Starting your first business is exhilarating. You’ve got the vision, the drive, and the courage to step away from the safety of a steady paycheck. But here’s what nobody tells you: the excitement of launching your dream can quickly turn into financial overwhelm if you don’t get the money piece right from day one.

Key Takeaway:

- Canadian entrepreneurs often struggle with financial planning due to mixing business/personal finances, underestimating costs (add 20-30% buffer), ignoring quarterly taxes (no withholding), lacking emergency funds, poor tracking, skipping reviews, and limiting money mindsets leading to cash flow crises, penalties, and burnout. [1]

- Mechanisms: Blended finances obscure profitability/deductions; reactive approaches miss opportunities; variable income amplifies risksproactive systems create clarity, reduce stress, and enable growth by treating finances as interconnected with business success. [1]

- Tips: Separate accounts/credit cards immediately; build 12-month projections conservatively; auto-set aside 25-30% for taxes; create emergency fund (10-20% annual budget); track ruthlessly via software (QuickBooks/Wave, weekly reconciliations); review quarterly; shift mindset to view money management as learnable work with accountant for Canadian deductions. [2]

- Caveats: For service-based/variable income, enforce clear terms/pricing; integrate personal goals (retirement) early; hire advisor worth it for tax savings/errors start small but consistent to avoid overwhelm. [2]

Bottom Line: Avoid the 7 common mistakes by separating finances, planning taxes/projections proactively, tracking rigorously, and shifting mindset building financial clarity that fuels sustainable Canadian entrepreneurial growth and peace of mind.

- Source: Unleash Your Power – Financial Planning for Canadian Entrepreneurs

- Source: Article Body & Practical Steps

I’ve seen it happen countless times. Talented coaches, consultants, and entrepreneurs pour everything into building their businesses, only to find themselves drowning in financial chaos six months in. Mixed-up accounts. Surprise tax bills. Cash flow crises that keep them up at night. The irony? Most of these disasters are completely preventable.

You don’t need an MBA or a finance degree to master financial planning. What you need is clarity on the common pitfalls, a solid framework to follow, and the right mindset to make confident decisions about your money. That’s exactly what you’re about to get.

Why Most Canadian Entrepreneurs Get Financial Planning Wrong

Here’s the challenge most first-time business owners face: they treat their business finances and personal finances as two separate worlds that never need to meet. The reality? These two areas are deeply interconnected, and ignoring the intersection of business and personal finances creates blind spots that can derail your success.

Many entrepreneurs operate under a dangerous assumption: “I’ll figure out the financial stuff as I go.” It sounds reasonable when you’re focused on landing your first clients or perfecting your services. But this reactive approach leads to costly mistakes like discovering you owe thousands in taxes because you didn’t set money aside quarterly, or realizing you can’t afford to hire help because you never created proper financial projections.

The real cost isn’t just financial. It’s the burnout from constant money stress. The missed opportunities are because you don’t have cash reserves. The sleepless nights, wondering if you made the right decision, leaving your stable job. I’ve walked through financial confusion myself in building multiple businesses, and here’s what I learned: financial clarity isn’t optional for entrepreneurs; it’s the foundation that lets you build everything else with confidence.

Here’s what this means for you: why small businesses fail to grow often comes down to financial planning gaps, not lack of talent or effort.

What Are The Most Common Financial Mistakes First-Time Business Owners Make?

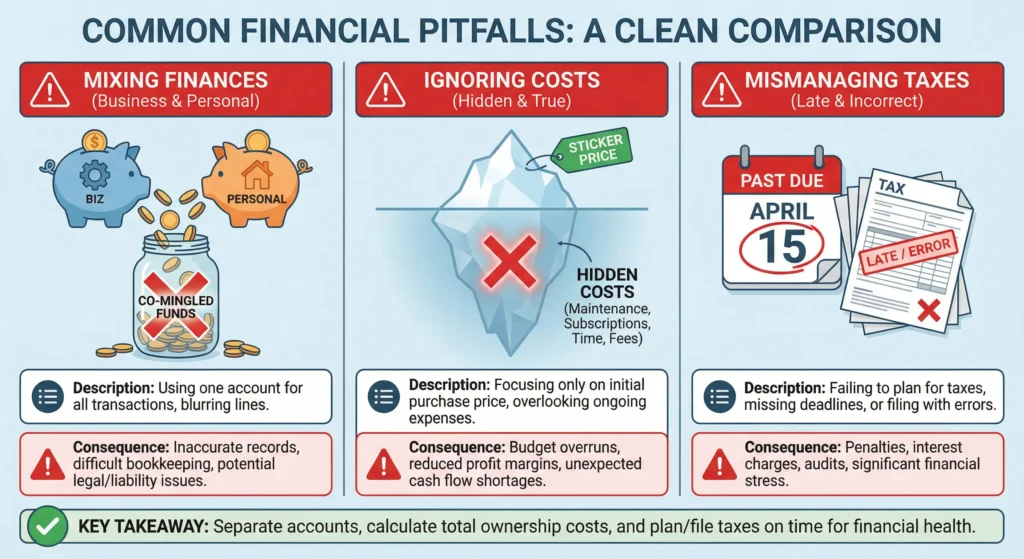

The most damaging mistakes Canadian entrepreneurs make fall into three categories: mixing finances, underestimating costs, and ignoring tax obligations. Each one can create serious problems, but the good news is they’re all avoidable with the right systems in place.

Mixing Business and Personal Finances

This is the number one mistake I see new entrepreneurs make, and it creates chaos fast. When you use your personal bank account for business expenses, you lose track of your true business costs. Come tax time, sorting through hundreds of transactions to figure out what’s deductible becomes a nightmare. You miss legitimate deductions. You can’t accurately gauge if your business is actually profitable.

The fix is simple but non-negotiable: open a dedicated business bank account on day one. Get a business credit card and use it exclusively for work expenses. This separation gives you instant clarity on your business cash flow and makes separating business and personal finances the foundation of healthy financial management.

Underestimating True Startup Costs

Most new business owners lowball their startup costs by 30-50%. They calculate the obvious expenses, website, business cards, maybe some equipment but forget about the hidden costs that add up fast. Software subscriptions. Professional fees for lawyers and accountants. Marketing expenses. The income gap while you’re building a clientele.

Research shows that inadequate financing is a leading cause of early business failure. When you create financial projections for new businesses, be brutally realistic. Add a buffer of at least 20-30% to your estimates. Assume it will take longer to generate a steady income than you hope.

Ignoring Tax Planning and Quarterly Obligations

Here’s a shock many first-time entrepreneurs face: when you’re self-employed in Canada, you’re responsible for remitting your own taxes quarterly. No employer is withholding from you anymore. If you spend every dollar you earn, you’ll face a massive tax bill that can cripple your business.

The solution? Set aside 25-30% of your gross income in a separate tax account immediately. Every time money comes in, transfer your tax portion before you do anything else. Work with an accountant who understands Canadian small business taxes to ensure you’re claiming all available deductions and meeting your obligations.

The Mindset Shift Every Canadian Entrepreneur Needs

Here’s a truth that stops many talented people from succeeding in business: your relationship with money directly impacts your business results. If you carry beliefs like “I’m just not good with numbers” or “money is complicated and stressful,” those beliefs will create exactly the financial chaos you fear.

Research on financial knowledge among Canadian entrepreneurs reveals something interesting: while 83% of business owners demonstrate solid financial literacy, confidence in managing money has actually decreased in recent years. This gap between knowledge and confidence is where overcoming mindset blocks around money becomes essential.

I’ve worked with entrepreneurs who felt blocked from financial abundance despite having income and talent. Once we identified and eliminated limiting beliefs using proven NLP techniques, they experienced radical shifts not just in their financial results, but in how they approached every business decision. The transformation wasn’t about learning more; it was about removing the mental obstacles that prevented them from applying what they already knew.

Your money mindset affects every decision you make: how you price your services, whether you invest in growth, how you handle slow months, and whether you have the confidence to scale. Understanding how a money mindset affects business decisions empowers you to make choices from clarity rather than fear.

The shift you need: move from “I’m bad with money” to “I can master this skill.” Financial planning isn’t a mysterious talent; some people are born with it but it’s a learnable competency. With the right framework and consistent practice, you’ll build genuine confidence in your financial decisions.

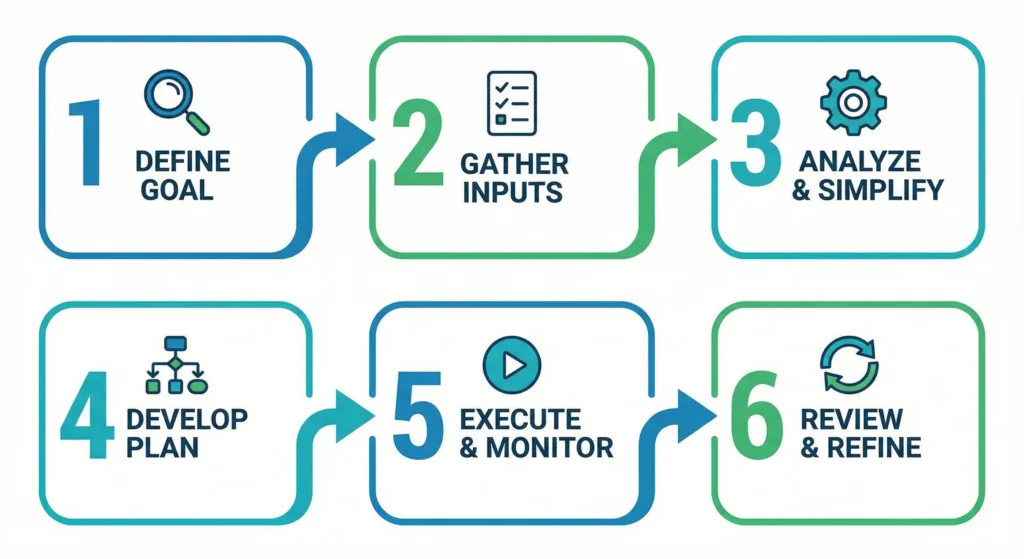

How Do You Create a Financial Plan That Actually Works?

Creating an effective financial plan isn’t about complex spreadsheets or sophisticated software. It’s about establishing six foundational practices that give you control, clarity, and confidence. Here’s your step-by-step framework.

Step 1: Separate Your Finances Immediately

This is your first and most critical action. If you haven’t already, open a business bank account this week. Transfer all business funds into it. Apply for a business credit card and commit to using it only for work expenses. This separation creates an instant audit trail and lets you see exactly how your business is performing financially.

Step 2: Build Your Financial Foundation

Start with basic financial projections for new businesses covering your first 12 months. List your fixed costs: rent, software, insurance, phone. Estimate variable costs like marketing and supplies. Project your income conservatively, assuming it takes longer than planned to reach steady revenue.

Create a simple budget that tracks actual spending against projections. Update it monthly. This living document keeps you honest about where money is really going and helps you course-correct before small problems become crises.

Step 3: Set Up Your Tax Strategy Early

Work with a qualified accountant to understand your specific tax obligations as a Canadian business owner. Set up a system where you automatically transfer 25-30% of every payment received into a dedicated tax savings account. This money is untouchable until tax time.

Learn what expenses are deductible for your business type. Keep meticulous records and receipts organized by category. This preparation transforms tax time from a stressful scramble into a straightforward process.

Step 4: Create an Emergency Fund

Build a contingency fund equal to 10-20% of your annual operating budget. This buffer is critical when implementing cash flow management strategies that keep your business resilient during slow periods or unexpected expenses.

Start small if needed, even setting aside $100 per week builds meaningful reserves over time. This fund isn’t for growth opportunities or fun expenses. It’s your safety net for genuine emergencies: major equipment failure, sudden loss of a key client, or market disruptions.

Step 5: Track Everything Ruthlessly

Get comfortable with basic accounting software like QuickBooks or Wave. Input every transaction. Reconcile your accounts weekly. This habit takes 20 minutes but gives you real-time visibility into your financial health.

Track your key metrics: revenue, expenses, profit margin, and cash reserves. Know these numbers cold. When you understand your financial reality at a granular level, you make smarter decisions about pricing, hiring, and growth investments.

Step 6: Review and Adjust Quarterly

Schedule quarterly financial reviews where you assess what’s working and what needs adjustment. Compare your actual numbers to projections. Celebrate wins. Address problems before they compound. This regular check-in keeps you proactive rather than reactive with your finances.

Having a written financial planning framework you revisit consistently is what separates entrepreneurs who build sustainable businesses from those who struggle year after year.

Strategic Financial Planning for Coaches and Service-Based Entrepreneurs

If you’re launching your coaching practice or building a service-based business, you face unique financial challenges. Variable income makes budgeting trickier. You’re selling your expertise, not physical products, which affects how you think about pricing and value. Payment processing fees and software subscriptions can quietly eat into margins.

Here’s what works: establish clear payment terms upfront. Require deposits or payment plans for longer engagements. Build pricing that reflects your expertise and the transformation you deliver, not just your time. When clients invest appropriately, they’re more committed to the work.

The reinvestment question haunts many service entrepreneurs: how much should you reinvest versus pay yourself? Apply smart reinvestment strategies by first ensuring you’re paying yourself a consistent base amount monthly. Then allocate percentages to taxes, savings, and reinvestment. A common split: 50% owner pay, 25% taxes, 15% operating expenses, 10% growth/savings.

You need both a business and a personal financial plan that work together. Your business supports your personal financial goals, retirement savings, emergency funds and lifestyle needs. But your personal financial stability also reduces pressure on your business to generate unrealistic returns immediately.

Conclusion

Financial planning for Canadian entrepreneurs isn’t about becoming a finance expert overnight. It’s about establishing fundamental practices that give you clarity and control. The seven mistakes we’ve covered, mixing finances, underestimating costs, ignoring taxes, lacking emergency funds, poor tracking, skipping reviews, and neglecting mindset, can all be prevented with consistent systems and the right perspective.

You now have the framework to build financial confidence: separate accounts, realistic projections, tax planning, emergency reserves, detailed tracking, and quarterly reviews. More importantly, you understand that your beliefs about money directly shape your results. Transform your financial chaos into confidence by addressing both the practical systems and the mindset blocks that keep you stuck.

Your transformation starts today with a single decision. Take decisive action: open that business bank account. Set up the tax savings transfer. Schedule your first financial review. Each step builds momentum and proves to yourself that you can master this essential skill.

Financial clarity isn’t the end goal; it’s the foundation that lets you focus on what you do best: serving clients, creating impact, and building the business you envision. When money stress no longer consumes your mental energy, you unleash your full potential.

Which of these seven mistakes are you most committed to avoiding? Take that first step today. If you’re ready to develop the mindset and skills that drive genuine business success, explore our life coaching certification training to transform not just your finances, but every aspect of your entrepreneurial journey.

FAQs

Why is financial planning important for Canadian entrepreneurs?

Financial planning helps Canadian entrepreneurs manage cash flow, prepare for taxes, reduce financial stress, and make confident growth decisions. Without a clear plan, even profitable businesses can struggle with sustainability, compliance, and long-term financial stability.

How do you create a financial plan for a small business in Canada?

Start by separating business and personal accounts, projecting income and expenses, setting aside 25–30% for taxes, tracking all transactions, and reviewing finances quarterly. Working with a Canadian accountant ensures your plan aligns with tax laws and business regulations.

What are the biggest financial planning mistakes Canadian entrepreneurs make?

The most common financial planning mistakes include mixing business and personal finances, underestimating startup costs, ignoring quarterly tax obligations, and failing to track cash flow. These errors often lead to unexpected tax bills, cash shortages, and stalled business growth.

What happens if you don’t plan for taxes as a self-employed Canadian?

Without proper tax planning, self-employed Canadians may face large year-end tax bills, penalties, and cash flow crises. Since no employer withholds taxes, failing to save quarterly can severely disrupt both personal finances and business operations.

Is hiring a financial advisor or accountant worth it for entrepreneurs?

Yes. A qualified accountant or financial advisor can help Canadian entrepreneurs minimize taxes, avoid costly errors, and improve profitability. The upfront cost is often outweighed by tax savings, better cash flow management, and reduced financial stress.