Your business credit score plays a crucial role in securing financing, building trust with suppliers, and expanding your business. Yet, many business owners are unaware of their credit standing until they face challenges, such as higher loan interest rates, strict payment terms from vendors, or even rejected credit applications.

Just like personal credit, lenders and suppliers use your business credit score to assess risk before offering credit or services. Regularly checking your business credit score helps you stay informed, correct potential errors, and improve your financial standing.

The good news? Checking your business credit score in Canada is simple. In this guide, we’ll walk you through where to check it, how to obtain your report, and what steps you can take to maintain or improve your score. Let’s ensure your business is financially strong and ready for future opportunities.

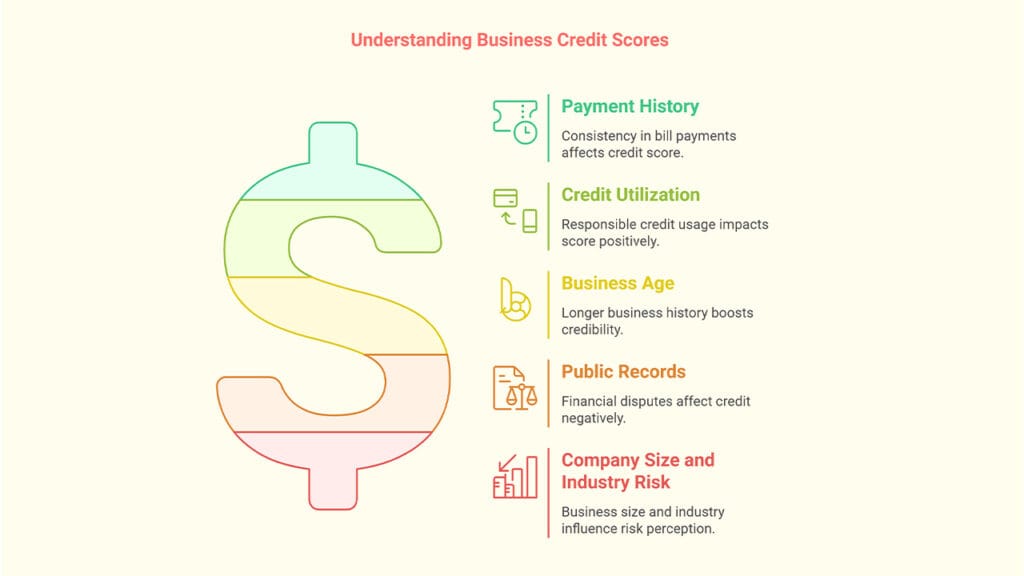

Factors Influencing Your Business Credit Score

A business credit score is a number that represents your company’s creditworthiness. Lenders, suppliers, and investors use it to assess how reliable your business is in managing debt and making payments on time. It is determined by various financial behaviors and business activities. Understanding these factors can help you make informed decisions to improve and maintain a strong credit profile.

Payment History

Your payment history is one of the most critical factors affecting your business credit score. Lenders and suppliers want to see that you consistently pay your bills and debts on time.

- On-time payments boost your score and establish your business as a reliable borrower.

- Late or missed payments negatively impact your score and can stay on your credit report for years.

- Accounts in collections signal financial distress, significantly lowering your creditworthiness.

Tip: Set up automatic payments or reminders to ensure you never miss a due date.

Credit Utilization

Credit utilization refers to the percentage of your available credit that your business is using. A lower credit utilization rate is considered favorable.

- Using 30% or less of your credit limit demonstrates responsible credit management.

- Consistently maxing out credit cards or credit lines can lower your score, as it signals financial strain.

- High outstanding balances compared to credit limits make lenders wary of lending to your business.

Tip: Keep your credit utilization low by paying off balances regularly and requesting credit limit increases if necessary.

Business Age

The longer your business has been operating, the more financial history you have, making lenders and creditors more confident in your ability to manage credit.

- Older businesses with a strong payment history tend to have higher credit scores.

- New businesses may have lower scores or limited credit history, making it harder to qualify for loans.

- Startups can build their credit profile by establishing trade lines with vendors and making consistent payments.

Tip: Even if your business is new, start building credit early by opening a business credit card or working with vendors that report to credit bureaus.

Public Records (Bankruptcies, Liens, and Legal Judgments)

Any public financial records related to your business can significantly impact your credit score.

- Bankruptcies stay on your business credit report for up to 10 years, drastically reducing your creditworthiness.

- Tax liens (if your business owes unpaid taxes) can lead to collections and legal action, damaging your score.

- Legal judgments from lawsuits or unpaid debts can be reported, signaling risk to lenders.

Tip: Address any financial disputes quickly and work out payment plans with creditors to avoid legal actions.

Company Size and Industry Risk

Some industries and business structures are perceived as riskier by lenders and credit bureaus.

- Larger, well-established businesses with multiple revenue streams often have stronger credit profiles.

- Smaller businesses or sole proprietorships may struggle with financing, as they pose a higher lending risk.

- Certain industries (such as hospitality, construction, or seasonal businesses) may be viewed as unstable due to economic fluctuations.

Tip: Even if your industry is considered high-risk, maintaining a strong payment history and low debt levels can help you secure financing.

What Is a Good Business Credit Score?

A business credit score is a numerical representation of your company’s creditworthiness, typically ranging from 0 to 100, depending on the credit bureau. Lenders, suppliers, and financial institutions use this score to assess how well your business manages its financial obligations.

Business Credit Score Ranges

- 80-100 (Excellent Credit)

- Businesses in this range are considered low-risk by lenders.

- Eligible for the best loan terms, lower interest rates, and higher credit limits.

- More likely to secure favorable trade agreements with suppliers.

- 50-79 (Good to Fair Credit)

- Businesses in this range may still qualify for financing but could face higher interest rates.

- Lenders may offer moderate credit limits based on risk assessment.

- Some suppliers may require upfront payments or shorter repayment terms.

- 0-49 (Poor Credit)

- Businesses with a score in this range are considered high-risk.

- Difficulty in securing loans or credit; may require collateral or personal guarantees.

- Suppliers may demand cash-on-delivery (COD) payments or stricter terms.

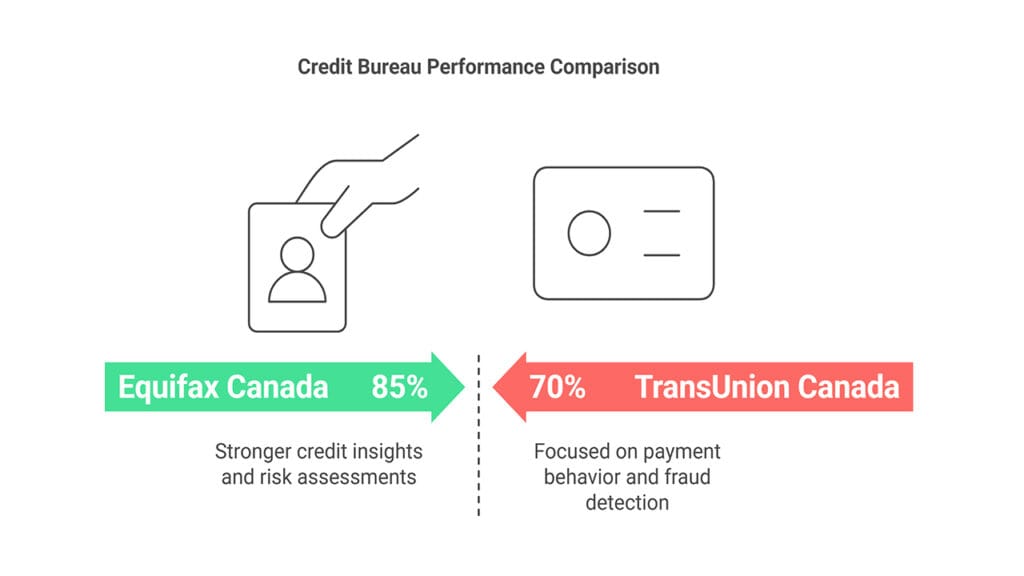

Major Credit Bureaus in Canada

In Canada, two major credit bureaus track and report business credit scores: Equifax Canada and TransUnion Canada. These organizations collect financial data, analyze credit behavior, and generate reports that lenders and suppliers use to assess your business’s creditworthiness.

Equifax Canada

Equifax provides business credit reports and credit scores, helping businesses understand their financial health.

Key Features:

- Generates detailed business credit reports showing payment history, credit limits, outstanding debts, and financial risk indicators.

- Offers credit monitoring tools to track changes and detect fraud.

- Provides risk assessments to help lenders and suppliers evaluate your business’s creditworthiness.

TransUnion Canada

TransUnion offers Small Business Credit Reports that provide insights into a company’s financial stability and credit risk.

Key Features:

- Tracks business payment behavior, including trade credit history and outstanding debts.

- Helps detect fraud and credit risks, ensuring businesses maintain a strong credit reputation.

- Offers tools for ongoing credit monitoring, helping businesses manage their credit health proactively.

How to check business credit score Canada: Steps

Regularly checking your business credit report is essential for understanding your company’s financial standing and identifying any potential issues that could affect your ability to secure financing or negotiate favorable terms with suppliers. Below are the steps to request your business credit report from both Equifax and TransUnion.

Checking Business Credit Score with Equifax Canada

- Visit the Equifax Canada website – Navigate to the Business Solutions section.

- Request a business credit report – You will need to provide your business name, registration number, and other identifying details.

- Pay the required fee – Business credit reports from Equifax are not free, and pricing varies depending on the type of report.

- Receive and review your report – Your Equifax business credit report includes:

- Your business credit score

- Payment history with lenders and suppliers

- Credit utilization and outstanding debts

- Any negative records, such as bankruptcies or legal judgments

Checking Business Credit Score with TransUnion Canada

- Go to the TransUnion Canada website and navigate to the Business Credit Reports section.

- Submit your request by entering your business details, including your company’s legal name and registration number.

- Pay for the report – Similar to Equifax, TransUnion charges a fee for business credit reports.

- Review your report, which includes:

- Financial activity and credit accounts

- Trade credit history (payments to suppliers and vendors)

- Public records, such as legal judgments or tax liens

- Risk factors that may affect your ability to secure financing

Applications to Check Business Credit Score

Unlike personal credit scores, business credit scores are not typically available for free in Canada. Most business credit reports must be purchased from Equifax Canada or TransUnion Canada. However, some financial institutions and third-party services offer insights into your business’s credit health, which can help you track and improve your financial standing.

Apps and Platforms to Check Business Credit Score

- Nav

- Provides free access to basic business credit insights.

- Offers paid plans for more in-depth reports and monitoring.

- Helps small businesses understand their credit standing with credit-building tools.

- Credit Karma

- Primarily focuses on personal credit scores, but small business owners can use it to monitor personal finances that may impact business credit.

- Can offer indirect insights into financial behavior that affects business lending decisions.

- Fundera by NerdWallet

- Helps small businesses assess their creditworthiness before applying for loans.

- Offers educational resources on how to improve business credit.

Conclusion

Your business credit score isn’t just a number, it’s a reflection of your company’s financial health and reliability. It determines whether you can secure funding, negotiate favorable terms with suppliers, and expand your business without unnecessary financial roadblocks.

By regularly checking your credit report, addressing errors, and maintaining responsible financial habits such as timely payments, low credit utilization, and strategic reinvestments, you set your business up for sustainable growth. The stronger your credit profile, the more opportunities you’ll unlock, from better loan terms to increased trust with partners and investors.

Financial success starts with awareness and action. Don’t wait until you need credit to check where your business stands. Stay proactive, monitor your credit regularly, and make smart financial choices that position your business for long-term stability and success.