A business bank account is more than just a place to store money, it’s a financial foundation for your company. Whether you’re launching a startup or running an established business, having a dedicated account helps manage cash flow, track expenses, and separate personal and business finances. But what if you don’t want to pay monthly fees?

Good news: Several Canadian banks offer the best free business bank accounts that can save you money while still providing essential banking services. But not all free accounts are created equal. Some come with transaction limits, hidden fees, or fewer features.

This guide will walk you through why you need a business bank account, what to look for, and which Canadian banks offer the best free options so you can make the right choice without unnecessary costs.

Why a Business Bank Account is a Must-Have

Many small business owners and freelancers use their personal bank accounts for business transactions. While this seems convenient, it creates problems later on, especially when applying for business funding.

Think of your business bank account as a financial hub. It organizes your revenue, expenses, and payments in one place, making life easier when tax season rolls around.

Separates Business and Personal Finances

Mixing personal and business finances is a recipe for confusion. A dedicated business account simplifies bookkeeping and helps you avoid tax headaches.

Boosts Professionalism

Customers and suppliers take you more seriously when you issue invoices and accept payments under your business name instead of your personal account.

Simplifies Accounting and Tax Filing

When all business transactions go through one account, tracking income and expenses is easier. This makes tax filing more accurate and helps you avoid unnecessary audits.

Saves Money and Reduces Fees

A free business account means zero monthly fees, saving you hundreds of dollars per year. Instead of paying a bank, you can reinvest that money into growing your business.

Best part? You don’t have to pay for a business bank account. Let’s find you the best free option!

What to Look for in a Free Business Bank Account

Not all “free” business bank accounts are truly free. Some banks advertise zero monthly fees but charge for transactions, e-transfers, or ATM withdrawals. Before choosing an account, consider these key factors:

No Monthly Fees

The whole point of a free business account is to avoid monthly charges. Look for one that offers unlimited or high transaction limits without extra costs.

Transaction Limits and Fees

Many free accounts cap the number of transactions (deposits, withdrawals, transfers) per month. If you exceed the limit, you might face hefty fees. Choose an account that fits your transaction volume.

Online and Mobile Banking

Convenience matters. A strong online banking platform lets you send e-transfers, pay bills, and check balances from anywhere. Look for features like mobile check deposits and integrations with accounting software.

ATM Access and Cash Deposits

If you handle a lot of cash, make sure the bank has a good ATM network and low fees for deposits. Some online-only banks don’t offer cash deposit options, which can be a deal-breaker for certain businesses.

Extra Business Services

Some free accounts include perks like payroll processing, business credit cards, and merchant services (e.g., accepting credit card payments). If your business needs these services, factor them into your decision.

Best Free Business Bank Accounts in Canada

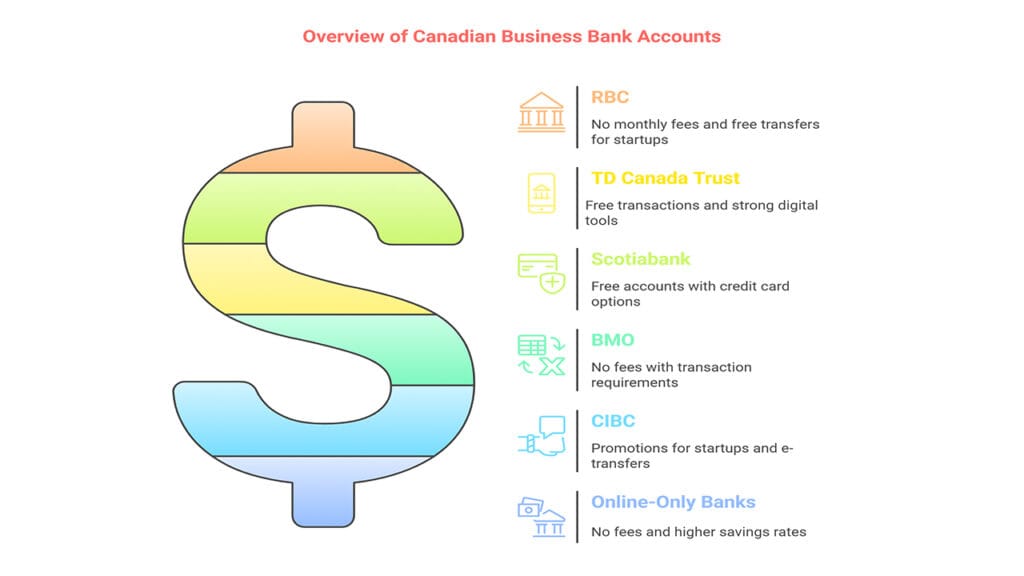

Several banks in Canada offer zero-fee business banking options. Here’s a look at the best ones:

RBC (Royal Bank of Canada)

- No monthly fees for new businesses under RBC’s Startup Banking package.

- Free electronic transfers and mobile banking.

- Access to a vast ATM network

TD Canada Trust

- Business banking with free transactions under special promotions.

- Strong digital banking tools.

- Merchant solutions for businesses that accept payments

Scotiabank

- Free business accounts under certain conditions.

- Includes business credit card options.

- Competitive rates on business loans and lines of credit

BMO (Bank of Montreal)

- No monthly fees if you meet transaction requirements.

- Free electronic fund transfers.

- Integrates with business accounting software

CIBC (Canadian Imperial Bank of Commerce)

- Affordable business banking with promotions for startups.

- Free e-transfers on some accounts.

- Strong customer support and business advisory services

Online-Only Banks (Tangerine, Simplii Financial, EQ Bank)

- No physical branches, but no fees either.

- Higher interest rates on business savings.

- Best for businesses that don’t handle cash deposits

Pro Tip: Some traditional banks waive fees for a limited time or if you maintain a minimum balance. Always read the fine print before signing up.

How to Open a Free Business Bank Account in Canada

Opening a business account is easier than you think. Most banks offer online applications, but you can also visit a branch if you prefer. Here’s what you’ll need:

Gather Required Documents

To open a business account in Canada, you typically need:

- Business registration or incorporation documents.

- Business Number (BN) from the Canada Revenue Agency.

- Government-issued ID for the business owner(s)

Apply Online or In-Branch

Many banks now offer fully online applications. You’ll need to upload documents, verify your identity, and answer questions about your business.

Fund Your Account and Start Using It

Once approved, deposit an initial amount (if required), set up online banking, and start managing your business finances.

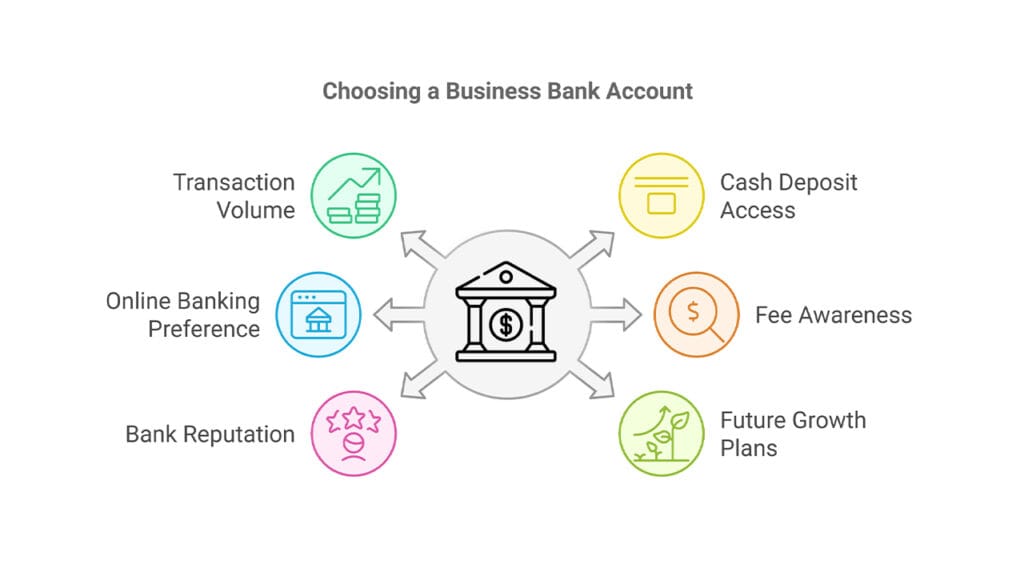

How to Choose the Right Free Business Bank Account

With multiple options available, how do you pick the right one? Here’s a step-by-step approach:

Assess Your Business Needs

Do you process a lot of transactions? Need access to cash deposits? Prefer online-only banking? Choose an account that aligns with your daily operations.

Compare Fees and Features

Even free accounts may charge for extras like wire transfers or international transactions. Make sure you’re not paying hidden fees.

Read Customer Reviews

A bank’s reputation matters. Check online reviews and ask other business owners about their experiences.

Plan for Future Growth

Your banking needs may change as your business expands. Pick a bank that offers additional services like credit lines, merchant solutions, and payroll management.

Potential Drawbacks of Free Business Bank Accounts

While free accounts save money, they aren’t perfect. Here are some downsides to watch for:

- Limited Features: Free accounts may not include advanced banking tools like overdraft protection or unlimited transactions.

- Hidden Fees: Some banks charge for extras like paper statements, wire transfers, or exceeding transaction limits.

- Customer Service Issues: Online-only banks may have limited phone support, which can be frustrating if you need help.

Solution: Read the fine print before committing. If a free account doesn’t meet your needs, consider a low-cost business account instead.

Pro Tips to Get the Most Out of Your Business Bank Account

- Use accounting software: Connect your account to QuickBooks, Wave, or Xero for automated bookkeeping.

- Set up automatic transfers: Move extra cash into a high-interest savings account to earn passive income.

- Track transactions: Keep an eye on hidden fees and set up alerts for unexpected charges.

- Negotiate with banks: If your business grows, banks may offer you better perks, like free international transactions.

Final Thoughts: Is a Free Business Bank Account Right for You?

If you’re a small business owner or startup looking to save money, a free business bank account is a great choice. It helps manage finances without extra costs, keeps personal and business transactions separate, and provides essential banking tools.

However, not all free accounts are created equal. Some come with transaction limits, hidden fees, or fewer features. The key is choosing the right one based on your business needs.

By comparing your options, understanding fees, and planning for future growth, you can find the best free business bank account in Canada and keep more money in your pocket.