Imagine waking up, grabbing your morning coffee, and working for yourself on your terms, with no boss breathing down your neck. Sounds like a dream, right? Well, thousands of entrepreneurs in Ontario have made it their reality. And the best part? You can, too.

Starting a small business might feel overwhelming at first, but it doesn’t have to be. Whether you want to turn a side hustle into a full-time gig or launch something brand new, you don’t need a fortune to get started. You just need the right steps, a solid plan, and the willingness to take action.

This guide will walk you through exactly how to start a small business in Ontario without unnecessary confusion. From finding your business idea to registering your company, getting customers, and making money, we’ve got you covered.

So, if you’re ready to be your own boss and build a business that fits your life, let’s dive in!

Step 1: Validate Your Business Idea

A great idea alone doesn’t make a successful business. You need to confirm demand, identify your ideal customers, and ensure profitability before you invest time and money.

How to Find a Profitable Business Idea

- Solve a Real Problem – Successful businesses address specific pain points. Ask: What problems do people have that I can solve?

- Leverage Your Skills & Interests – Consider what you’re good at and passionate about.

- Analyze Market Trends – Look at growing industries in Ontario. Some high-potential sectors include e-commerce, technology, personal services, and sustainable products.

- Study Competitors – If competitors are making money, there’s demand. Find gaps you can fill.

How to Validate Your Idea

- Talk to Potential Customers – Ask real people if they’d pay for your product or service.

- Run a Small-Scale Test (MVP) – Sell a basic version of your product before fully launching.

- Set Up a Landing Page – Offer pre-orders or a waitlist to measure interest.

- Conduct a Paid Ad Test – Spend $50–$100 on Facebook or Google ads and track engagement.

If people are willing to pay, your idea is solid. If not, make any necessary changes before continuing.

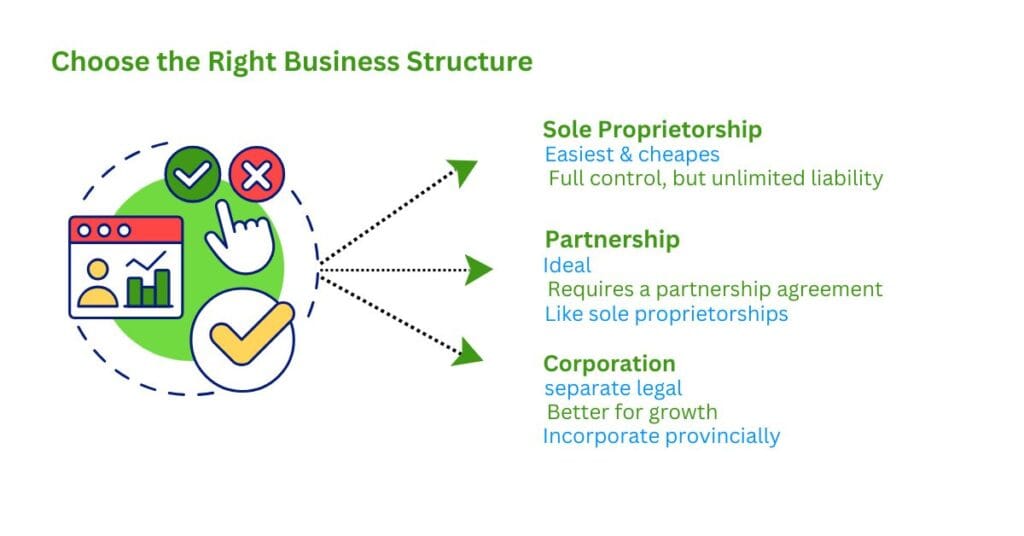

Step 2: Choose the Right Business Structure

Your business structure affects your taxes, liabilities, and growth potential. In Ontario, you can register as:

Sole Proprietorship

- Easiest & cheapest option great for freelancers, consultants, and small startups.

- Full control, but unlimited liability, your personal assets are at risk if sued.

Partnership

- Ideal if you’re starting a business with others.

- Requires a partnership agreement to outline roles and profit-sharing.

- Like sole proprietorships, partners are personally liable for debts.

Corporation

- A separate legal entity, reducing personal liability.

- Better for growth, investors, and tax benefits but involves more paperwork.

- You can incorporate provincially (Ontario) or federally (Canada-wide).

Most small businesses start as sole proprietorships and incorporate later.

Step 3: Register Your Business in Ontario

Once you’ve chosen a structure, make it official.

What You Need to Do

- Register Your Business Name – If not using your name, register it via the Ontario Business Registry.

- Get a Business Number (BN) – Register with the Canada Revenue Agency (CRA) for tax purposes.

- Obtain Necessary Licenses & Permits – Use BizPal to check requirements for your industry.

- Register for HST/GST – Required if your revenue exceeds $30,000/year.

Skipping this step can lead to legal trouble so get it done right from the start!

Step 4: Secure Funding for Your Business

Starting a business costs money, but there are affordable ways to fund it without massive debt.

Funding Options for Ontario Entrepreneurs

- Bootstrapping – Use personal savings and reinvest profits.

- Small Business Loans – Apply through banks or the Canada Small Business Financing Program (CSBFP).

- Government Grants & Programs – Free money! Check Ontario and federal funding opportunities:

- Starter Company Plus – Grants for Ontario startups.

- Futurpreneur Canada – Loans and mentorship for young entrepreneurs.

- Women Entrepreneurship Strategy Fund – Funding for women-led businesses.

Angel Investors & Crowdfunding – Good for scalable businesses.

Smart Tip: Start lean, avoid unnecessary expenses until you generate revenue.

Step 5: Set Up Business Operations & Finances

Organized operations make scaling easier. Get these essentials in place:

Open a Business Bank Account

- Required for corporations; recommended for all businesses.

- Helps separate business and personal finances for taxes.

Get Business Insurance

- Liability Insurance – Protects you from legal claims.

- Property Insurance – Covers equipment, inventory, and workspace.

- WSIB Registration – Mandatory if hiring employees.

Set Up Accounting & Taxes

- Use accounting software like QuickBooks or Wave.

- Keep detailed records of all transactions.

- Pay HST/GST and income tax on time to avoid penalties.

Step 6: Branding & Marketing Get Your First Customers!

Your business needs visibility to attract customers.

Build a Professional Brand

- Choose a Business Name & Logo – Use Canva for free design tools.

- Create a Website – Platforms like Shopify, Wix, or WordPress make it easy.

- Set Up Social Media – Pick 1–2 platforms where your target audience is active.

Find Your First Customers Fast

- Leverage Your Network – Friends, family, and local groups can be early customers.

- List Your Business Online – Google My Business, Yelp, and industry directories.

- Run Targeted Ads – Small Facebook/Instagram ad campaigns can generate leads.

- Offer Promotions – Free trials, discounts, or referral programs encourage sales.

Businesses that focus on marketing early tend to grow faster.

Step 7: Scale & Grow Your Business

Once your business gains traction, focus on expansion.

How to Scale Without Losing Control

- Raise Your Prices – As demand grows, adjust pricing for profitability.

- Expand Your Product/Service Offerings – Keep existing customers engaged.

- Build Partnerships – Collaborate with complementary businesses.

- Hire & Automate – Use freelancers, software, and outsourcing to manage workload.

Track Business Metrics – Monitor revenue, expenses, and customer feedback. Use analytics tools like Google Analytics & QuickBooks.

Final Thoughts: Turning Your Idea into a Thriving Business

Starting a small business in Ontario doesn’t have to be overwhelming. By following these steps, validating your idea, registering legally, managing finances, and building your brand, you’ll set yourself up for long-term success.

Remember, the most successful businesses aren’t the ones that never make mistakes, they’re the ones that learn, adapt, and keep moving forward.

Need Help? Government resources like Enterprise Toronto and Small Business Centres Ontario offer free advice, workshops, and mentorship to help you succeed.

Your dream business is within reach now go build it!

Frequently Asked Questions About Starting a Small Business in Ontario

Q1: Why should you start a small business in Ontario?

Ontario offers a thriving economy, access to skilled labor, diverse markets, and government support programs. Entrepreneurs benefit from strong infrastructure, proximity to U.S. trade, and multiple grants and tax incentives, making it an ideal location for small business growth.

Q2: How do you start a small business in Ontario step by step?

Start by choosing a business idea and structure (sole proprietorship, partnership, or corporation). Register your business name, get required licenses, open a business bank account, and apply for permits. Finally, build a business plan and secure financing.

Q3: What legal requirements must you follow to run a small business in Ontario?

Business owners must register with ServiceOntario, obtain necessary licenses and permits, follow provincial tax regulations, and comply with employment standards if hiring staff. Certain industries may also require federal or municipal approvals.

Q4: How much does it cost to start a small business in Ontario?

Costs vary by business type, but basic expenses include registration ($60–$300), licenses, insurance, and marketing. On average, entrepreneurs should budget $5,000–$10,000 in startup costs, though some service-based businesses can launch with less.

Q5: Is it better to incorporate or register a sole proprietorship in Ontario?

A sole proprietorship is cheaper and simpler to set up but offers no liability protection. Incorporation provides limited liability, tax planning advantages, and stronger credibility, but comes with higher costs and more paperwork. The choice depends on long-term goals.