You’re staring at your business numbers late at night, knowing something needs to shift. Revenue has plateaued. Your strategy feels unclear. You’re working harder but not seeing the breakthrough you expected. The question gnaws at you: Should you hire a business coach or a financial advisor? This is the classic Business coach vs financial advisor dilemma many entrepreneurs face.

If you’ve felt torn between these two paths, you’re not alone. Most entrepreneurs hit this crossroads, unsure whether they need someone to fix their numbers or transform their approach. The truth? The answer depends entirely on what’s actually blocking your growth right now, not on generic advice or what worked for someone else’s business.

Key Takeaway:

- Entrepreneurs face a dilemma choosing between a business coach and financial advisor based on their current blockers; the right choice accelerates growth by addressing specific challenges like execution gaps or wealth management, with coaching often yielding 5-7x ROI for transformation. [1]

- Financial advisors manage assets, investments, tax optimization, and exit planning as licensed fiduciaries focused on wealth preservation; business coaches enhance leadership, mindset, decision-making, and execution through techniques like NLP, without handling finances or portfolios. [1]

- Use a decision matrix: hire a financial advisor for investment, tax, or succession needs; choose a coach for revenue plateaus, leadership gaps, or execution blocks. Start with coaching in early stages (under $100K revenue) for clarity and systems; add advisors at $1M+ for wealth growth; sequence them for compounding results. [2]

- Hiring the wrong professional wastes resources—coaches don’t fix financial complexities, advisors ignore growth barriers; prioritize the primary bottleneck first to avoid stagnation, as misaligned support fails to create sustainable progress. [2]

Bottom Line: Choose based on your main growth blocker to ensure the right support drives breakthrough results.

In this post, you’ll discover a clear decision framework that helps you choose the right professional based on your actual challenges, business stage, and growth goals. No fluff, just practical guidance to help you invest in the support that will move your business forward fastest.

What’s The Real Difference Between A Business Coach And A Financial Advisor?

Here’s the direct answer: financial advisors manage your money and investments, while business coaches transform how you lead, decide, and execute.

Financial advisors specialise in wealth management and business exit planning. They help you allocate assets, minimise tax liability, build retirement portfolios, and structure succession plans. They’re licensed professionals bound by fiduciary standards, meaning they’re legally obligated to act in your financial best interests. Most work with clients who have significant assets under management and charge fees based on portfolio size.

Business coaches work differently. They focus on your leadership, decision-making, mindset, and execution gaps, the human factors that either accelerate or sabotage growth. A coach doesn’t tell you what to do. Instead, they help you identify blind spots, overcome limiting beliefs, and build the skills to lead your business effectively. NLP-based coaching approaches address the subconscious patterns that keep entrepreneurs stuck despite having sound financial strategies.

The credentials differ, too. Financial advisors hold licenses like CFP (Certified Financial Planner) or RIA (Registered Investment Advisor). Business coaches may have certifications in areas like NLP, ICF coaching credentials or specialised business expertise but the real differentiator is their ability to facilitate transformation, not manage portfolios.

Think of it this way: if your business were a car, a financial advisor helps you invest the profits from driving it. A business coach teaches you to drive it better, faster, and with more confidence behind the wheel.

When Your Business Actually Needs A Financial Advisor

Let’s be clear about when financial expertise becomes essential.

You’ve Built Wealth But Need Strategic Asset Management

Once your business generates consistent profit and you’ve accumulated significant assets, you need professional guidance on how to preserve and grow that wealth. This goes beyond basic accounting. You’re looking at investment portfolio diversification, risk management across multiple asset classes, and strategic wealth building that compounds over time.

If you’re asking questions like “How should I structure my investment portfolio?” or “What’s the most tax-efficient way to take money out of my business?” you need a financial advisor with distinct expertise in investment management.

Tax Planning And Investment Portfolio Complexity

As your business scales, tax optimisation becomes increasingly complex. Should you incorporate? How do you minimise capital gains? What retirement vehicles make sense for business owners? Financial advisors work alongside your accountant to create strategies that protect your wealth from unnecessary tax burdens while maximising growth opportunities.

Exit Strategy And Succession Planning

Planning to sell your business in 5-10 years? Transitioning ownership to a partner or family member? These scenarios require sophisticated financial planning that business coaches aren’t equipped to handle. Financial advisors help you structure deals, evaluate offers, and ensure you actually capture the value you’ve built.

When Your Business Actually Needs A Business Coach

Now let’s talk about when coaching becomes your highest-leverage investment.

You’re Hitting A Revenue Plateau Despite Strong Finances

Your books are clean. Cash flow is positive. But revenue has flatlined for six months or worse, you’re working twice as hard for the same results. This isn’t a money management problem. It’s an execution, strategy, or leadership gap.

Research shows coaching delivers substantial ROI in these exact scenarios. When Intel implemented executive coaching across their organisation, the program contributed approximately one billion dollars per year in operating margin, not from managing investments, but from improving how leaders think, communicate, and make decisions.

Darren G. experienced this firsthand. He felt blocked from promotions and raises despite a well-paying job, unable to start his own business or unlock the abundance he wanted. Through coaching that addressed his goal blocks and limiting beliefs, he achieved radical improvements in thinking, actions, and relationships, transforming both his professional trajectory and personal abundance. No financial strategy could have created that shift.

Leadership Gaps Are Limiting Your Scale

You know what needs to happen, but your team isn’t executing. Communication breaks down. Accountability feels like pulling teeth. You’re micromanaging because delegation creates more problems than it solves.

These are leadership skill gaps and revenue plateaus that signal coaching readiness. The U.S. Chamber of Commerce research found that leadership gaps appear most problematic in high-priority areas like managing change, strategic planning, and inspiring commitment, exactly where leadership development coaching creates breakthrough results.

Heather Chetwynd gained unexpected business clarity through NLP Practitioner training, discovering how to integrate powerful techniques into her work, elevating her professional edge beyond what any financial advisor could provide. She left with a practical toolbox for coaching clients and leading her business with greater effectiveness.

You Know What To Do But Can’t Execute Consistently

This is where coaching creates transformational value. You’ve read the books. Attended the conferences. Made the plans. But somehow, execution stalls. Procrastination wins. Old patterns repeat despite your best intentions.

Business coaches address the mindset blocks, fear patterns, and subconscious resistance that sabotage implementation. Through techniques like NLP reframing, anchoring, and belief change work, they help you overcome the internal obstacles that no amount of financial planning can fix. Strategic reflection often delivers tenfold returns because it helps you build a business aligned with your actual vision, not someone else’s template.

How Do You Know Which One To Hire First?

Here’s your decision matrix: identify your primary blocker, then choose accordingly.

If your primary challenge is: “I have profits but don’t know how to invest them wisely”, → Start with a financial advisor.

If your primary challenge is: “I’m stuck at the same revenue level despite working harder”, → Start with a business coach.

If your primary challenge is: “I need exit planning for a business sale in 2-3 years”, → Start with a financial advisor.

If your primary challenge is: “I can’t get my team to execute, or I’m struggling with confidence and decision-making”, → Start with a business coach.

The numbers support prioritising coaching for growth-focused entrepreneurs. Studies consistently show coaching typically returns 5-7 times the initial investment, with some organisations reporting ROI as high as 788% from productivity and retention improvements alone. That’s because coaching addresses the root causes of business stagnation: your thinking, leadership, and execution patterns.

Want to go deeper on measuring impact? Learn how to measure coaching ROI effectively so you can track the tangible value coaching delivers.

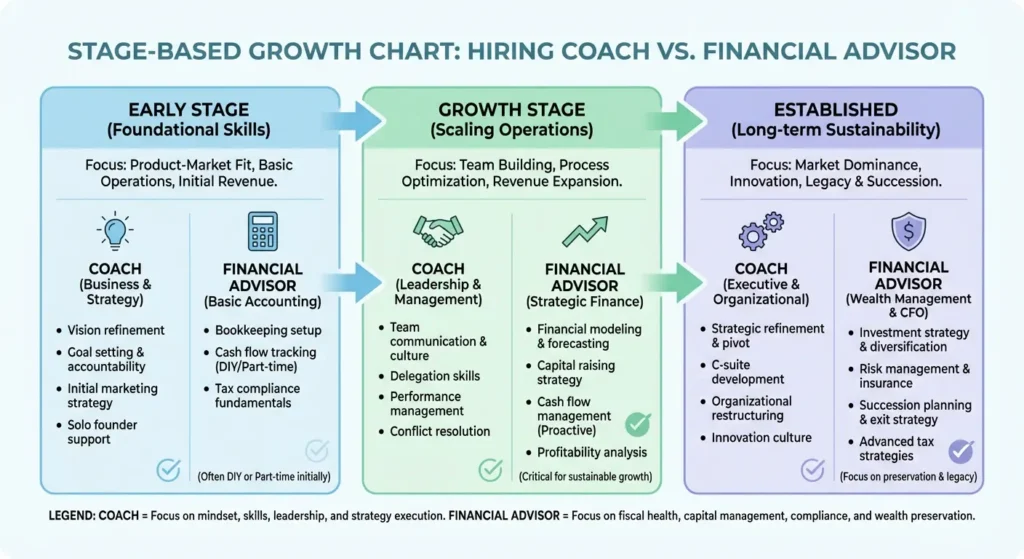

The Stage-Based Framework

Early Stage (Under $100K revenue): Business coach first. You need clarity, confidence, and execution systems more than sophisticated wealth management.

Growth Stage ($100K-$1M revenue): Business coach for scaling challenges; financial advisor consultation for tax strategy and basic investment guidance.

Established ($1M+ revenue): Both. Your business complexity requires strategic coaching for leadership and a financial advisor for wealth preservation and growth.

Signs You Need Both (And How They Complement)

The most successful entrepreneurs eventually work with both professionals but in sequence, not simultaneously. A business coach helps you break through growth barriers and build sustainable systems. Once you’ve scaled and accumulated significant wealth, a financial advisor ensures you protect and multiply those gains.

They complement each other beautifully when you’re clear on what each delivers. Your coach focuses on who you need to become as a leader. Your financial advisor focuses on what you need to do with the wealth you create.

The Hidden Cost of Choosing Wrong

Let’s address what happens when you invest in the wrong professional at the wrong time.

Financial Advice Won’t Fix Execution Problems

You can have the most sophisticated investment portfolio in the world, but if you can’t lead your team, execute your strategy, or overcome your fear of visibility, your business won’t grow. Financial advisors optimise wealth you’ve already created; they don’t create the conditions for wealth generation in the first place.

Research shows two-thirds of small businesses close within ten years, often due to overly optimistic assumptions, emotional decision-making, and deficiencies in core business skills. These are coaching issues, not financial management issues.

Coaching Won’t Replace Fiduciary Expertise

On the flip side, even the best business coach can’t help you structure a tax-efficient exit strategy or build a diversified investment portfolio. Coaches aren’t licensed to give specific financial product recommendations or manage assets under a fiduciary obligation.

If you hire a coach when you actually need complex tax planning or succession structuring, you’re wasting time and money solving the wrong problem.

The Compounding Effect of Aligned Support

Here’s what most entrepreneurs miss: the sequence matters more than the choice. When you identify common growth barriers accurately and address them with the right professional, your progress compounds.

A coach who helps you overcome limiting beliefs and build confident leadership creates exponential business growth. That growth generates wealth. That wealth, managed by a skilled financial advisor, multiplies through strategic investment and tax optimisation. Each professional amplifies the other’s impact when hired in the right order.

Your Next Step

Choosing between a business coach and a financial advisor isn’t about which profession is superior. It’s about which bottleneck you need to break through first.

If your business has stalled because of leadership gaps, execution challenges, or mindset blocks that keep you playing small, no amount of investment advice will move the needle. You need transformation first, optimisation second. Coaching typically delivers 5-7x returns specifically because it addresses these root-level barriers to growth.

If you’ve already scaled, accumulated significant assets, and need expert guidance on wealth preservation and strategic financial planning, coaching won’t solve that problem. You need fiduciary expertise and portfolio management.

You now have the clarity to invest in the right support at the right time. The question isn’t whether you need help; you already know you do. The question is: which professional will accelerate your breakthrough fastest?

Ready to transform your leadership, overcome the blocks holding you back, and unleash the business growth you know is possible? Discover how business coaching in Toronto can help you achieve the clarity, confidence, and results you’re looking for.

Frequently Asked Questions: Business Coach vs Financial Advisor

Can a business coach help with financial planning?

No. Business coaches focus on leadership, strategy, and execution, not financial product recommendations or portfolio management. They help you grow your business and make better decisions, but they’re not licensed to provide specific investment or tax advice. For financial planning, you need a certified financial advisor.

How much does a business coach typically cost compared to a financial advisor?

Business coaches often charge hourly rates ($150-$500) or package pricing ($3,000-$15,000 for multi-month engagements). Financial advisors typically charge 1% of assets under management annually, meaning fees scale with your portfolio size. A coach is often more accessible for entrepreneurs in growth stages without significant accumulated wealth.

Do I need to be making a certain amount of revenue before hiring either professional?

Not necessarily. Business coaches work with entrepreneurs at any revenue level, even pre-launch because they address mindset, strategy, and leadership gaps that exist regardless of business size. Financial advisors typically work best when you have significant assets to manage (often $100K+ in investable assets), making them more relevant once you’ve achieved consistent profitability.

Can I work with both a business coach and a financial advisor at the same time?

Yes, and many successful entrepreneurs eventually do. However, most benefit from addressing their primary bottleneck first. If execution and leadership gaps are limiting growth, start with coaching. Once you’ve scaled and accumulated wealth, add a financial advisor to optimise and protect those gains. Working with both simultaneously works best for established businesses with complex needs.

How long should I work with a business coach before seeing results?

Most entrepreneurs see initial shifts within 4-8 weeks, improved clarity, confidence, and decision-making. Measurable business results like revenue increases or team performance improvements typically emerge within 3-6 months of consistent coaching. The timeline depends on your commitment to implementation and the specific challenges you’re addressing. Coaching isn’t a quick fix, but it creates compounding returns over time.