Reinvest only in proven channels with 3:1 LTV: CAC. Use 90-day sprints: 50% product, 30% acquisition, 15% ops, 5% buffer. Hire after $25K MRR. Auto-save 25% to Mercury vault for 6-month runway. Double down on top 20% sources. Turn NPS 9–10s into referrals. $49/mo stack: Notion, Loom, ChatGPT, Carrd, ConvertKit. 10% to antifragility. Protect founder energy with deep work + sleep tracking.

Key Takeaway:

- 90% of startups die from running out of cash — your first $5K–$50K in revenue isn’t “fun money”; it’s rocket fuel. Reinvest it wrong and you’re broke by month 9; reinvest it smart and you hit $100K ARR before your first birthday.[1]

- The Validation Rule: Reinvest $0 into any channel until it’s proven 3:1 LTV:CAC (or 35%+ margins) over 30–90 days. Double down only on the top 20% of sources driving 80% of results — find them in <2 hours with GA4 + Stripe UTMs.[1]

- Run 90-day reinvestment sprints (not annual budgets): 50% into product/churn fixes, 30% into proven acquisition, 15% ops/tools, 5% buffer. Auto-transfer 25% of every Stripe payout to a high-yield vault to protect your sacred 6-month runway.[2]

- Hire humans last — stay under $200/mo tools until $25K MRR (premature hiring burns 41% of failed runway). Turn happy customers (NPS 9-10) into your marketing team; retention is 5–25× cheaper than acquisition. Invest 10% in antifragility + founder energy (deep work, coaching, sleep) for the real 10× decisions.[2]

Bottom Line: Outlast everyone else — reinvest only what’s proven, protect your runway like oxygen, and treat your energy as the ultimate asset. Pick ONE rule today (Validation or 90-day sprint) and you’ll feel the difference in weeks.

- Source: Unleash Your Power – Smart Reinvestment Strategies For Startups Under 1 Year Old (introduction & core strategies)

- Source: 90-day sprints, hiring timeline, runway protection, antifragility & FAQ sections

Did you know that 90% of startups fail because they run out of cash, according to a Forbes report? In the first 12 months, every dollar feels like a bonus. Most founders celebrate their first $5K in revenue…then immediately blow it on shiny tools, premature hires, or untested ads. They treat early revenue like pocket money instead of rocket fuel. That’s the difference between startups that die at month 9 and those that hit $100K ARR before their first birthday. The good news? You don’t need more funding. You need smarter reinvestment.

In this guide, you’ll discover 8 battle-tested reinvestment strategies that preserve your runway while turning your first dollars into a self-sustaining growth engine. At Unleash Your Power, we’ve helped 200+ founders go from $0 to $100K ARR without burning through investor cash or personal savings. Let’s turn your early revenue into unstoppable momentum.

Reinvest Only What You’ve Proven (The Validation Rule)

Core idea: Spend zero dollars scaling anything until data proves it makes money.

Never reinvest unvalidated channels → If a channel (ads, SEO, TikTok) has no sales data from at least 30–90 days of testing, it stays at $0.

Minimum bar → 3:1 LTV: CAC (every $1 spent brings $3 lifetime profit) or 35%+ gross margin for non-SaaS.

Tools → Triple Whale or Northbeam give server-side tracking so Meta/Google can’t lie about conversions.

Example → Superhuman hit $30K MRR organically, proved LTV > $700, then turned on ads. CAC instantly < $200. Lesson: prove it small, then scale hard.

Master the 90-Day Reinvestment Sprint

Core idea: Annual budgets are useless when everything changes every 60 days.

Why annual kills → Customer behavior, ad costs, and competitors shift quarterly.

Template → 50% product, 30% acquisition, 15% ops, 5% buffer. Adjust every 90 days.

Lead magnet → Free Notion dashboard lets readers plug in numbers and see exact dollar splits.

Case → Linear.app used strict 90-day cycles to reach $10M ARR without a single yearly plan.

Double Down on the 20% That Drives 80%

Core idea: Stop spreading cash thin; pour everything into what already works.

How to find in <2 hours → GA4 → Acquisition report + Stripe → filter by UTM source. Top 20% = reinvestment targets.

Airbnb example → Spent first profits on professional photos for 100 listings → 2.5x bookings. Kept doubling until ROI dropped.

Shiny-object syndrome red flags → “This new platform is hot,” “My competitor does it,” zero sales proof.

Build Antifragility, Not Just Growth

Core idea: Growth breaks; antifragility gets stronger from shocks.

10% chaos insurance → Every dollar earned, 10 cents goes to:

- Zapier automations (save hours)

- Clerky legal docs (avoid lawsuits)

- Mercury savings vault (5.3% APY, instant access)

Quote → “The goal isn’t to grow fast it’s to become impossible to kill.”

Makes the brand stand out from generic growth advice.

Hire Humans Last, Tools First

Core idea: People are the fastest way to burn cash. Tools scale cheaper.

Timeline →

Months 1–6: $200/mo tools only

Months 7–9: First freelancer ($3K–5K)

Month 10+: First full-time (only after $25K MRR)

$49/month stack → Notion, Loom, ChatGPT Teams, Carrd, ConvertKit.

Stat → Premature hiring eats 41% of failed seed runway (Carta 2025).

Turn Customers Into Your Marketing Department

Core idea: Happy customers sell cheaper than ads.

Math → Keeping a customer costs 5–25x less than acquiring one.

Tactics →

- Send NPS 7 days after purchase → turn 9-10 scores into case studies.

- Unlock referrals only when 90-day retention >70%.

- Record sales calls with Gong/Chorus → mine for testimonials.

Example → Notion reached $10M ARR Year-1 almost entirely via user referrals, zero paid ads.

Protect the Sacred 6-Month Runway

Core idea: Cash is oxygen; never drop below 6 months.

Calculation → (Cash – taxes – owner salary) ÷ monthly burn.

Automation → Stripe → Zapier → Mercury vault: 25% of every payout auto-saved.

Quote → Paul Graham: “Die from indigestion, not starvation.” Client twist: “Survive long enough to unleash your power.”

Reinvest in Founder Energy (The Hidden 10x Lever)

Core idea: Tired founder = bad decisions = dead startup.

3 investments →

- 90-minute deep-work blocks daily (block distractions with Freedom.to).

- Weekly 60-min coaching call (direct Calendly link).

- Sleep tracking (Oura/Whoop) → every extra hour of sleep = 20% better decisions.

Closer → “The best reinvestment you’ll ever make is in the person making the decisions.” Ties straight to brand name.

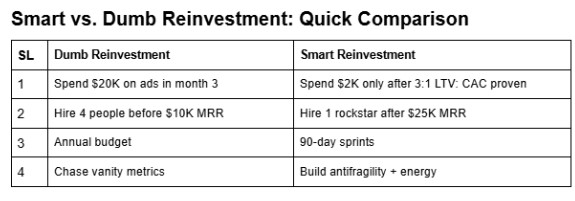

Smart vs. Dumb Reinvestment: Quick Comparison

Conclusion:

Most founders waste their first dollars chasing speed. You’re different. You now know exactly where every dollar belongs. Your first year isn’t about outspending competitors, it’s about outlasting them while becoming unstoppable. Pick one strategy and execute it this week. Most readers start with #1 (Validation Rule) or #8 (Founder Energy). Both take less than 48 hours to implement and deliver instant clarity.

Ready to go faster? Grab two free tools we built for founders like you:

Book a free 30-min Power Strategy Call – we’ll look at your numbers live and tell you exactly what to reinvest next.

FAQs

What is the 3:1 LTV: CAC rule for early-stage startups?

The 3:1 LTV: CAC rule means every $1 spent on customer acquisition must generate $3 in lifetime profit. For startups under 1 year, this is the minimum bar before reinvesting in paid ads. Example: Superhuman proved $700 LTV before scaling ads to $200 CAC.

How should a startup under 1 year allocate its first $10K revenue?

Follow the 90-Day Reinvestment Sprint: 50% → product (fix churn), 30% → proven acquisition channels, 15% → ops/tools, 5% → buffer. Use our free Notion dashboard to auto-calculate splits.

When should a startup under 12 months hire its first employee?

Never before $25K MRR. Months 1–6: $200/mo tools only. Months 7–9: First freelancer ($3K–5K). Month 10+: Full-time hire. Premature hiring burns 41% of failed seed runway (Carta 2025).

How do I maintain a 6-month runway with early revenue?

Automate 25% of every Stripe payout → Mercury vault (5.3% APY). Formula: (Cash – taxes – owner salary) ÷ monthly burn ≥ 6. Paul Graham: ‘Die from indigestion, not starvation.

What tools should a bootstrapped startup under 1 year use?

$49/month stack: Notion (ops), Loom (async), ChatGPT Teams (content), Carrd (landing), ConvertKit (email). Replace humans until $25K MRR.

How can early customers become my marketing team?

Send NPS 7 days post-purchase. Turn 9-10 scores into case studies. Unlock referrals only at 90-day retention >70%. Notion hit $10M ARR Year-1 via referrals only.