Ever wondered why some businesses grow faster than others? The secret often lies in access to funding. Whether it’s a new startup or an established business looking to expand, securing the right financing can be the key to success. But traditional loans can be hard to get, especially if your business has limited credit history or collateral.

That’s where the Canada Small Business Financing Loan (CSBFL) comes in. Backed by the Government of Canada, this program helps small businesses secure funding with lower risk. It’s designed to help entrepreneurs invest in equipment, commercial real estate, and leasehold improvements without the strict lending requirements of traditional bank loans.

But how does it work? What are the requirements? And how do you apply? This guide will walk you through everything you need to know from eligibility and loan terms to the application process and repayment options. Whether you’re launching a new venture or expanding an existing one, the CSBFL could be the funding solution your business needs.

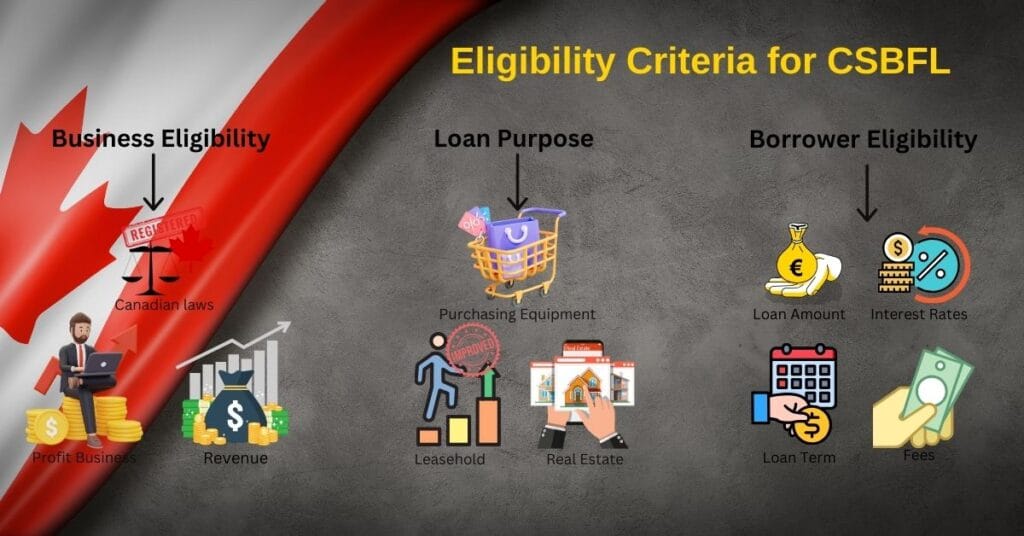

Eligibility Criteria

Business Eligibility

The CSBFL is available to small, for-profit businesses operating in Canada. To qualify, a business must meet the following criteria:

- It must be a for-profit business (corporations, partnerships, and sole proprietorships are eligible).

- It must have gross annual revenue of $10 million or less.

- The business must operate within Canada and be registered under Canadian laws.

Certain industries are not eligible for this loan. Farming businesses are excluded from the program since they have separate government loan programs available through organizations like the Canadian Agricultural Loans Act (CALA) program. Other ineligible businesses may include those engaged in charitable or non-profit activities.

Loan Purpose

The CSBFL is intended to help businesses acquire assets and improve their operations, not to cover everyday operating costs.

Eligible uses of the loan include:

- Purchasing equipment – Businesses can use the loan to buy machinery, tools, vehicles, and technology necessary for operations.

- Acquiring commercial real estate – This includes purchasing office space, warehouses, retail locations, or other business-related properties.

- Making leasehold improvements – This refers to renovations and upgrades made to rental properties, such as installing new flooring, upgrading lighting, or improving interior spaces.

However, certain expenses are not covered under the CSBFL. Businesses cannot use the loan for:

- Working capital (e.g., payroll, rent, utility bills).

- Inventory purchases (e.g., raw materials or stock for resale).

- Goodwill and franchise fees (e.g., fees for buying into a franchise or business acquisition costs).

Borrower Eligibility

To apply for the CSBFL, borrowers must meet certain criteria. Applicants must be Canadian citizens or permanent residents and must demonstrate creditworthiness and financial stability. While the loan is backed by the government, the lender makes the final decision on approval, meaning that businesses must still meet the bank or credit union’s lending requirements.

Lenders will review the applicant’s business plan, financial statements, and credit history to determine whether the loan is a suitable risk. Borrowers with a strong repayment history and clear business goals are more likely to be approved.

Loan Details

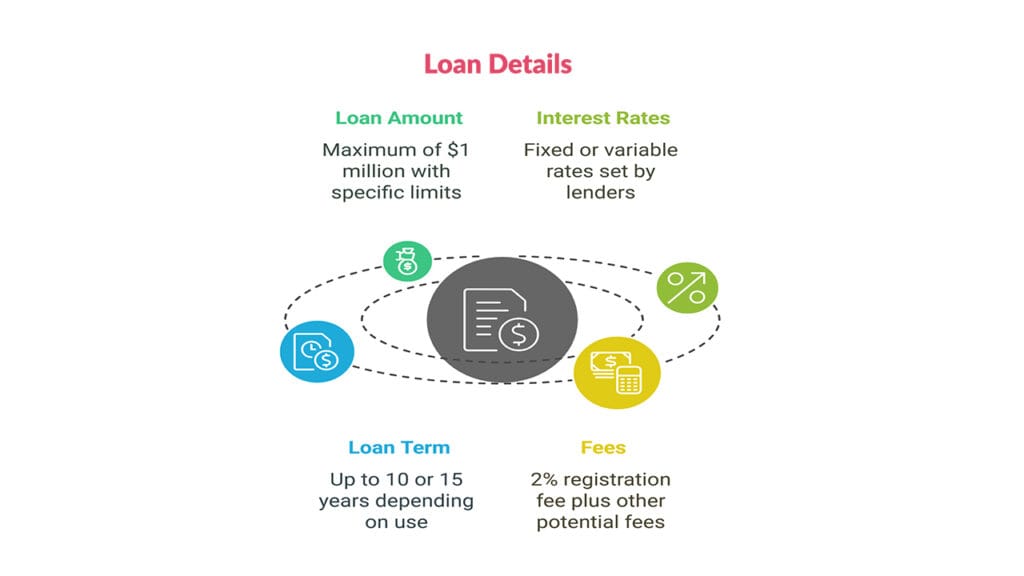

Loan Amount

The maximum loan amount available under the CSBFL is $1 million, but how the funds are used is subject to limits:

- Up to $500,000 can be used for equipment purchases and leasehold improvements.

- Up to $1 million can be used for commercial real estate purchases.

Interest Rates

Interest rates on CSBFL loans are set by the lender and can be either fixed or variable. A fixed interest rate remains the same throughout the loan term, while a variable interest rate is typically set at the lender’s prime rate plus up to 3%. Businesses should compare different lenders to find the most favorable rates.

Loan Term

The maximum repayment period for a CSBFL loan depends on how the funds are used:

- Up to 10 years for loans used to purchase equipment or make leasehold improvements.

- Up to 15 years for loans used to buy commercial real estate.

Fees

A 2% registration fee applies to all CSBFL loans. This fee is calculated based on the total loan amount and can be included in the loan financing. Other fees may also apply, including legal fees, appraisal fees, and administrative costs charged by the lender.

Application Process

Applying for the Canada Small Business Financing Loan (CSBFL) is a straightforward process, but proper preparation is key to increasing your chances of approval. Here’s a simple breakdown of how to apply:

Step 1: Prepare Your Documents

Before applying, gather all the necessary documents to show the lender that your business is financially stable and capable of repaying the loan. You’ll need:

- A Business Plan: Clearly explain your business goals, how the loan will be used, and how it will help your business grow.

- Financial Statements: Include cash flow projections, income statements, and balance sheets to demonstrate financial health.

- Credit History: Both the business and the owner’s credit history will be reviewed. If your business is new, your personal credit score will be important.

- Legal Documents: Some lenders may ask for additional paperwork, such as business registration certificates or lease agreements.

Being well-prepared will help speed up the process and improve your chances of getting approved.

Step 2: Choose a Lender

The CSBFL is offered by various banks, credit unions, and financial institutions, including RBC, TD, BMO, Scotiabank, and CIBC. Since loan terms can vary, it’s a good idea to compare lenders to find the best interest rates, repayment terms, and additional fees.

When meeting with potential lenders, ask about:

- Interest rates (fixed vs. variable).

- Repayment schedules and flexibility.

- Any extra fees (e.g., legal or administrative costs).

Choosing the right lender can make a big difference in how affordable and manageable your loan is over time.

Step 3: Submit Your Application

Once you’ve chosen a lender, you’ll need to submit a formal application along with all required documents. The lender will review your application by:

- Checking your credit score and financial history.

- Evaluating your business plan and repayment ability.

- Confirming that the loan will be used for an eligible purpose (e.g., equipment, real estate, renovations).

Lenders may ask for additional details or clarification, so be ready to provide any extra information they need. The review process can take anywhere from a few days to a few weeks.

Step 4: Loan Approval and Funds Disbursement

If approved, the lender will provide a loan agreement outlining the repayment terms, interest rates, and any fees. Carefully read and understand the agreement before signing.

Once everything is finalized, the loan funds will be disbursed based on the approved purpose, such as paying for equipment, renovations, or commercial property purchases. The lender may require proof that the funds were used correctly, so keep records of all transactions.

Government Guarantee for the Canada Small Business Financing Loan

One of the biggest benefits of the CSBFL is that the Government of Canada guarantees 85% of the loan, reducing the risk for lenders and making it easier for small businesses to secure financing. This guarantee encourages banks and credit unions to approve loans for businesses that may not meet traditional lending criteria.

Risk Sharing: How It Works

With the government covering 85% of the loan balance in case of default, lenders are more willing to provide financing to small businesses. For example, if a business defaults on a $100,000 loan, the government repays $85,000, while the lender covers the remaining 15%. This reduces financial risk for banks, making funding more accessible for entrepreneurs.

Borrower Responsibility

Even though the loan is government-backed, borrowers are fully responsible for repayment. If a business fails to make payments, the lender can take legal action, seize business assets, and report the default to credit agencies, which can hurt the borrower’s credit score.

Repayment Terms for the Canada Small Business Financing Loan

Understanding the repayment terms of the CSBFL is crucial for managing finances effectively. The loan offers a flexible repayment schedule, prepayment options, and consequences for default, helping businesses plan for long-term financial success.

Repayment Schedule

Businesses must make monthly or quarterly payments based on their loan agreement. The repayment period depends on the loan’s purpose:

- Up to 10 years for equipment purchases and leasehold improvements.

- Up to 15 years for commercial real estate purchases.

A structured repayment plan helps businesses manage cash flow while repaying their loan.

Prepayment Options

Some lenders allow businesses to pay off the loan early without penalties, reducing overall interest costs. However, not all lenders offer this flexibility, some charge prepayment fees. Business owners should review their lender’s prepayment policy before signing the loan agreement.

Default and Consequences

Failing to repay the loan can have serious financial consequences, including:

- Damage to credit score, making future borrowing difficult.

- Legal action from the lender to recover funds.

- Seizure of business assets used as collateral.

Although the government guarantees 85% of the loan, this protects the lender, not the borrower. Business owners remain fully responsible for repayment, making financial planning essential to avoid default.

Benefits of the CSBFL

Easier Access to Funding

Many small businesses struggle to get loans due to limited credit history or collateral. The CSBFL reduces risk for lenders by guaranteeing 85% of the loan, making it easier for businesses to get approved and access the funds they need to grow.

Flexible Repayment Terms

With repayment terms of up to 10 years for equipment and 15 years for real estate, the CSBFL offers longer repayment periods than many traditional loans. This helps businesses manage cash flow while investing in long-term growth. Some lenders also allow early repayment without penalties, reducing overall interest costs.

Government Support for Small Businesses

By backing loans, the government encourages banks and credit unions to lend to small businesses, boosting economic growth and job creation. This program is especially helpful for startups and newer businesses that might not qualify for regular bank loans.

Challenges to Consider

Loan Restrictions

The CSBFL cannot be used for working capital, meaning funds can’t cover payroll, rent, or inventory. Businesses needing cash flow support may need to explore other financing options.

Additional Costs

Borrowers must pay a 2% registration fee on the loan amount, and some lenders charge extra fees for legal or administrative services. These costs should be factored into financial planning.

Repayment Responsibility

Although the government guarantees 85% of the loan, borrowers are still fully responsible for repayment. If payments are missed, lenders can take legal action, seize business assets, and report defaults to credit agencies, which can hurt the business owner’s credit score.

Conclusion

The Canada Small Business Financing Loan (CSBFL) is a great option for entrepreneurs looking to invest in equipment, commercial real estate, or business improvements. With government backing, flexible repayment terms, and easier loan approval, it provides much-needed support to small businesses.

Before applying, business owners should carefully review their financial situation, research lenders, and prepare a strong business plan. With the right planning, the CSBFL can be a powerful tool to help businesses grow and thrive in Canada’s competitive marketplace.