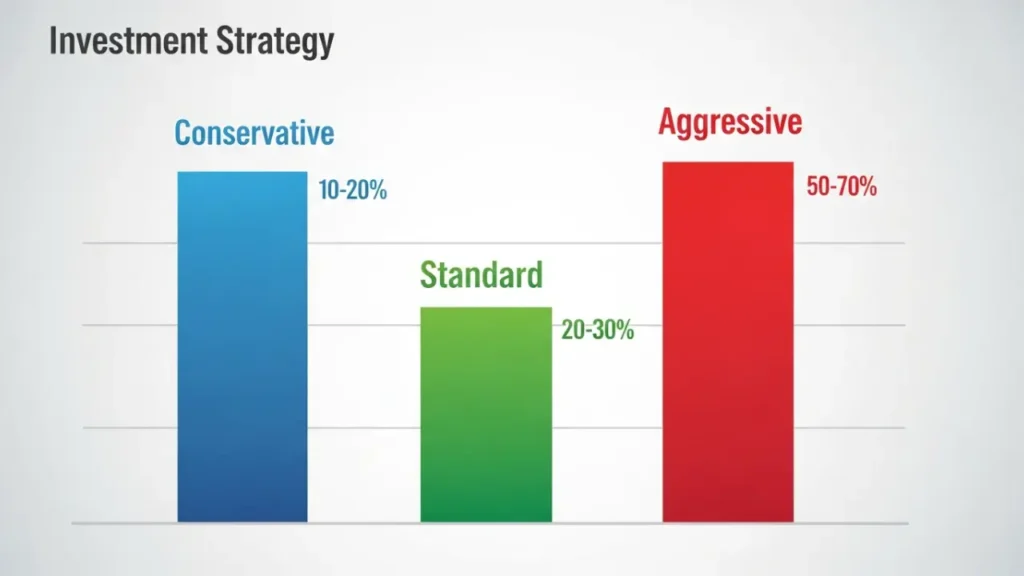

Most small businesses should reinvest 20–30% of their monthly profits to maintain healthy growth. Startups aiming for rapid expansion may reinvest 50–70%, while mature, stable businesses can sustain with 9–20%. The key is to reinvest consistently, track ROI, and balance growth with personal income and stability.

Every successful business grows because its owners make one smart decision repeatedly reinvesting profits strategically.

Reinvestment isn’t just about spending money; it’s about fueling sustainable growth, improving systems, and securing long-term stability. But how much should you actually reinvest each month?

This guide breaks down everything you need to know, from benchmarks and influencing factors to practical calculations and reinvestment ideas to help you make informed, data-driven choices for your business.

Key Takeaways

- There’s no one-size-fits-all percentage, but 20-50% of net profit is a solid guideline for reinvestment.

- Your reinvestment rate should match your business goals, cash flow health, and industry context.

- Reinvestment is most effective when used strategically and tracked for results.

- Monthly discipline in reinvesting helps transform profit into growth and long-term business value.

Key Factors Influencing How Much to Reinvest

Determining how much profit to reinvest depends on your business’s stage, goals, and financial stability. Here are the main factors that guide smart reinvestment decisions:

Business Stage: Startup vs. Mature Business

Your reinvestment rate should align with your business phase.

- Startups often reinvest 50–70% of profits to fund growth, marketing, and product development.

- Mature businesses usually reinvest 10–30%, focusing on maintenance, efficiency, and modest expansion.

Profit Margins and Industry Norms

Different industries operate with different profit capacities.

- High-margin sectors (like software or consulting) can comfortably reinvest more.

- Low-margin sectors (like retail or food services) should be more conservative to preserve cash.

Knowing your industry averages, such as those shared by Knocked-Up Money+1, helps you stay realistic and competitive.

Cash Flow Stability and Reserves

Strong cash flow allows for confident reinvestment.

Ensure you have 3–6 months of expenses in reserve before allocating profits.

- If your cash flow is steady, reinvest more.

- If it’s tight or irregular, build stability first.

As AmazingAccountants notes, sustainable reinvestment depends on consistent liquidity.

Growth Goals vs. Personal Income Needs

Balance your growth ambitions with your personal financial needs.

- Aim higher (40–70%) if you want rapid expansion.

- Choose a moderate rate if your focus is on steady income and work-life balance.

Your reinvestment plan should match your long-term goals and comfort level with risk.

Reinvestment Benchmark Ranges and Rules of Thumb

There’s no single formula for how much profit a small business should reinvest each month but several proven benchmarks can guide your decisions. The right percentage depends on your business goals, cash flow stability, and growth stage.

Common Guidance (20–30% of Profits)

For most small and mid-sized businesses, reinvesting 20–30% of monthly profits strikes a healthy balance. It allows for steady growth while keeping enough cash for operations, taxes, and the owner’s income. This range supports sustainable business expansion without overextending your resources.

Aggressive Growth Stage (50–70% of Profits)

If your business is in a rapid growth phase like expanding locations, launching new products, or scaling marketing, reinvesting up to 70% of profits can accelerate progress dramatically. This high reinvestment level works best when your personal expenses are covered elsewhere or when you have strong financial buffers in place.

Conservative or Steady Stage (10–20% of Profits)

Established businesses that prioritize stability over fast growth can comfortably reinvest 10–20% of profits. This approach focuses on maintenance, small upgrades, and efficiency improvements while preserving cash reserves for emergencies or predictable payouts.

Simple Allocation Models: The 30/50/20 Rule

Many experts recommend following the 30/50/20 allocation model:

- 30% for reinvestment (marketing, equipment, staff)

- 50% for operating expenses and the owner’s salary

- 20% for savings, taxes, and reserves

This model ensures that every dollar earned has a clear purpose helping your business grow while keeping your finances balanced and stress-free.

How to Calculate Your Monthly Reinvestment Amount

Turning the theoretical into a concrete dollar figure is a straightforward, three-step process. Performing this calculation monthly ensures your reinvestment is data-driven and intentional.

Step 1: Determine Net Profit for the Month

This is your foundational number. It is not your total revenue, but what remains after all expenses are paid. Crucially, you must include a fair market-rate salary for yourself as an expense. The formula is simple:

Net Profit = Total Revenue – Total Operating Expenses (Including Your Salary)

If you pay yourself a draw from profit instead of a salary, calculate your net profit first, then decide on the draw from the remainder.

Step 2: Review Essential Reserves and Debts

Before you decide to reinvest, you must ensure the business’s financial health is stable. Ask yourself:

- Do I have a sufficient cash buffer? Most experts recommend 3-6 months of operating expenses set aside for emergencies. If you are below this threshold, prioritizing your reserve fund is a form of strategic reinvestment in stability.

- Are there high-interest debts? It often makes more financial sense to pay down a loan with a 10% interest rate than to reinvest in a marketing campaign that might only yield a 7% return. Conduct a cost-benefit analysis.

Step 3: Choose a Reinvestment Percentage Aligned with Your Goals

Now, refer to the benchmarks in Section 3. Given your business stage (aggressive growth vs. stable), your financial stability (from Step 2), and your growth objectives, select a percentage.

Example Calculation: Putting It All Together

Let’s assume your business had the following month:

- Monthly Revenue: $30,000

- Monthly Expenses (including your $4,500 salary): $22,000

- Net Profit: $30,000 – $22,000 = $8,000

- Chosen Reinvestment Rate (You’re in growth mode): 30%

- Monthly Reinvestment Amount: $8,000 x 0.30 = $2,400

This $2,400 is now your dedicated “Strategic Growth Fund” for the upcoming month.

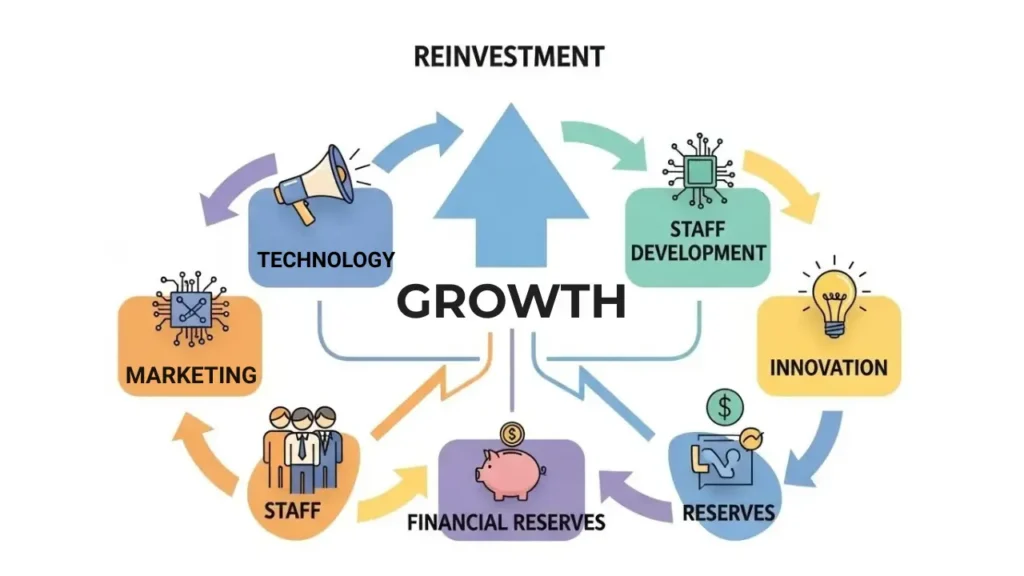

What to Reinvest In: Effective Use of Reinvestment Funds

Once you’ve determined how much profit to reinvest, the next step is deciding where to allocate it for maximum impact. Smart reinvestment isn’t about spending more, it’s about spending wisely in areas that fuel long-term growth and stability.

Marketing & Customer Acquisition

Investing in marketing directly drives revenue growth. This includes:

- Running social media or Google Ads campaigns to attract new customers.

- Improving your website for better SEO and user experience.

- Hiring a freelance marketing expert or agency for strategic planning.

- Developing lead magnets like e-books or free trials to grow your audience

Strong marketing ensures steady customer inflow the lifeline of every business.

Equipment, Technology, and Process Improvements

Efficiency boosts profit margins. Use funds to:

- Upgrade outdated equipment or software that slows operations.

- Adopt automation tools for accounting, CRM, or project management.

- Streamline workflows to reduce errors and save time.

These investments often pay for themselves through improved productivity and cost savings.

Talent and Training

Your team is your greatest asset. Reinvest in people through:

- Hiring key roles that drive growth (e.g., marketing manager, operations head)

- Providing skill-based training to improve performance.

- Offering employee benefits or bonuses to boost motivation and retention.

Well-trained, motivated employees deliver higher-quality work and foster innovation.

New Product Development or Market Expansion

Innovation keeps your business relevant. Consider reinvesting in:

- Research and development (R&D) for new products or services.

- Testing new markets or customer segments.

- Creating minimum viable products (MVPs) to validate new ideas.

These forward-looking investments open doors to fresh revenue streams and growth opportunities.

Reserve Fund Growth for Emergencies

A healthy reserve fund ensures financial stability. Set aside part of your reinvestment for building or replenishing your cash buffer. Aim for 3–6 months of expenses in savings. This protects your business during slow periods or emergencies, helping you stay resilient.

Pitfalls and What to Avoid

Even well-intentioned reinvestment can go wrong if not done carefully. Avoid these common mistakes:

- Reinvesting Too Much When Cash Flow Is Shaky

Never use essential operating cash for reinvestment. Stability should come before growth. Always ensure rent, payroll, and utilities are fully covered first.

- Reinvesting Without Tracking ROI

Every dollar spent should have a clear purpose and measurable result. For example, if you spend $1,000 on ads, track how many leads or sales it generates. Data-driven decisions prevent waste.

- Ignoring Personal Salary

You should always pay yourself a fair salary before reinvesting profits. Underpaying yourself might cause stress and resentment, leading to burnout.

- Treating Reinvestment as Optional

Reinvestment isn’t a luxury it’s a necessity for sustained growth. Make it a consistent part of your monthly financial plan rather than an afterthought.

Conclusion: Building Sustainable Business Growth

Reinvesting profits isn’t just about spending more; it’s about growing smarter. Setting aside a portion of your monthly earnings keeps your business evolving, competitive, and financially healthy. Whether you’re a startup reinvesting 50–70% for faster growth or a mature business allocating 20–30% for steady improvement, the goal is purposeful reinvestment.

Focus on areas that directly strengthen your foundation: marketing, technology, team training, and emergency reserves. Avoid overinvesting when cash flow is unstable or neglecting your personal income needs.

A balanced reinvestment strategy builds both long-term stability and scalability. It ensures your business doesn’t just survive month to month but thrives, adapts, and grows into a lasting source of wealth and freedom.

FAQs

How do I know when I’m ready to reinvest profits?

You’re ready when: 1) You are consistently profitable, 2) You have a stable cash flow buffer, and 3) You have identified a specific, high-impact area for investment.

Can I reinvest more than 50% of my profits?

Absolutely. If you are in a high-growth phase, have minimal personal financial pressure, and see clear opportunities, reinvesting 70% or more can accelerate your trajectory dramatically.

What happens if I reinvest too little or too much?

Reinvesting too little leads to stagnation, missed opportunities, and vulnerability to competitors. Reinvesting too much (especially without a cash buffer) risks cash flow crises and owner burnout from underpayment.

Should I pay myself before reinvesting?

Yes. You should pay yourself a fair market-rate salary as a standard business expense. This happens before you calculate net profit. The reinvestment decision then comes from the profit left over, ensuring you are taken care of.

How frequently should I review my reinvestment percentage?

Review it at least quarterly. Your business needs and goals will change, and your reinvestment strategy should be flexible enough to adapt.