Track ROI effectively by monitoring Return on Investment when you reinvest in your business ensures the funds you put back in actually create value. Tracking ROI (Return on Investment) when you reinvest in your business ensures the funds you put back in actually create value. By defining clear goals, using analytics and accounting tools, comparing baseline and post-investment metrics, and reviewing results regularly, you can verify whether your reinvestment efforts yield profit, efficiency, or growth. Both financial and non-financial returns matter in the bigger picture.

Key Takeaway:

- Stop reinvesting blindly — ROI tracking turns every dollar into a growth accelerator: set specific goals (e.g., 15% lead boost in 3 months), baseline metrics, and use the formula (Net Profit ÷ Cost) × 100 to spot winners like a $2K campaign yielding 50% ROI or automation saving $1K/month.[1]

- Master the 5 core methods: (1) Define measurable goals, (2) Deploy tools like QuickBooks/Xero for finances, Google Analytics/HubSpot for marketing, (3) Compare pre/post-investment baselines, (4) Capture financial (revenue/profit) + non-financial returns (NPS, morale via turnover rates), (5) Review monthly/quarterly to scale or kill initiatives.[1]

- Dodge the pitfalls: Don’t ignore costs (a $10K revenue win might net just 20% after $8K expenses), skip baselines, chase short-term only (training compounds over months), or neglect reviews — vague goals like “improve marketing” make everything guesswork.[2]

- Implement in 30 days: Pick one reinvestment (e.g., ads or training), baseline it today, track with free tools like Sheets, aim for 20–50%+ ROI (above your capital cost), and adjust ruthlessly — consistency beats perfection for resilient, profitable scaling.[2]

Bottom Line: Track ROI like your business’s heartbeat — it transforms risky bets into proven engines of growth, freeing you to reinvest smarter, scale faster, and build unbreakable momentum without the waste.

- Source: Unleash Your Power – Best Ways To Track ROI When Reinvesting In Your Business (introduction, why track ROI & core methods sections)

- Source: Common mistakes, implementation steps, examples & FAQ sections

Ever wondered if the money you’re pouring back into your business is truly paying off? Reinvesting profits can fuel growth, but without tracking ROI, it’s like driving blindfolded. You might be spending on marketing, technology, or training, but unless you measure the return, you’ll never know what’s actually moving the needle.

ROI (Return on Investment) reveals whether your reinvested funds are generating real value or just draining cash. It helps you understand which efforts lead to growth, which ones need tweaking, and where to focus next.

In this guide, you’ll learn what ROI really means in the context of business reinvestment, how to measure it effectively, and what pitfalls to avoid. You’ll also discover practical strategies to track and analyze returns so every dollar you reinvest becomes a step toward sustainable, measurable success.

Understanding ROI and Why It Matters

ROI stands for Return on Investment, and it’s a key metric businesses use to evaluate performance. The basic formula is:

ROI = (Net Profit from Investment ÷ Cost of Investment) × 100

For example, if you spend $5,000 on a new tool and it delivered $8,000 in profit, that’s (($8,000–$5,000)/$5,000) × 100 = 60 % ROI.

Why ROI matters:

- It helps you compare different investments on a common scale. Morgan & Westfield

- It keeps you focused on returns, not just spending.

- It encourages planning and measurement instead of guessing.

Bear in mind: ROI alone doesn’t capture timing, risk, or intangible benefits so it should be used alongside other metrics. Salesforce

Key Areas Where Reinvestment ROI Should Be Tracked

When you reinvest profits, understanding where and how your money creates returns is crucial. Each business area delivers a different type of ROI: financial, operational, or strategic. Below are the core areas where you should consistently measure the impact of your reinvestments:

Marketing & Customer Acquisition

Marketing is one of the most common and measurable areas for reinvestment. Every dollar spent should generate awareness, leads, and ultimately, sales. To track ROI here, focus on metrics such as:

- Cost per Lead (CPL): The amount spent to generate a single lead

- Customer Acquisition Cost (CAC): How much it costs to gain one paying customer.

- Conversion Rate: The percentage of leads that become paying customers

- Customer Lifetime Value (LTV): The total profit a customer generates over their relationship with your business.

Example: If you spend $2,000 on a digital campaign that brings 10 customers, each generating $300 in profit, your total profit is $3,000. The ROI would be (($3,000 – $2,000) / $2,000) × 100 = 50% ROI.

Equipment, Tools & Process Improvements

Investments in tools, systems, and technology often yield returns through efficiency and cost savings. While the ROI may not appear as direct revenue, the gains show up in reduced errors, saved time, and improved output quality.

- Measure time saved per task, error reduction, or cost-per-unit decrease after implementation.

- Assign a financial value to the saved time or improved productivity.

Example: Automating a manual process saves 40 hours/month of admin work. If the employee’s hourly rate is $25, that’s $1,000 in saved labor. If the automation tool costs $500, your ROI is (($1,000 – $500) / $500) × 100 = 100% ROI.

Talent and Training

Reinvesting in your team enhances both performance and company culture. Employee development can boost efficiency, creativity, and retention, all of which translate into measurable value.

Track:

- Employee Productivity: Output per employee before and after training.

- Turnover Rate: Lower turnover means reduced hiring costs.

- Sales per Employee or Client Satisfaction Scores: Indicate the impact of skill development.

Example: If a sales training program costs $3,000 and results in $7,000 additional monthly sales, your ROI is (($7,000 – $3,000) / $3,000) × 100 = 133% ROI.

Product or Market Expansion

Entering new markets or launching new products can deliver long-term ROI. However, the payoff may take several months or even years to materialize.

Track:

- Revenue Growth: Compare sales before and after expansion.

- New Customer Acquisition: Monitor growth in new market segments.

- Repeat Purchase Rate or Retention: Measures how well the new product performs over time.

Example: If expanding into a new region costs $10,000 and generates $15,000 in new revenue within six months, the ROI would be (($15,000 – $10,000) / $10,000) × 100 = 50% ROI.

Best Methods to Track ROI in Your Business

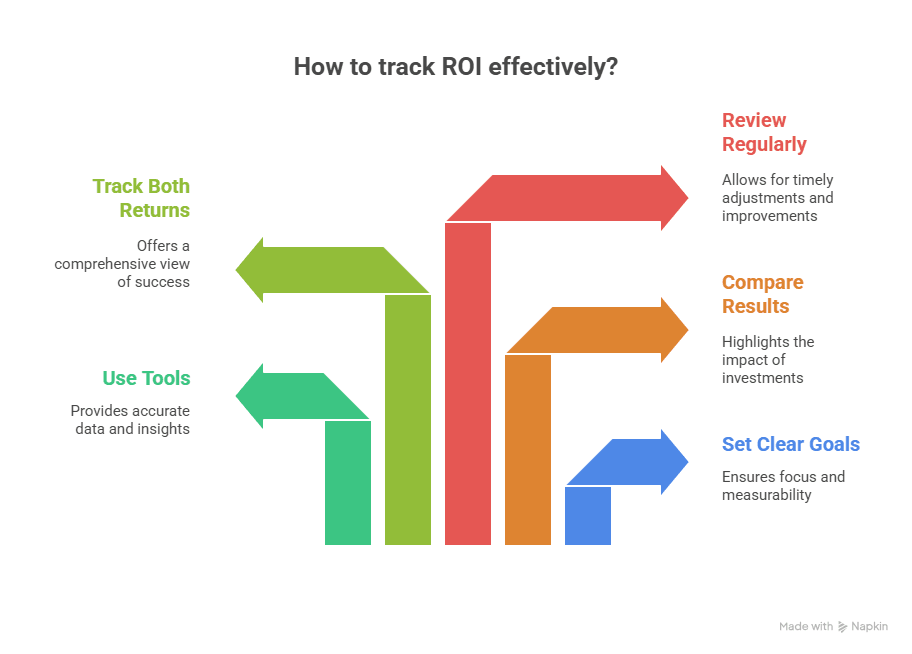

Tracking ROI helps ensure your reinvested profits deliver measurable growth. Here’s how to do it effectively:

Set Clear, Measurable Goals

Start by defining specific outcomes you want to achieve. Avoid vague goals like “boost awareness.” Instead, use measurable targets such as:

- “Increase leads by 15% in 3 months.”

- “Cut production costs by 10% in 6 months.”

Clear goals make ROI calculation accurate and purposeful.

Use Accounting & Analytics Tools

Leverage technology to track data efficiently:

- QuickBooks or Xero for financial tracking.

- Google Analytics or HubSpot for marketing metrics.

- Trello or Airtable for workflow improvement tracking.

These tools automate reporting and help you visualize performance.

Compare Baseline to Post-Investment Results

Always record “before” metrics like sales, cost per lead, or customer churn so you can compare results after investing. This before-and-after approach clearly shows the real impact of your reinvestment.

Track Financial and Non-Financial Returns

ROI isn’t just about money.

- Financial ROI: Profit growth, cost reduction, revenue increase.

- Non-financial ROI: Improved morale, better brand image, higher satisfaction.

Use proxy indicators like NPS scores or turnover rates to capture these softer gains.

Review Regularly

Monitor ROI monthly or quarterly to stay on track.

- Adjust or end underperforming initiatives.

- Scale successful ones for greater impact.

Regular reviews keep your reinvestment strategy data-driven and efficient.

Common Mistakes to Avoid When Measuring ROI

Tracking ROI is essential for sustainable business growth, but many entrepreneurs fall into common traps that distort results or mislead decisions. Here’s what to watch out for:

Focusing Only on Revenue (Ignoring Costs and Time)

A major mistake is looking only at how much revenue an investment generates without subtracting costs or time spent. For example, if a campaign earns $10,000 in new sales but costs $8,000 in ads and labor, your true profit is only $2,000. Ignoring expenses can make low-profit initiatives look more successful than they are. Always calculate net ROI after deducting all direct and indirect costs, including time and overhead.

Missing the Baseline Data

Without a “before” snapshot, you can’t measure real progress. Many business owners forget to record initial metrics like sales volume, website traffic, or customer satisfaction before investing. This makes post-investment comparisons meaningless. Establish a baseline for every metric before launching any initiative to accurately track growth and identify true cause-and-effect results.

Ignoring Long-Term Returns

Not all investments yield quick results. Training employees, improving brand reputation, or enhancing customer experience may take months or even a year to show impact. Dismissing these as low ROI simply because the gains are delayed is short-sighted. Recognize that some investments offer compounding benefits over time, improving efficiency, loyalty, and brand trust.

Failing to Review Regularly

Another pitfall is “set and forget.” If you don’t revisit your ROI data monthly or quarterly, underperforming projects can continue draining resources. Schedule consistent reviews to analyze trends, spot issues early, and make timely adjustments. This ensures every dollar reinvested continues to serve a clear purpose.

Using Vague or Unclear Goals

Vague objectives like “improve marketing” or “grow brand visibility” make ROI impossible to measure. You need specific, quantifiable goals such as “increase conversion rate by 10%” or “gain 200 new subscribers in 3 months.” Without clarity, results can be misinterpreted, and decision-making becomes guesswork.

Tools and Templates to Simplify ROI Tracking

Tracking ROI doesn’t have to be complicated. With the right tools and templates, you can simplify data collection, visualize performance, and make smarter reinvestment decisions. Here are some of the best tools to use across different business functions:

Spreadsheet ROI Calculators (Google Sheets / Excel)

For small businesses or startups, a simple spreadsheet is often the easiest starting point. You can build an ROI calculator that tracks costs, returns, and percentage gains for each investment. Customize it with formulas to automatically compute ROI for marketing campaigns, product launches, or team training. The flexibility of spreadsheets makes them ideal for businesses that prefer a hands-on, low-cost approach.

Financial Dashboards (QuickBooks, Xero)

Accounting software like QuickBooks and Xero provide real-time dashboards to monitor expenses, profit margins, and cash flow. They make it easier to spot trends, compare months, and identify which investments are generating the strongest returns. Automated syncing with your bank accounts and invoices ensures accuracy and saves time on manual entry.

Marketing ROI Tools (HubSpot, Google Analytics

If your reinvestment focuses on marketing, tools like HubSpot or Google Analytics are essential. They help track cost per lead (CPL), customer acquisition cost (CAC), conversion rates, and campaign ROI. By integrating ad platforms and CRMs, you can attribute profits directly to specific marketing efforts and optimize your budget based on real data.

Project Tracking Templates (Notion, Airtable)

For teams managing multiple projects, Notion and Airtable provide visual dashboards that link tasks, timelines, costs, and outcomes in one place. You can tag each project with its expected ROI and track progress over time. These tools make it easier to maintain transparency across departments and ensure accountability for results.

FAQs

- What’s a good ROI percentage for reinvestments?

Anything above your cost of capital is acceptable, but for small businesses an ROI of 20–40% is a strong target. Higher (50%+) is excellent, but consistency matters more than high peaks. - How often should I review ROI results?

Monthly for small initiatives; quarterly for longer-term investments like product development or training. - How do I measure ROI for non-financial investments (training, brand)?

Use proxy metrics: employee retention rate, productivity per employee, brand awareness surveys, Net Promoter Score (NPS). Estimate the dollar value of improvements if possible. - Can ROI be negative?

Yes, this means costs exceeded returns. Use it as a signal to stop or reconsider the investment strategy. - What tools do small businesses use to track ROI?

Common tools include Xero and QuickBooks for financials, Google Analytics and HubSpot for marketing, Excel/Google Sheets for custom tracking, and Notion/Airtable for project/output tracking.

Conclusion

Tracking ROI when reinvesting in your business isn’t just good practice; it’s essential for sustainable growth. By measuring how every dollar you reinvest is working, you make informed decisions, reduce waste, and drive better results. Use clear goals, capture baseline data, employ tools, review regularly, and act on outcomes.

Over time, this approach transforms reinvestment from a hopeful expense into a powerful engine for growth, helping your business become more efficient, resilient, and profitable.