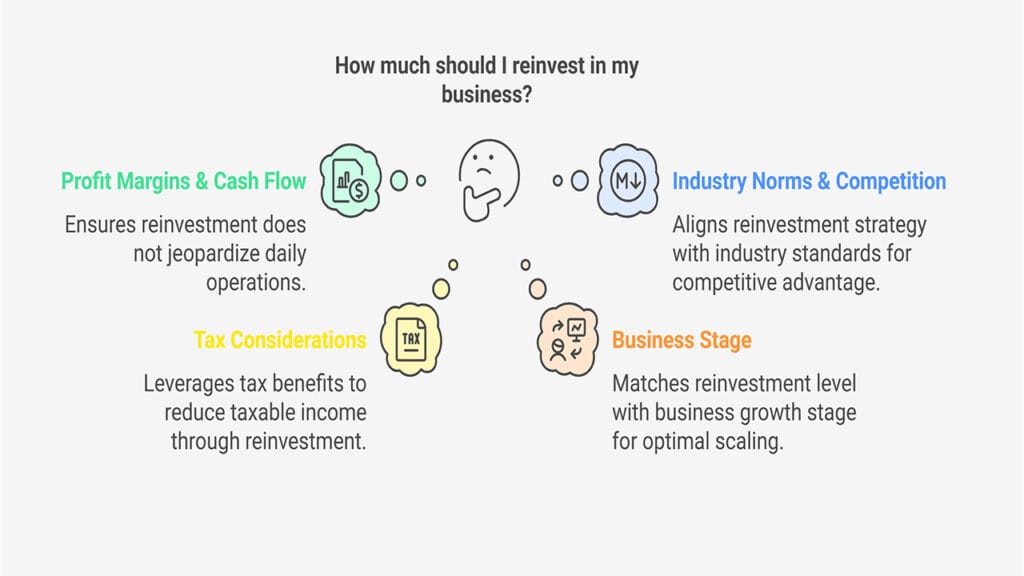

Key Factors to Consider Before Reinvesting

Current Profit Margins and Cash Flow

Before deciding how much to reinvest, you need a clear understanding of your profit margins and cash flow. Small businesses often face high operating costs due to rent, taxes, labor, and supply chain expenses. A strong cash flow ensures you can reinvest without putting daily operations at risk.

To gauge your reinvestment capacity:

- Calculate your net profit margin to understand how much of your revenue is actual profit.

- Track cash flow trends over several months to spot seasonal fluctuations.

- Set aside an emergency reserve before allocating funds to reinvestment.

For example, reinvesting heavily when cash flow is tight could lead to liquidity issues, forcing you to take on debt or cut essential expenses. The key is to strike a balance, grow your business while maintaining financial stability.

Industry Norms and Competition

Reinvestment strategies vary widely across industries. A tech startup may reinvest 50–100% of its profits in early years to scale quickly, focusing on product development and customer acquisition. In contrast, retail businesses typically reinvest 20–30%, prioritizing inventory, store expansion, and marketing.

To determine a smart reinvestment strategy for your industry:

- Research industry benchmarks to see how competitors allocate their profits.

- Consider your business stage, early-stage companies often reinvest aggressively, while mature businesses may focus on optimizing efficiency.

- Identify key areas where reinvestment will give you a competitive edge, such as technology, talent acquisition, or customer experience.

Understanding industry norms helps ensure you’re reinvesting strategically, not too conservatively, where growth stalls, and not too aggressively, where financial risks increase.

Tax Considerations

As a business owner, understanding corporate tax structure is essential when deciding on reinvestment.

For example, businesses in Ontario pay a combined federal and provincial corporate tax rate of 12.2% for small businesses (on the first $500,000 of active business income). Reinvesting profits into the business could help reduce your taxable income, as certain expenses like marketing, hiring, or equipment upgrades are deductible.

Your Business Stage

The age and size of your business will play a big role in how much you should reinvest.

- Startup Phase: Businesses in the early stages typically need to reinvest heavily, often 50–100% of profits to achieve growth. For example, an Ontario-based software company might use all its profits to hire developers and scale its product.

- Growth Phase: Businesses that have gained traction but are not yet mature often reinvest 30–50% of their profits to maintain momentum.

- Mature Phase: For established businesses with steady cash flow, reinvestment percentages may drop to 10–30%, focusing more on maintaining operations and innovation rather than rapid growth.

Key Factors That Determine How Much to Reinvest

Reinvesting isn’t about throwing money at your business and hoping for the best, it’s about making smart, strategic moves. But how much should you set aside? That depends on several key factors. Let’s break them down so you can make the right decision.

Business Stage and Growth Goals

A startup is like a new plant, it needs constant care to grow. Every dollar counts, whether it’s for product development, marketing, or building a customer base. That’s why many startups reinvest 50% or more of their profits, focusing on rapid growth to stay ahead.

Established businesses, on the other hand, have different priorities. Growth is still important, but so is stability. If your company is profitable, reinvestment shifts from survival to expansion, maybe you want to open a new location, improve efficiency, or reach new customers. In this case, reinvesting 20-30% of profits is common while keeping enough cash for operations and unforeseen challenges.

Industry and Business Model

Not all businesses require the same level of reinvestment. A tech company might put most of its profits into research, new features, and marketing. A restaurant may need to upgrade equipment, hire staff, or improve its location.

- Product-based businesses often reinvest in inventory, manufacturing, and distribution.

- Service-based businesses focus on branding, staff training, and automation.

- E-commerce stores typically reinvest in website upgrades, advertising, and fulfillment processes.

The key is understanding what fuels growth in your industry and directing funds where they’ll have the most impact.

Revenue, Profit Margins, and Cash Flow

Reinvestment should never put you in financial trouble. Before deciding how much to reinvest, consider these three factors:

- Revenue: Are sales steady or seasonal? If your income fluctuates, reinvest cautiously to avoid cash shortages.

- Profit Margins: Higher-margin businesses can reinvest more aggressively, while lower-margin businesses must balance reinvestment with maintaining stability.

- Cash Flow: If your expenses regularly exceed your income, reinvesting too much can drain your reserves. Always ensure your cash flow supports growth without putting daily operations at risk.

Competition and Market Trends

If your competitors are evolving, staying the same isn’t an option. Companies that reinvest in innovation, customer experience, and marketing often dominate their industries.

Think about where your market is headed. Are new technologies or consumer preferences reshaping your industry? Businesses that reinvest in adapting to these changes stay ahead, while those that don’t eventually fall behind.

Reinvesting wisely is the difference between growth and stagnation. Now that you know what affects how much to reinvest, let’s dive into the numbers, how much should you put back into your business?

How to Determine the Right Reinvestment Percentage

Reinvestment is essential for business growth, but how much should you reinvest? The right percentage depends on your goals, financial position, and industry norms. A well-planned reinvestment strategy ensures growth without jeopardizing stability.

Set Clear Goals

What do you hope to achieve with your reinvestment? Whether it’s boosting revenue, launching a new product line, hiring staff, upgrading technology, or opening a second location, your goals will dictate how much reinvestment is necessary.

Here’s how different businesses approach reinvestment:

- A coffee shop in Toronto reinvesting in a second location may allocate 40–50% of profits toward expansion, covering rent, renovations, and equipment.

- A tech company focused on research and development (R&D) may reinvest 60–100% of profits, prioritizing innovation and product development over short-term profits.

- A service-based business (e.g., consulting or marketing) may reinvest 20–30% in advertising, training, and technology upgrades to attract more clients.

Align your reinvestment percentage with your business objectives and growth strategy to maximize impact.

Conduct a Break-Even Analysis

A break-even analysis helps determine how much reinvestment is required to meet your goals and how long it will take to recoup your investment. This is especially crucial in regions like Ontario, where costs such as rent, labor, and taxes can be higher than in other parts of Canada.

To conduct a break-even analysis:

- Calculate total reinvestment costs – Include expenses like rent, salaries, inventory, marketing, and technology upgrades.

- Estimate additional revenue generated – Determine how much extra revenue the reinvestment is expected to bring in.

- Find your break-even point – Divide reinvestment costs by projected monthly profit increase to see how long it will take to recover your investment.

For example, a manufacturing business may need to reinvest heavily in automation to stay competitive, while an e-commerce store may prioritize digital marketing. Or if a retail store in downtown Toronto reinvests $50,000 in a new storefront and expects an additional $5,000 in profit per month, it will take 10 months to break even. This analysis ensures that your reinvestment is financially viable and timed correctly.

Balance Reinvestment with Personal Income

While reinvesting is crucial for growth, business owners still need to pay themselves. Many entrepreneurs struggle with this balance, especially in the early years. A common guideline is to reinvest 20–50% of profits, while keeping the rest as retained earnings or personal income.

Here’s how to strike a balance:

- Cover personal living expenses first – Ensure you withdraw enough for basic needs before reinvesting aggressively.

- Build a financial buffer – Maintain at least 3–6 months of operating expenses in cash reserves before committing to large reinvestments.

- Reinvest based on business stage – Startups and high-growth businesses often reinvest more (50–100%), while established businesses may reinvest less (20–30%) and focus on stability.

For example, a solopreneur who relies entirely on their business income might reinvest 20–30%, while a fast-growing e-commerce brand may push 50%+ back into marketing and inventory.

When NOT to Reinvest

While reinvesting is often necessary, there are times when it’s better to hold off:

- High Debt Levels: If your business is already carrying significant debt, focus on reducing liabilities before reinvesting.

- Economic Uncertainty: The Economy can be influenced by factors like interest rate changes, real estate market fluctuations, and global trade dynamics. During uncertain times, it may be wiser to save profits as a buffer.

- Lack of Clear ROI: Avoid reinvesting without a clear plan or measurable return on investment. For instance, investing in new equipment might make sense for a manufacturing business, but if it doesn’t increase efficiency or revenue, the investment may not be worthwhile.

5 Smart Ways to Reinvest

Knowing how much to reinvest is one thing. Knowing where to put that money is what truly drives growth. A bad reinvestment drains resources without real results, while a smart one multiplies your success. Let’s go over five of the best ways to reinvest for maximum impact.

Expanding Your Product or Service Offerings

A business that never evolves eventually gets left behind. Customers’ needs shift, competitors innovate, and what worked yesterday won’t always work tomorrow. The best way to stay ahead? Keep improving what you offer.

- Listen to your customers. What are they asking for that you don’t provide? Pay attention to reviews, surveys, and direct feedback.

- Test before going all in. Instead of launching something huge, start small. A limited release lets you gauge demand without risking too much capital.

- Solve real problems. The most successful businesses don’t just sell products; they solve frustrations. Focus on making life easier, better, or more convenient for your audience.

Strengthening Your Marketing and Customer Acquisition

You can have the best product in the world, but if no one knows about it, it won’t sell. That’s why marketing is one of the smartest reinvestments you can make.

- Invest in digital marketing. SEO, paid ads, social media, and email campaigns help you reach more people. The key is focusing on the platforms where your audience spends their time.

- Refine your messaging. A weak brand voice loses attention. If your marketing isn’t connecting, reinvest in better branding, copywriting, or content creation.

- Retain existing customers. It’s cheaper to keep a customer than to find a new one. Loyalty programs, email follow-ups, and better customer service turn one-time buyers into repeat customers.

Improving Operations and Efficiency

Reinvesting in smoother operations saves time, money, and stress. When your business runs efficiently, you can focus on growth instead of fixing constant problems.

- Upgrade your tools. Slow websites, outdated software, and inefficient workflows waste time. The right systems increase productivity and improve customer experience.

- Automate repetitive tasks. If you or your team spend hours on things like invoicing, scheduling, or customer support, automation can free up time for more important work.

- Streamline logistics. If you sell physical products, improving shipping speed, inventory management, or supply chain efficiency can boost customer satisfaction and profits.

Investing in Your Team and Personal Growth

A business is only as strong as the people behind it. Whether it’s hiring new talent or improving your own skills, reinvesting in knowledge pays off.

- Hire strategically. If you’re stretched too thin, reinvest in employees who can take tasks off your plate. A strong team helps you scale faster.

- Train your team. A well-trained staff works more efficiently and provides better service. Workshops, courses, and mentorship programs can make a big difference.

- Invest in yourself. Business success starts with the owner. Books, courses, and networking events can give you the skills and connections to grow even further.

Building a Stronger Customer Experience

A great product gets you noticed, but a great experience keeps customers coming back. People remember how a business makes them feel, and those impressions turn into loyalty.

- Make support seamless. Fast response times, helpful service, and clear communication build trust.

- Simplify the buying process. If your checkout process, booking system, or sales funnel is complicated, people will leave. Make it easy for customers to do business with you.

- Go the extra mile. Surprise discounts, personal follow-ups, or handwritten thank-you notes make customers feel valued and they’ll keep coming back.

Final Thoughts

Reinvesting in your business is essential for growth, but the amount you reinvest depends on your unique circumstances. Factors like high operating costs, tax incentives, and industry trends play a crucial role in shaping reinvestment strategies. By assessing your financial position, setting clear goals, and leveraging local opportunities, you can make informed decisions that help your business thrive in one of Canada’s most dynamic provinces.

Remember, there’s no one-size-fits-all answer to how much you should reinvest. Start with what’s sustainable for your business, and adjust as you grow.