You’re staring at your business bank account. Six months of strong revenue. Enough cash to finally hire that operations manager or invest in the marketing automation you’ve been researching. But here’s the question keeping you up at night: Is now the right time? What if you invest too early and run out of runway? What if you wait too long and miss the growth window?

Key Takeaway:

- Reinvestment cycles aren’t random spends—they’re rhythmic, stage-aligned strategies that drive 30% faster growth by compounding profits into exponential momentum, turning $10K investments into ongoing revenue engines without the feast-or-famine traps.[1]

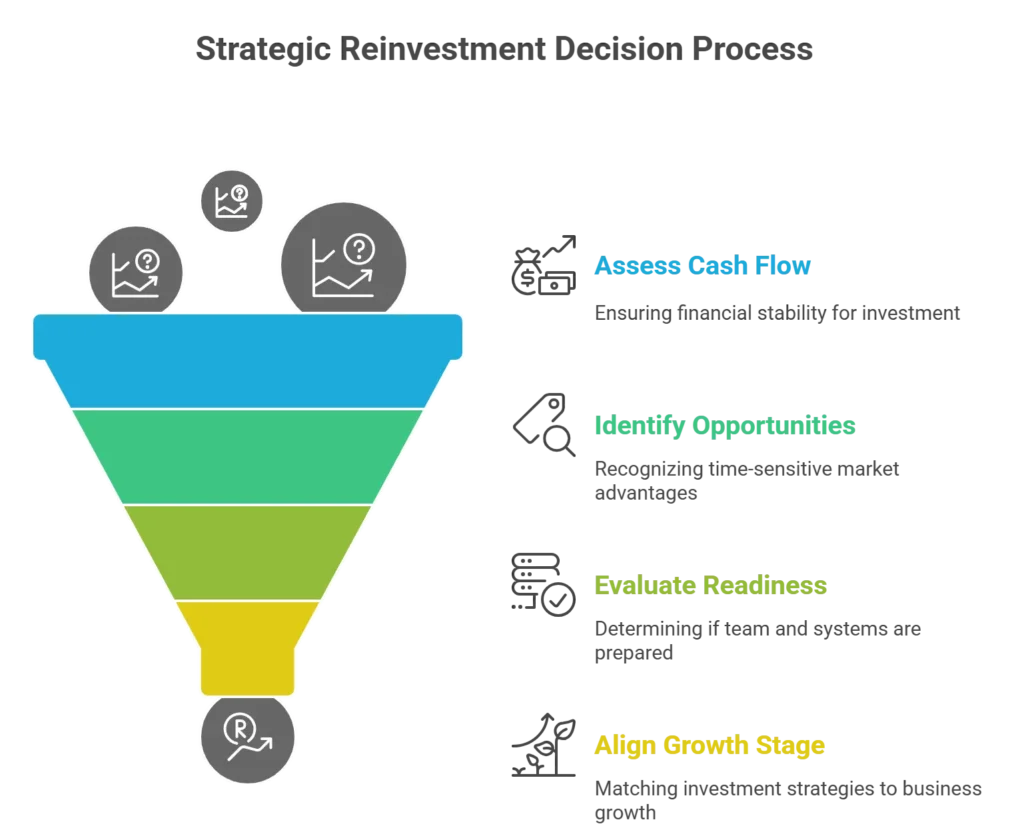

- Time it right with 4 factors: 3-4 months’ positive cash flow (MIT: startups hit this in 3-4 years), strategic windows (market/hire opportunities), team/systems readiness, and stage alignment (validation at 6-figures, scaling at 7+)—ignore them and risk burnout or missed edges.[1]

- Follow the 4-step framework: (1) Assess health (6-month profits, reserves, stability); (2) Target high-ROI multipliers (marketing/sales over ops); (3) Allocate 20-70% of profits (50-70% early stages, 20-30% mature); (4) Review quarterly to measure, adjust, and compound like Amazon’s 100% reinvestment sprint.[2]

- Dodge killers: Never reinvest without runway buffer (match investment size), overload with multiples (one per 90 days), or let scarcity/recklessness rule—use NLP mindset shifts for bold, data-driven decisions that build unbreakable scaling resilience.[2]

Bottom Line: Master reinvestment cycles to outpace competitors—assess your health today, pick one high-ROI move with full runway, and cycle strategically to fuel sustainable breakthroughs from six to seven figures and beyond.

- Source: Unleash Your Power – How Do Business Reinvestment Cycles Affect Long-Term Growth? (introduction, what are cycles, why they matter & timing factors sections)

- Source: Strategic framework, when to reinvest, common mistakes, FAQs & conclusion

I’ve seen brilliant entrepreneurs freeze at this exact moment, and I’ve watched others make bold moves that either catapulted their business forward or nearly buried it. The difference wasn’t luck. It was understanding how business reinvestment cycles work and when to pull the trigger. Let’s talk about the strategic framework that separates sustainable growth from expensive mistakes.

What Are Business Reinvestment Cycles?

Business reinvestment cycles aren’t one-time decisions; they’re recurring strategic choices about when and where to deploy your profits back into your business. Think of them as the heartbeat of your growth strategy. Each cycle involves assessing your current position, identifying high-impact opportunities, investing capital, and measuring results before starting the next cycle.

The keyword here is “cycles.” Too many entrepreneurs treat reinvestment like a single event: “I’ll buy equipment when I hit $X in revenue.” But scaling profitably requires understanding that reinvestment is an ongoing rhythm aligned with your business life stage. What you invest in at $300K revenue looks completely different from what you need at $800K.

This isn’t reactive spending when something breaks. It’s the intentional deployment of capital at strategic intervals, quarterly, annually, or triggered by specific milestones that compounds your growth over time. Companies that adopt cyclical strategies grow 30% faster than those making random investments.

Why Do Reinvestment Cycles Matter More Than One-Time Investments?

Here’s where it gets interesting. Most entrepreneurs think about reinvestment as isolated transactions: hire someone, buy software, run ads. But the real power comes from understanding how these investments interact over time.

Compound Growth Through Strategic Timing

When you reinvest strategically, each dollar creates additional revenue that can be reinvested again. Compound growth through reinvestment works like this: you invest $10K in better customer acquisition, which brings $30K in new revenue, which funds the next $15K investment in systems that save you 20 hours a week, which you redirect into business development that generates another $50K. This isn’t linear, it’s exponential. Amazon reinvested 100% of profits for its first six years, building the virtuous cycle that made them a trillion-dollar company.

The Cost of Mistimed Investments

Timing isn’t just important; it’s everything. Invest too early, before you have consistent cash flow, and you’ll burn through your safety net just as the market shifts. I’ve watched entrepreneurs hire full teams at $400K revenue, only to realize they couldn’t sustain payroll when two clients left unexpectedly. Their expenses spiraled out of control because they didn’t have the runway to weather normal business fluctuations.

Invest too late, and you miss the window entirely. Your competitor captures the market share you could have owned. Your best clients leave because you can’t deliver at their level anymore.

Creating Momentum vs. Killing It

The right reinvestment at the right time creates momentum; each success builds on the last. The wrong investment at the wrong time kills it dead. This is why understanding cycles matters so much. It’s not about being conservative or aggressive. It’s about being strategic.

What Are The Four Critical Factors In Reinvestment Timing?

Cash flow stability, market opportunity, internal capacity, and growth stage alignment. Let me break these down because understanding these four factors will transform how you make reinvestment decisions.

Factor 1: Cash Flow Predictability – You need at least three to four months of positive cash flow before making significant investments. Not revenue cash flow. According to MIT research, startups typically become cash-flow positive after three to four years. If you’re fluctuating between profitable and break-even month to month, you’re not ready yet.

Factor 2: Strategic Opportunity Windows – Sometimes market conditions or competitive dynamics create time-sensitive opportunities. A key hire becomes available. A software platform offers a limited discount. Your biggest competitor stumbles. These windows don’t stay open forever. The question isn’t just “do I have the money?” but “what’s the cost of missing this opportunity?”

Factor 3: Team and Systems Readiness – Can your business actually absorb the investment? I’ve seen entrepreneurs buy enterprise software when their team is still learning basic spreadsheets. Or hire specialists when they don’t have onboarding systems. The investment fails not because it was wrong, but because the foundation wasn’t ready. Check out these smart reinvestment strategies to ensure your business is prepared.

Factor 4: Your Growth Stage – Entrepreneurs scaling from six to seven figures need different strategies than those going from seven to eight. At the six-figure stage, you’re validating your model. At the seven-figure stage, you’re building systems and teams. Understanding how much to reinvest at each stage prevents costly misalignment.

The Strategic Reinvestment Framework for Scaling Entrepreneurs

Here’s the framework I use with clients to make confident reinvestment decisions.

Step 1 – Assess Current Business Health

Start with brutal honesty about your numbers. What’s your average monthly profit over the last six months? Not your best month, your average. What are your cash reserves? Are you consistently paying yourself a salary, or are you still in feast-or-famine mode? Three key indicators signal readiness: steady revenue, personal compensation, and business stability.

Step 2 – Identify High-ROI Opportunities

Not all investments are created equal. Revenue multipliers (marketing systems, sales team, strategic partnerships) return more than they cost. Cost centers (fancy offices, unnecessary tools, premature hires) drain resources without direct returns. Focus your reinvestment on high-ROI growth activities rather than status symbols.

Step 3 – Set Reinvestment Percentages by Stage

Financial experts recommend strategic reinvestment percentages ranging from 20% to 70% of profits depending on your growth phase. Early-stage businesses might reinvest 50-70% to build momentum. Mature businesses might drop to 20-30% while maintaining healthy margins. The key is consistency; set your percentage and stick to it for a full cycle before adjusting.

Step 4 – Build In Review Cycles

Reinvestment isn’t “set it and forget it.” Schedule quarterly reviews to assess what’s working. Did that marketing investment generate the projected ROI? Is your new hire delivering value? Adjust your next cycle based on real data, not assumptions.

How Do You Know When It’s Time To Reinvest?

The clearest signal is when you’re consistently cash-flow positive, paying yourself a reasonable salary, and the business feels stable. Not perfectly stable. If you’re checking your bank account every day hoping you can make payroll, you’re not ready.

Three green lights for reinvestment: First, you have at least six months of operating expenses in reserves. Second, your core operations run smoothly without you micromanaging every decision. Third, you’ve identified a specific opportunity with clear ROI projections.

Three red flags to hold off: First, your revenue is unpredictable or declining. Second, you’re already stressed about current cash flow. Third, you can’t articulate exactly how this investment will generate returns. If you can’t explain it clearly, you don’t understand it well enough to invest in it.

Common Reinvestment Mistakes That Kill Growth

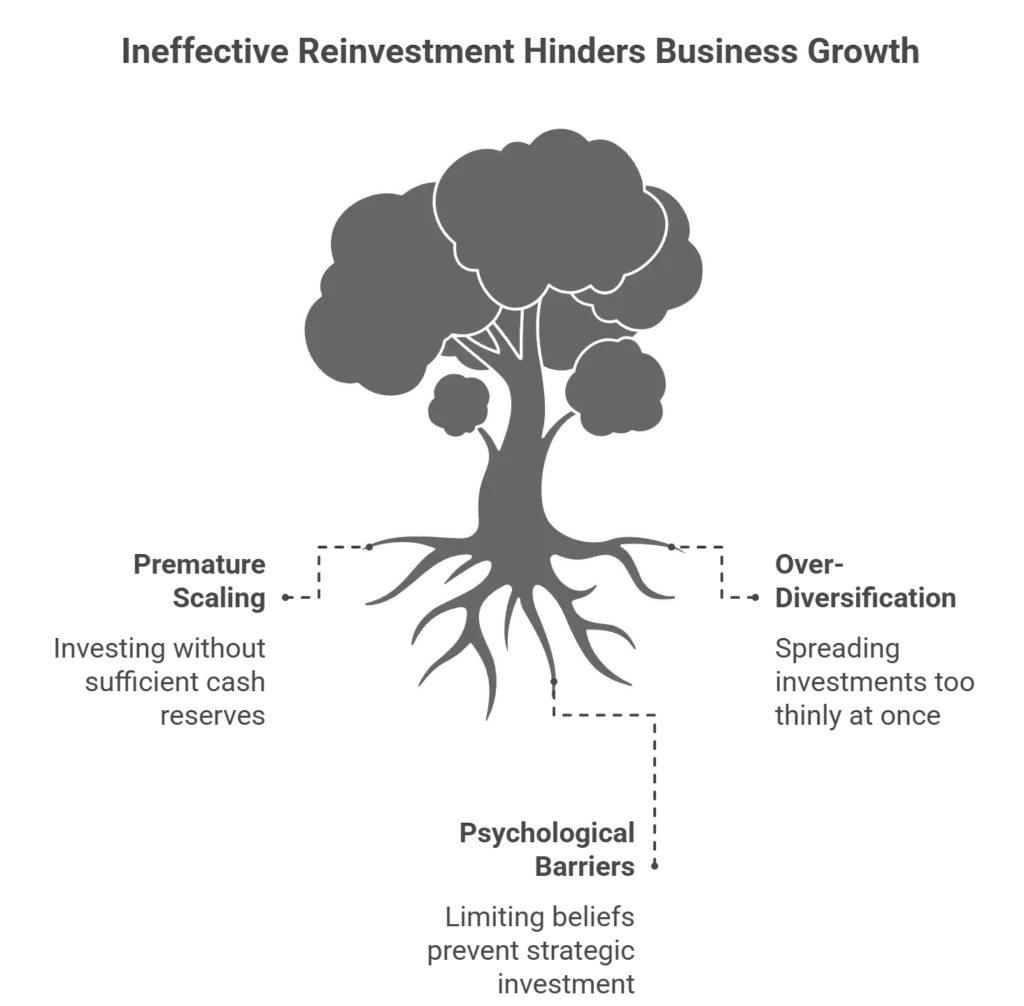

Let’s talk about the mistakes that derail even smart entrepreneurs.

Mistake #1 – Reinvesting Before You Have Runway

This is the most dangerous mistake. You see an opportunity, you have cash in the bank, and you go all-in. Then two clients leave. Or a payment gets delayed. Or a key project stalls. Suddenly you’re scrambling to cover basic expenses. Understanding why small businesses fail to grow often comes down to premature scaling without adequate reserves.

The solution? Always maintain a cash buffer. If you’re investing $50K, make sure you have another $50K sitting untouched as your safety net. Growth is important, but survival is essential.

Mistake #2 – Investing in Everything at Once

When cash finally starts flowing, the temptation is to fix everything simultaneously. New website, better CRM, three new hires, upgraded office, expanded marketing, all at once. This fragments your focus and makes it impossible to measure what’s actually driving results. It also puts enormous strain on your cash flow and team capacity.

Instead, prioritize ruthlessly. What’s the one investment that will have the biggest impact in the next 90 days? Start there. Measure results. Then move to the next priority.

Mistake #3 – Ignoring the Mindset Component

This might surprise you, but the biggest barrier to smart reinvestment isn’t financial, it’s psychological. I worked with a client who had significant cash reserves but felt paralyzed about deploying it. Through NLP techniques, we identified limiting beliefs about abundance and risk that were keeping him stuck. Once he cleared those mental blocks, he made strategic investments that unlocked radical shifts in his business growth. Developing an entrepreneur’s mindset through proven strategies helps you move past fear-based decision-making and into confident action.

You’re either operating from scarcity (hoarding cash out of fear) or recklessness (spending impulsively to feel successful). Neither works. The goal is strategic confidence: making decisions based on data, opportunity, and readiness, not emotion. One entrepreneur I worked with realized he was removing himself as the bottleneck by addressing his own limiting beliefs before making major financial decisions.

Your Next Steps

Strategic reinvestment cycles aren’t about spending more money; they’re about deploying capital at the right time, in the right places, for maximum compounding effect. The entrepreneurs who scale successfully understand that growth isn’t linear. It’s rhythmic. You invest, you measure, you adjust, and you invest again.

You now have a framework to make confident decisions about when and where to reinvest. Start by honestly assessing your current cash flow and business stability. Identify one high-ROI opportunity that aligns with your growth stage. Set your reinvestment percentage and commit to quarterly reviews. And address any mindset blocks that might be keeping you stuck.

The difference between a business that plateaus at six figures and one that breaks through to seven isn’t usually the amount of capital available. It’s the strategic timing and deployment of that capital. Master the cycle, and you master sustainable growth. If you’re ready to develop the strategic clarity and confident decision-making that drives real results, business coaching can provide the accountability and expertise to accelerate your growth.

Your transformation starts today. What’s the one investment your business needs most right now?

Frequently Asked Questions

What percentage of profits should I reinvest in my business?

Financial experts recommend reinvesting anywhere from 20% to 70% of your profits depending on your growth stage. Early-stage businesses scaling from six to seven figures typically reinvest 50-70% to build momentum and capture market share. As your business matures and stabilizes, you can reduce this to 20-30% while maintaining healthy profit margins and personal compensation.

How do I know if my business is ready for reinvestment?

Your business is ready when you have three key indicators in place: consistent positive cash flow for at least 3-4 months, you’re paying yourself a reasonable salary, and the business feels stable without constant firefighting. Additionally, you should have at least six months of operating expenses in reserves before making significant investments. If you’re checking your bank account daily worrying about payroll, focus on stabilization before reinvestment.

What’s the difference between a reinvestment cycle and a one-time investment?

A reinvestment cycle is a recurring strategic process where you assess opportunities, invest capital, measure results, and adjust before starting the next cycle, typically quarterly or annually. One-time investments are isolated purchases that don’t consider timing, compounding effects, or systematic evaluation. Cycles create exponential growth by building on previous successes, while one-time investments often fail to generate sustained momentum.

What are the biggest mistakes entrepreneurs make when reinvesting profits?

The three most common mistakes are: investing before you have adequate cash runway (leading to cash flow crises), trying to fix everything simultaneously instead of prioritizing high-ROI opportunities, and ignoring the psychological barriers that cause either fear-based hoarding or impulsive spending. Successful entrepreneurs address both the financial metrics and the mindset component of reinvestment decisions.

Should I reinvest profits or pay down business debt first?

This depends on your interest rates and growth opportunities. If you’re carrying high-interest debt, prioritize paying it down first since those interest payments reduce your available capital for growth. However, if you have low-interest debt and a high-ROI opportunity with clear projections, strategic reinvestment can generate returns that exceed your debt costs. The key is running the numbers objectively and ensuring you’re not sacrificing financial stability for growth.