Starting a business is exciting, but buying equipment can be a major financial hurdle. Whether it’s laptops, office furniture, machinery, or vehicles, these costs add up fast and can drain your cash flow before you even get started.

Equipment leasing offers a smarter alternative, giving you the tools you need for a fixed monthly fee instead of a massive upfront investment. This frees up cash for marketing, payroll, and growth while keeping your business financially flexible.

Many entrepreneurs assume they need to buy everything outright, but leasing can provide the same essential equipment at a fraction of the cost. Whether you’re launching a construction company, restaurant, photography studio, or e-commerce brand, leasing can help you get started without the financial strain.

In this guide, we’ll break down how equipment leasing works and why it might be the perfect solution for your startup.

What Is Equipment Leasing?

At its core, equipment leasing is a rental agreement for business equipment. Instead of buying expensive machinery, vehicles, or technology, you pay a monthly fee to use it for a set period, just like renting an apartment instead of buying a house.

Once your lease ends, you typically have three options:

- Return the equipment and upgrade to a newer model.

- Renew the lease if you still need it.

- Buy it at a reduced price

This flexibility allows startups to access high-quality equipment without a massive upfront investment.

Why Startups Should Consider Leasing Instead of Buying

New businesses need cash flow to survive. Tying up thousands of dollars in equipment can limit your ability to cover marketing, payroll, and other growth expenses. Leasing offers a smarter alternative, you get the tools you need while keeping cash in your pocket. Here’s why leasing is a game-changer for startups:

Low Upfront Costs

Buying business equipment, whether it’s computers, industrial machinery, or vehicles can cost hundreds of thousands of dollars. Leasing allows you to spread the cost over time, making it much easier to afford.

Easier Budgeting

Since leasing comes with fixed monthly payments, you always know how much you need to pay. This makes financial planning easier with no unexpected expenses and no surprise breakdown costs.

Access to the Latest Technology

Technology evolves fast. When you buy equipment, you’re stuck with it even when a newer, better model comes out. Leasing allows you to upgrade easily at the end of your contract, so your business always has cutting-edge tools.

Tax Benefits

Leasing payments are often tax-deductible as a business expense. This means you can write off your lease costs each year, reducing your taxable income. Always check with an accountant, but in many cases, leasing can save you money at tax time.

No Maintenance Headaches

When you own equipment, you’re responsible for repairs and maintenance, which can get expensive. Many leasing agreements include maintenance and servicing, so you don’t have to worry about costly breakdowns.

Preserves Business Credit

Since leasing doesn’t require a large loan, it keeps your credit lines open for other business needs. If you plan to apply for a business loan later, leasing ensures you still have borrowing power.

What Type of Equipment Can You Lease?

Just about anything! Startups across all industries can benefit from equipment leasing. Here are some common examples:

Tech & Office Equipment

- Laptops & desktops

- Printers & scanners

- Office furniture

- Phone systems

- POS (Point-of-Sale) systems

Construction & Industrial Equipment

- Forklifts & cranes

- Excavators & bulldozers

- Power tools & generators

- Welding & manufacturing machines

Restaurant & Food Service

- Ovens & grills

- Refrigerators & freezers

- Coffee machines

- Dishwashers & prep stations

Retail & E-Commerce

- Display fixtures

- Security systems

- Warehouse shelving

- Packaging equipment

Medical & Healthcare

- X-ray machines

- Lab equipment

- Patient beds & exam tables

- Dental chairs & imaging devices

No matter what industry you’re in, leasing can help you access high-quality equipment without the upfront costs.

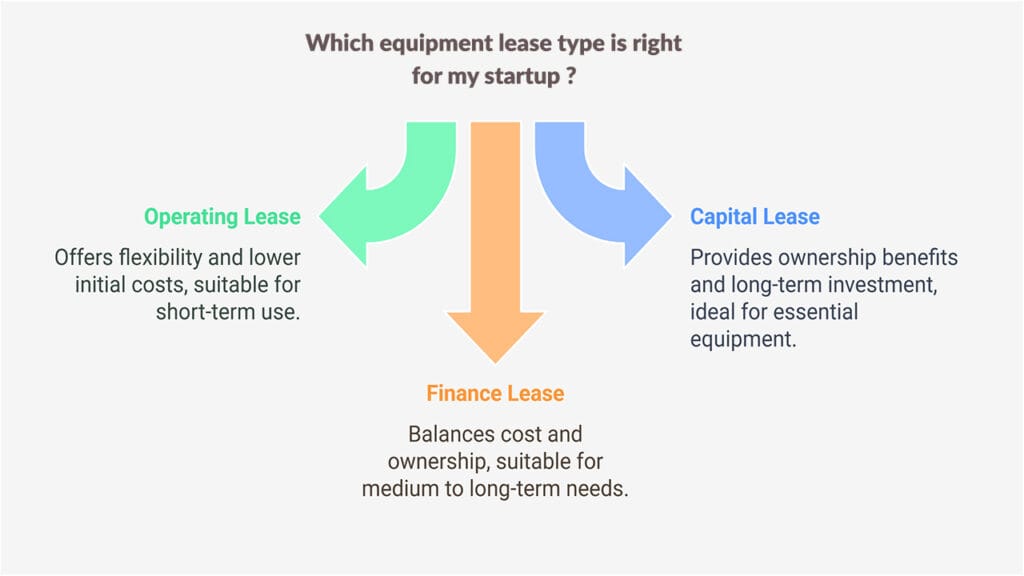

Types of Equipment Leasing: Which One Is Right for Your Startup?

Choosing the right type of equipment lease can make a huge difference in your start-up’s growth, cash flow, and flexibility. Depending on your business needs, you may find that one lease option works better than another. Let’s dive into the three main types of equipment leasing and how they can benefit your business.

Operating Lease

An operating lease is a short-term lease where you rent equipment for a period shorter than its useful life. At the end of the lease, you return the equipment. This type of lease typically comes with lower monthly payments compared to a capital lease and doesn’t result in ownership.

Start-ups that need equipment temporarily or anticipate upgrading to newer models regularly will benefit most from an operating lease. This option offers maximum flexibility, allowing your business to avoid the burden of owning outdated or underused equipment.

Example: A tech start-up needs cutting-edge computers and software for a short-term project or an upcoming year but plans to upgrade in the near future. An operating lease allows them to stay current with the latest technology without committing to ownership.

Capital Lease

A capital lease is a long-term arrangement where the lease term covers a significant portion of the equipment’s useful life. The key difference from an operating lease is that at the end of the term, the business has the option (and often the obligation) to purchase the equipment, typically for a nominal fee.

Businesses that require equipment for a long-term investment will benefit most from a capital lease. It’s ideal if your start-up plans to use the equipment for several years and would prefer ownership at the end of the lease.

Example: A construction company leases heavy machinery like bulldozers or cranes on a capital lease, using the equipment for years. By the end of the lease term, the company can buy the equipment for a fraction of its value, making it a long-term asset for the business.

Leaseback Agreements

A leaseback agreement involves a start-up selling its existing equipment to a leasing company and then leasing it back. This unique type of lease offers immediate capital by turning your owned equipment into liquid assets, all while still allowing you to use the equipment in your operations.

If your start-up needs quick cash flow but still wants to retain the use of your equipment, a leaseback agreement can be an excellent option. It’s perfect for businesses that own valuable assets but need to free up funds for other business operations or growth initiatives.

Example: A manufacturing start-up owns high-value machinery but needs additional capital to expand its workforce. By entering a leaseback agreement, they sell the equipment to a leasing company, immediately receiving cash, while continuing to use the machinery in day-to-day operations.

When deciding between different equipment lease types, consider your business needs and long-term goals.

How Equipment Leasing Works: A Step-by-Step Guide

Starting the leasing process is easier than you think. Here’s how it works:

Step 1: Determine What You Need

Before you start shopping for leasing options, make a list of the essential equipment your business requires. Consider:

- What equipment is necessary to run your business smoothly?

- How long will you need it? Some equipment may only be needed short-term, while others will be part of your operations for years.

- Will you need to upgrade frequently? Technology changes fast, and leasing makes it easier to stay current.

- How will this equipment impact your business growth? Focus on equipment that boosts productivity or revenue.

Example: A restaurant owner might need commercial ovens, refrigerators, and espresso machines, while a digital marketing agency may prioritize high-performance computers and software.

Step 2: Research Leasing Companies

Not all leasing companies are the same. Some specialize in specific industries, while others offer more flexible terms. Finding the right provider ensures you get the best deal and avoid hidden costs.

What to Look for in a Leasing Company:

- Industry expertise – Some leasing companies specialize in medical, restaurant, or construction equipment. Choose one that understands your field.

- Competitive pricing – Compare interest rates and lease terms to find the best offer.

- Flexible contract terms – Look for options like early buyout clauses, upgrade flexibility, and maintenance coverage.

- Customer support & reputation Read online reviews and check their Better Business Bureau (BBB) rating.

Popular Equipment Leasing Providers:

- CIT Bank – Best for small businesses looking for flexible financing.

- National Funding – Great for startups needing a quick approval process.

- Balboa Capital – Ideal for tech and office leasing.

- LeaseQ – Best for restaurant and medical equipment leasing.

Pro Tip: Request quotes from multiple companies before making a decision

Step 3: Compare Lease Options

There are two main types of leases, each suited to different business needs. Understanding the differences helps you choose the right fit for your company.

Operating Lease (Best for Short-Term Use & Frequent Upgrades)

- Lower monthly payments.

- The leasing company retains ownership.

- You return the equipment at the end of the lease. Ideal for businesses that need to upgrade regularly (e.g., tech, medical, or creative industries).

Example: A graphic design agency leases high-end computers and design software for two years. Instead of owning outdated equipment, they upgrade to the latest models when the lease ends.

Finance Lease (Best for Long-Term Use & Ownership)

- Higher monthly payments.

- The business owns the equipment at the end of the lease.

- Best for long-term investments in essential equipment (e.g., construction machinery, restaurant ovens, trucks).

Example: A construction company leases bulldozers and forklifts under a finance lease. After five years, they own the equipment for a fraction of its original cost.

Step 4: Submit an Application

Once you choose a leasing provider and lease type, you’ll need to apply for approval. Each company has different requirements, but most will ask for:

- Business plan or financial projections help the lender understand your growth potential and ability to make payments.

- Credit history (personal or business) – Strong credit improves approval chances and secures better terms. Startups with no credit may need a personal guarantee.

- Proof of business registration shows your company is legally established.

Pro Tip: If your startup has a limited credit history, consider working with a leasing company that specializes in new businesses or offers lower-credit financing options.

Step 5: Get Approved & Sign the Agreement

Once approved, review the contract carefully before signing. Leasing agreements can include hidden fees or strict terms that may not benefit your business.

Key Terms to Pay Attention To:

- Lease Length – How long is the lease term? Does it align with your business plan?

- Monthly Costs – Understand the breakdown of payments, including any fees or taxes.

- Maintenance Responsibilities – Some leases include maintenance, while others leave repairs up to you.

- End-of-Lease Options – Can you buy the equipment, renew the lease, or return it?

Pro Tip: If the contract is unclear or overly complex, have a business attorney review it before signing.

Step 6: Receive & Use Your Equipment

Once the lease is finalized, the provider delivers the equipment, and you can start using it immediately!

Common Mistakes to Avoid When Leasing Equipment

While leasing is a great option, it’s important to avoid these common pitfalls:

- Leasing unnecessary equipment – Don’t overextend yourself. Lease only what you need to start and grow your business.

- Ignoring the fine print – Always read the contract carefully. Check for hidden fees, early termination penalties, or required insurance policies.

- Not comparing multiple offers – Shop around! Some companies charge higher interest rates or have less flexible terms than others.

- Forgetting about the end-of-lease options – Will you upgrade, renew, or buy? Make sure you plan ahead before the lease ends.

Final Thoughts: Is Equipment Leasing Right for Your Startup?

If you need essential equipment without tying up your capital, leasing can be a game-changer. It offers lower upfront costs, predictable payments, tax benefits, and access to high-quality tools all while keeping your business financially agile.

But leasing isn’t just about saving money; it’s about strategic growth. The right lease can help you scale faster, adapt to industry changes, and stay competitive without being locked into outdated equipment.

To make the most of it:

Assess your needs. Only lease what directly impacts your operations.

Compare providers, look for flexible terms, fair rates, and upgrade options.

Understand the terms, Know your obligations, potential fees, and end-of-lease options.

Smart decisions today shape your success tomorrow. Explore leasing options now and give your startup the tools it needs to thrive!