Canada offers a strong economy, government support for entrepreneurs, and a growing demand for innovative products and services. Many business owners have built profitable ventures by tapping into high-demand markets, setting their own schedules, and achieving financial independence without the constraints of a traditional 9-to-5 job.

But here’s the reality: not every business is worth your time and money. Some require heavy investment with slow returns, while others turn a modest startup cost into steady profits. The most successful businesses strike the right balance high demand, low overhead, and room to scale. So, where’s the real opportunity? Right now, industries like e-commerce, real estate, tech services, and consulting are proving to be some of the most recession-resistant and profitable options.

Let’s dive in. This guide breaks down the most profitable businesses in Canada, covering startup costs, earning potential, and key success factors. If you’re ready to take control of your income and build something that works for you, this is where it all begins.

Most Profitable Business Ideas in Canada

Starting a business in Canada can be a great opportunity, but choosing the right industry is key to success. Below are some of the most profitable business ideas, including startup costs, success rates, and profit margins, to help you decide on the best fit.

E-Commerce & Online Retail (Low Startup Cost, High Profit Potential)

E-commerce is one of the easiest and most cost-effective businesses to start in Canada. With platforms like Shopify, Amazon, and Etsy, you can sell dropshipping products, custom print-on-demand items, or handmade goods.

- Startup Cost: As low as $500 – $10,000, depending on the business model.

- Success Rate: Around 50% – 65%, with strong marketing and product selection.

- Profit Margin: 20% – 60%, depending on the product and fulfillment method.

Example: A Canadian entrepreneur turned a dropshipping Shopify store into a six-figure business using targeted Facebook ads.

Real Estate & Property Investment (High ROI, Passive Income)

Real estate has long been one of the most lucrative businesses in Canada, offering high returns and long-term passive income. Investing in rental properties, Airbnb management, or even house flipping can generate substantial profits.

- Startup Cost: Can range from $50,000 – $200,000 for house flipping or rental investments. Airbnb property management can start at $5,000 – $20,000.

- Success Rate: 65% – 80%, depending on location and investment strategy.

- Profit Margin: 8% – 50%, depending on the business model.

Example: A Toronto-based investor bought and renovated a house, flipping it for a $200,000 profit within a year.

Tech & IT Services (Growing Market, High Demand)

Canada’s tech industry is rapidly expanding, making IT services a highly profitable business with low startup costs. Services like AI development, cybersecurity consulting, and web design are in high demand.

- Startup Cost: Between $2,000 – $50,000, depending on the level of expertise and software required.

- Success Rate: Around 65% – 75%, with strong client acquisition.

- Profit Margin: 40% – 80%, as IT services have minimal overhead.

Example: A cybersecurity consultant in Vancouver earns over $150,000 per year by helping businesses secure their networks.

Consulting & Coaching (Expertise-Based, High Profit Margins)

If you have specialized knowledge or experience, consulting or coaching is a low cost, high-profit business. You can offer business consulting, career coaching, or fitness coaching, either online or in person.

- Startup Cost: $1,000 – $10,000, mainly for branding, website development, and marketing.

- Success Rate: 70% – 80%, depending on expertise and marketing efforts.

- Profit Margin: 50% – 90%, since there are minimal operating costs.

Example: A career coach in Toronto charges $200 per session, working with clients globally via Zoom.

Sustainable & Eco-Friendly Businesses (Government Support, Emerging Market)

With growing environmental awareness, green businesses are booming. Selling eco-friendly products, installing solar panels, or offering waste reduction services can be very profitable.

- Startup Cost: $5,000 – $100,000, depending on the type of business.

- Success Rate: 60% – 70%, with government incentives supporting green businesses.

- Profit Margin: 30% – 60%, depending on scalability and operations.

Example: A startup selling biodegradable packaging made over $1 million in its first year.

Food & Beverage Industry (Consistent Demand, High Margins)

The food industry is always in demand, but high operational costs can make it challenging. Businesses like cloud kitchens, specialty coffee shops, or meal prep services have become more profitable alternatives.

- Startup Cost: $5,000 – $250,000, with cloud kitchens being more affordable than traditional restaurants.

- Success Rate: 60% – 75%, with location and customer retention playing a role.

- Profit Margin: 15% – 50%, depending on expenses like rent, labor, and food costs.

Example: A Vancouver-based meal prep service scaled to six figures by catering to keto and vegan customers.

Healthcare & Wellness (Recession-Proof, High Demand)

With Canada’s aging population and growing wellness trends, healthcare related businesses are recession-proof. Businesses like home healthcare, mental health therapy, or naturopathic clinics are highly profitable.

- Startup Cost: $5,000 – $100,000, depending on the service type.

- Success Rate: 65% – 80%, as healthcare services remain in constant demand.

- Profit Margin: 30% – 70%, depending on the specialization.

Example: A mental health therapist built a six-figure online counseling practice through virtual sessions.

Logistics & Transportation (Essential Service, High Earnings)

With the rise of e-commerce, logistics and delivery businesses have become essential. Trucking, last-mile delivery, and e-bike rentals are among the most profitable transportation businesses in Canada.

- Startup Cost: $10,000 – $200,000, with trucking requiring more capital.

- Success Rate: 60% – 75%, depending on demand and operational efficiency.

- Profit Margin: 20% – 50%, with scalability potential.

Example: A trucking business in Ontario turned a $20,000 investment into $500,000 annual revenue.

Franchise Businesses (Low Risk, Established Brand)

Buying a franchise can be a low-risk way to start a business, as it comes with brand recognition and a proven system. Popular options include fast food, cleaning services, and gyms.

- Startup Cost: $20,000 – $1 million, depending on the franchise brand.

- Success Rate: 85% – 90%, higher than independent businesses.

- Profit Margin: 10% – 50%, depending on the franchise model.

Example: A Tim Hortons franchise owner in Alberta generates over $1M in annual revenue.

Content Creation & Digital Businesses (Scalable, Passive Income)

With YouTube, blogging, and social media marketing booming, digital businesses offer scalability and passive income potential.

- Startup Cost: $500 – $10,000, mainly for website hosting, content creation tools, and marketing.

- Success Rate: 50% – 75%, depending on niche selection and audience engagement.

- Profit Margin: 40% – 90%, since most digital businesses have low overhead.

Example: A Canadian YouTuber built a six-figure business through sponsorships and online courses.

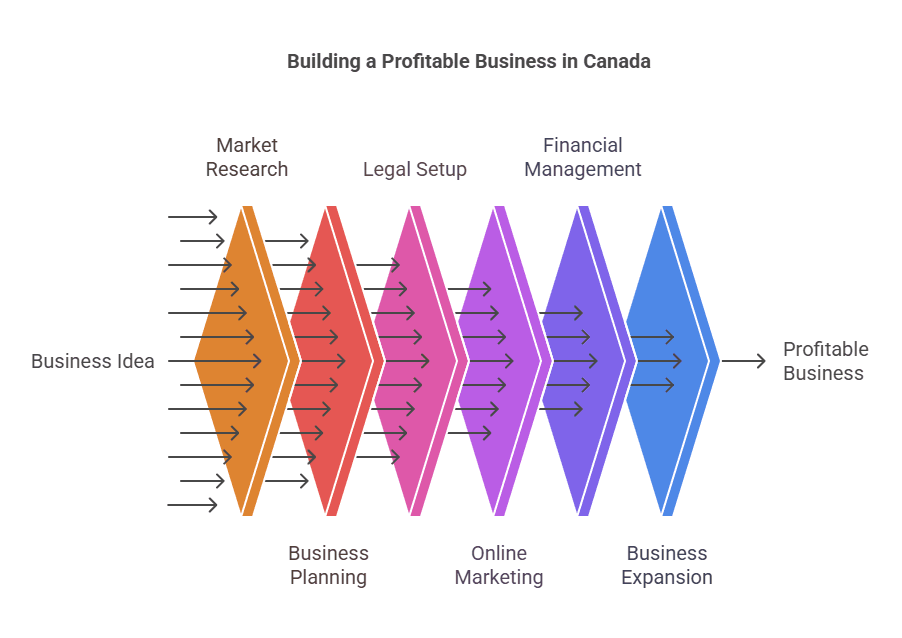

Steps to Start a Profitable Business in Canada

Starting a business in Canada takes more than just a great idea it requires careful planning, smart financial management, and strategic marketing. Whether you’re launching an online store, service-based business, or brick-and-mortar shop, following these key steps will help you build a strong foundation and maximize profitability.

Research the Market & Identify Demand

A successful business solves a real problem or meets a market need. Before investing time and money, analyze industry trends, study competitors, and validate demand.

How to test your idea:

- Conduct surveys or interviews with potential customers.

- Launch a small-scale version of your product or service

- Research search trends and online forums to gauge interest.

Example: If launching an organic skincare brand, study customer preferences, spending habits, and competitor pricing to ensure a viable market.

Create a Business Plan & Financial Strategy

A solid business plan keeps you focused and is essential if you plan to seek funding.

Key elements to include:

- Target audience & unique selling proposition (USP).

- Revenue streams (products, services, or subscriptions).

- Cost structure & pricing strategy.

- Marketing & growth plan.

Example: A specialty coffee shop should analyze local demand, assess competitors, and set pricing based on ingredient costs and profit margins.

Register & Legally Set Up Your Business

To operate legally, you must register your business and set up financial structures properly.

- Choose a Business Name – Check availability through the Canadian Business Registry.

- Select a Business Structure:

- Sole Proprietorship – Simple to start but offers no liability protection.

- Partnership – Shared ownership with a co-founder.

- Corporation – More protection and tax benefits, ideal for attracting investors.

- Register with the CRA – Obtain a Business Number (BN) and necessary permits.

- Open a Business Bank Account – Keeps personal and business finances separate.

Example: A freelance graphic designer may start as a sole proprietor, while a tech startup may incorporate to attract investors.

Build an Online Presence & Market Your Business

A strong digital presence is essential for attracting customers and growing your brand.

- Create a Professional Website – Platforms like Shopify, WordPress, or Wix make it easy.

- Leverage Social Media & Digital Marketing:

Promote your business on Instagram, Facebook, and LinkedIn.

Run targeted Google Ads and email marketing campaigns. - Network & Collaborate – Join industry forums, LinkedIn groups, and business communities.

Example: A fitness coach can grow their business by posting workout tips on Instagram, running ads, and selling online coaching programs.

Secure Funding & Manage Finances

Understanding your financial needs early on will help prevent cash flow problems.

Ways to fund your business:

- Small business loans – Options from RBC, TD, and BDC.

- Government grants – Programs like CSBFP (Canada Small Business Financing Program) and the Canada Digital Adoption Program.

- Crowdfunding – Platforms like Kickstarter or GoFundMe can help raise capital.

Tracking expenses, revenue, and profits regularly will keep your business financially healthy.

Scale & Expand Smartly

Once your business is stable, focus on efficiency and growth.

- Automate Processes – Use tools like Hootsuite for social media and Mailchimp for email marketing.

- Delegate & Outsource – Hire freelancers or employees for tasks like accounting and content creation.

- Expand Offerings & Market Reach:

Introduce new products or services.

Consider opening more locations or shipping internationally. - Monitor Finances & Performance – Use analytics tools to track revenue, customer feedback, and trends.

Example: A successful e-commerce brand can increase revenue by offering subscription boxes or expanding into international markets.

Conclusion

Starting a business in Canada isn’t just about having a great idea it’s about making smart, strategic moves that set you up for long-term success. From market research and legal setup to funding, marketing, and scaling, every step you take brings you closer to profitability.

The most successful businesses aren’t built overnight, but with careful planning and the right mindset, you can create something sustainable and rewarding. Stay adaptable, track your progress, and be willing to adjust your strategies as you grow.

The best time to start is now. Take the first step, keep learning, and turn your vision into a thriving business. Your success story starts today!