Is Your Business a Monument to Your Past or a Vehicle for the Future?

Your business isn’t your baby. It’s a vehicle. And right now, you’re the only one who knows how to drive it.

You’ve built something from nothing. Late nights, missed family dinners, and personal guarantees on loans that kept you up at night. You’ve turned vision into revenue, chaos into systems, and doubt into proof. But here’s the question that keeps you awake now: what happens when you’re ready to step away?

The statistics are brutal. Seventy percent of small businesses that go to market never find a buyer. Only 30% of family-owned businesses survive to the second generation. According to recent data on small business succession, over 200,000 small businesses are listed for sale each year, but most owners end up closing their doors instead of cashing out. Why? Because they confuse building a business with building a job that only they can do.

If you’re in your 50s or 60s and thinking about your exit, you need to work with a business leadership coach who understands the psychology of letting go, not just the mechanics of selling. You need to understand why businesses fail to scale past their founder’s capacity. Because right now, your business might be worth a number on paper, but if it can’t run without you, that number is fiction.

This isn’t about retirement planning. This is about building something that outlasts you. Your business shouldn’t be a monument to your past it should be a vehicle for the future. Here’s how to make that shift, overcome founder’s syndrome, build real leadership health, and exit profitably without sacrificing everything you’ve built.

Key Takeaways:

- Start succession planning 3-5 years before your target exit 70% of small businesses that wait too long never find a buyer.

- Your business’s value reflects leadership health, not just your indispensability; founder’s syndrome actively destroys valuation.

- The best successor candidates need two critical skills: technical competence and advanced communication mastery to lead transitions.

- Emotional attachment is normal, but confusing your identity with your business guarantees a failed exit and diminished legacy.

- A profitable exit requires building systems that work without you; making yourself replaceable is the ultimate measure of leadership success.

Why Most Small Business Owners Can’t Let Go (And Why That Kills Valuations)

Let’s talk about founder’s syndrome. It’s the condition where your business becomes so identified with you, your personality, your decisions, your presence, that it can’t function without you. Organizational psychology research identifies it as one of the primary reasons businesses fail to transition successfully.

You know you have it if you’re micromanaging decisions that your team should own. If you catch yourself saying “nobody can do it like me” or “they just don’t get it.” If your business runs on your personality instead of on documented processes. If every major decision still funnels through you, even though you’ve got competent people on the payroll.

Here’s what nobody tells you: the traits that made you successful early on your drive, your control, your refusal to compromise, become liabilities when it’s time to exit. According to workforce research, only 35% of small businesses have even started succession planning, and just 8% have a complete written plan. Those who wait too long see their valuations crater.

The paradox is simple: buyers don’t pay for heroes. They pay for systems. They pay for businesses that generate predictable results through documented processes and capable leadership teams. When your business is completely dependent on you, every potential buyer sees risk, not value. And risk gets priced as a discount, sometimes a massive one.

Think your business is worth $2 million because of your revenue and customer base? If you’re the only one who can close deals, manage key relationships, and make strategic decisions, a smart buyer will cut that valuation in half. Maybe more. Because they’re not buying a business, they’re buying a job where they have to replace you, the irreplaceable.

That’s founder’s syndrome. And it’s costing you millions.

The Three Non-Negotiables of a Profitable Exit

If you want to exit profitably, you need three things in place years before you’re ready to walk away. Not months. Years.

Start 3-5 Years Before Your Target Exit Date

Banking industry succession experts consistently recommend starting succession planning three to five years before your target exit. Why so long? Because real leadership development takes time. Financial cleanup takes time. Building the relationships and trust that make transitions smooth takes time.

When you wait, you get forced into distressed sales. The numbers don’t lie. The median close rate for businesses listed on BizBuySell between 2018 and 2022 was just 6.46%. Meanwhile, businesses with structured succession plans in place years in advance command premium valuations and attract serious buyers.

Set your exit date today, even if it’s five or seven years out. Then work backward. What needs to be true about your leadership team, your financials, your documented systems, and your market position for someone to write you a check that reflects the real value you’ve built? That’s your roadmap.

Build Leadership Health Into Your Valuation

Your business value isn’t just revenue times a multiplier. It’s leadership quality times everything else. Leadership health is the invisible multiplier that separates businesses that sell at premium valuations from those that barely find buyers.

What does leadership health look like? Decision-making happens at multiple levels, not just at the top. You have documented processes that new leaders can follow and improve. You’ve invested in formal leadership development programs for your key people. Your successor candidates aren’t just technically competent; they’re equipped to lead through change, build trust, and make strategic decisions.

Here’s the multiplier effect: businesses with strong leadership benches command 2-3x valuation premiums compared to single-leader-dependent operations. Why? Because buyers see continuity, not risk. They see systems that work regardless of who’s in the CEO chair.

Audit your organization chart right now. If you disappeared tomorrow, who would make the decisions? Who manages key client relationships? Who sets strategic direction? If the answer to most of those questions is “nobody” or “I don’t know,” you don’t have leadership health. You have a problem that’s destroying your exit value.

Master the Communication That Makes Transitions Smooth

Most succession plans fail not because of financial issues or strategic gaps, but because of communication breakdowns. Expectations get misaligned. Trust erodes. Key stakeholders, employees, clients, vendors lose confidence during the transition. And the whole thing falls apart.

The skills gap here is real. Your successor might be technically brilliant at operations or sales, but technical competence doesn’t equal leadership communication. The ability to build rapport across different personality types, navigate conflict without damaging relationships, and influence without relying on positional authority are learnable skills, but most people don’t have them.

That’s where advanced communication frameworks like NLP become essential. Understanding how people process information differently, how to frame messages for maximum impact, how to read and respond to unspoken concerns, these skills determine whether your transition preserves value or destroys it.

According to exit planning research, 68% of business owners sought professional advice on transitions in 2023, but 78% still lacked a formal transition team. The ones who succeed? They invest in developing communication mastery in their successor candidates years before the actual handoff.

Start now. Identify your top two or three successor candidates and get them trained in the communication skills that will make or break your transition.

How Founder’s Syndrome Is Costing You Millions

Let me tell you about a real case. A dentist built a successful practice worth $830,000. He had a buyer lined up, a contract signed, and even terms where the new buyer would pay him rent since he still owned the real estate. But he couldn’t let go emotionally. He kept second-guessing decisions, inserting himself into operations, making the new buyer’s transition impossible.

One year later, after the deal fell apart and his circumstances changed, he was forced to sell for less than $250,000. His emotional inability to disengage cost him over half a million dollars. That’s not a theory. That’s a documented case of founder’s syndrome impact.

I’ve seen this pattern play out countless times in coaching. One client, Darren, faced similar blocks around abundance and career growth, the same mindset issues that trap business owners in founder’s syndrome. Through identifying and eliminating those goal blocks, he unlocked radical shifts in thinking and behavior. That same process helps business owners release attachment and plan profitable exits.

The identity trap is real. When you say “I AM my business” instead of “I BUILT a business,” you’ve tied your self-worth to something that needs to change hands for you to capture its value. You’ve made your identity incompatible with your exit.

Control feels like protection. Holding tight feels like you’re preserving what you built. But it’s actually destruction. Every day you remain indispensable, you’re actively destroying the transferable value of your business.

Here’s the tough love: if your business can’t function without you, you haven’t built a business. You’ve built a job. An expensive, high-stress job that nobody else can or wants to do. And jobs don’t sell for millions. Systems do. Leadership teams do. Businesses that generate results independently of any one person do.

When Should I Start Succession Planning If I’m Not Ready to Retire Yet?

Start now. Seriously. Three to five years minimum before your target exit, but the best practice is to start grooming leadership from day one of building your business.

Why so early? Because succession planning isn’t just about retirement. It’s about emergency preparedness. Death, disability, divorce, sudden health crisis, any of these can force an exit under the worst possible terms. A national survey of business owners found that while 44% plan to grow their businesses, only 14% have clear plans to sell or transfer ownership. The rest? They’re hoping nothing bad happens.

Early succession planning also builds your leadership pipeline, which improves retention, accelerates growth, and increases current operational efficiency. You’re not planning to leave; you’re building the capacity to scale beyond your personal limitations.

The benefit of starting early: more options, better valuations, less stress. The cost of waiting: forced sales, destroyed value, and a legacy that ends the day you walk out the door.

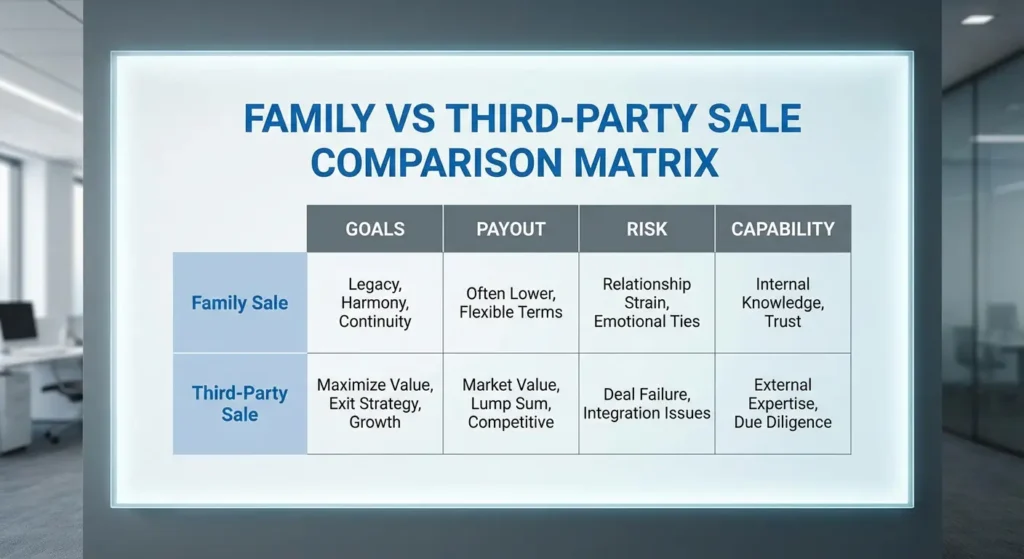

How Do I Choose Between Family Succession vs. Selling to a Third Party?

Match the decision to your goals, not your emotions. Do you want legacy or maximum payout? Do you want to keep it in the family or get top dollar? Both are legitimate goals, but they require different strategies.

Then assess candidates objectively. Qualification should trump relation. Just because someone shares your last name doesn’t mean they have the capability, interest, or temperament to run your business successfully.

The reality check: only 30% of family-owned businesses survive to the second generation, and just 12% make it to the third. Those aren’t odds those are warnings. Don’t force a family succession if the next generation isn’t genuinely capable and committed.

If you do choose family succession, invest heavily in executive coaching for successor development. Give them the training, mentorship, and gradual responsibility increases they need to earn the role, not just inherit it. And be brutally honest about whether they’re developing or just coasting on your goodwill.

If you choose third-party sales, start building relationships with potential buyers or brokers years in advance. Get your financials clean. Document everything. Build a business that’s attractive because it runs independently, not because you’re willing to stay on for five years of earn-out.

What If I Don’t Trust Anyone to Run My Business as Well as I Do?

That’s founder’s syndrome talking. And it’s destroying your exit options.

Let me reframe this: your job isn’t to find someone who runs your business exactly like you do. Your job is to build leaders who run it differently but equally well. Maybe better in some areas. Different strengths, different approach, same or better results.

The solution is systems, training, and gradual handoff with clear checkpoints. You document the critical processes. You train successors on not just what to do, but why decisions get made in certain ways. You give them increasing autonomy in lower-stakes situations, then higher-stakes ones, building trust through demonstrated competence.

One of the most powerful tools for building this trust is understanding how people communicate, make decisions, and process information differently from you do. That’s where frameworks like NLP become game-changers. When you understand that your successor might reach the same right decision through a completely different thinking process, you stop requiring them to be you. You start evaluating them on results, not methods.

Stop asking, “Can they do it like me?” Start asking, “Can they get results that preserve or grow what I’ve built?” Those are different questions with different answers.

How Can I Ensure My Business Maintains Its Value During the Transition?

Three pillars: operational continuity, relationship preservation, and financial stability.

Operational continuity means documenting everything. Standard operating procedures, decision frameworks, vendor relationships, customer service protocols, pricing strategies, all of it gets written down, tested, and handed off systematically.

Relationship preservation is where most transitions fail. Your key clients, vendors, and employees need to maintain confidence through the change. That requires transparent communication, early relationship-building between successors and stakeholders, and demonstrated competence before the final handoff.

This is where advanced communication skills become non-negotiable. Your successor needs to be able to build rapport quickly, read emotional undercurrents, address concerns before they become problems, and maintain trust through uncertainty. These aren’t soft skills; they’re the hard skills that determine whether your business value survives transition or evaporates.

Consider investing in an Advanced NLP Certification for your top succession candidates. The communication frameworks you’ll learn how to build instant rapport, how to reframe objections, and how to influence ethically. These are exactly the skills that keep client relationships intact and employee confidence high during leadership changes.

Financial stability means running your business for value, not just tax efficiency. According to financial advisors specializing in transitions, most small businesses run lean on paper to minimize taxes. That’s smart until you want to sell. Then buyers look at your profit history and discount your valuation because your financials don’t reflect the real earning power.

Start showing stronger financials three to five years before exit. Yes, you’ll pay more in taxes. But you’ll make that back many times over in valuation premium when buyers see a business generating consistent, documented profits.

Frequently Asked Questions

1. When should a small business owner start succession planning?

Expert consensus from the banking and coaching industries recommends starting succession planning 3 to 5 years before your target exit date. This window is necessary to clean up financial records, document operational systems, and groom a successor. Starting early prevents a “distressed sale” and significantly increases your business valuation by proving the company can thrive without your daily involvement.

2. What is “Founder’s Syndrome” and how does it affect business value?

Founder’s Syndrome occurs when a business becomes so closely tied to the owner’s personality and decision-making that it cannot function independently. In terms of valuation, this is a major red flag for buyers. Because a buyer is looking for a predictable system rather than a “job” they have to fill, a business suffering from Founder’s Syndrome often sees its valuation discounted by 50% or more due to the high risk of failure post-transition.

3. How can I increase the sale price of my business before exiting?

To maximize your exit profit, focus on Leadership Health and Documented Systems. Buyers pay a premium for “transferable value.” You can increase your multiplier by:

Showing 3+ years of clean, profit-focused financial statements.

Implementing Standard Operating Procedures (SOPs) for all core tasks.

Developing a leadership team that handles key client relationships and strategic decisions.

Reducing “owner reliance” so the business runs smoothly in your absence.

4. Should I sell my business to a family member or a third party?

The choice between family succession and a third-party sale depends on whether you prioritize legacy or maximum liquidity.

Family Succession: Requires a successor with both technical competence and the desire to lead. Note that only 30% of family businesses survive the second generation.

Third-Party Sale: Usually yields a higher immediate payout but requires rigorous financial transparency and “plug-and-play” systems. Regardless of the path, objective coaching is recommended to ensure the successor is chosen based on merit rather than emotion.

5. Why do 70% of small businesses fail to sell?

The primary reason 70% of small businesses fail to find a buyer is a lack of exit readiness. Most owners wait until they are burnt out or facing a crisis to list their business. Without a formal succession plan, documented processes, or a trained leadership bench, the business carries too much “key-man risk.” Buyers view these businesses as unstable investments and choose to walk away rather than take on the operational chaos left behind by the founder.

Your Business Is a Vehicle, Not a Monument

Here’s what it comes down to: succession planning isn’t about retirement. It’s about legacy.

What do you want to be known for? Building something that lasted beyond you, that created opportunities for others, that generated value long after you stepped away? Or building something so dependent on you that it died the day you left?

The profitable exit path is clear: start now, build leadership health into your operations, and master the communication skills that make transitions smooth. Stop making yourself indispensable and start making yourself replaceable. That’s not weakness, that’s the ultimate measure of leadership success.

If you built this business once from nothing, you absolutely have the capability to build the leaders who will sustain it. You just need to shift from hero to architect. From irreplaceable operator to strategic builder of systems and people.

One client unlocked radical shifts in thinking and behavior by identifying the goal blocks that kept him stuck. The same process works for succession. Your emotional attachment is normal. Your fear of letting go is understandable. But neither of those is a good business strategy.

Ready to plan a profitable exit that preserves your legacy? Book a discovery call for James’s Business Leadership Coaching to build the succession strategy that fits your goals. Or explore the Advanced NLP Certification to master the communication skills that make leadership transitions seamless and successful.

Your business shouldn’t be a monument to your past. Make it a vehicle for the future. The future where you cash out at the value you’ve actually built, and what you created keeps generating impact long after you’re gone.

That’s a legacy worth planning for. Start today.