You’ve built something real. Your business works, your clients love what you do, and the path to growth is crystal clear in your mind. There’s just one problem: traditional lenders keep telling you “not yet” or “too risky.” You’ve got the vision, the drive, and the track record to back it up, but accessing the capital you need feels like shouting into a void.

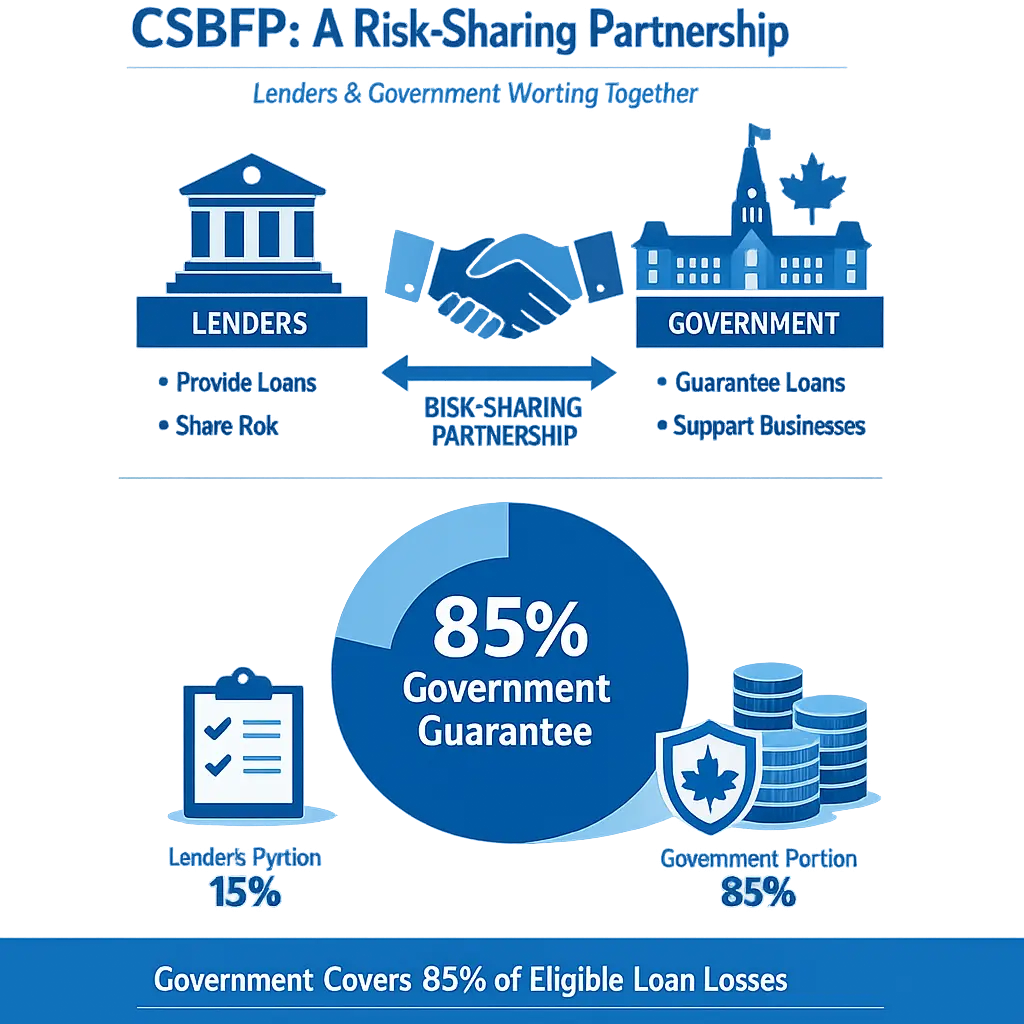

Here’s where the Canada Small Business Financing Program changes everything. When banks see risk, CSBFP creates opportunity by guaranteeing 85% of lender losses if things go sideways. This shifts the entire conversation. Suddenly, lenders who would’ve passed on your application start saying yes.

This isn’t free money dropped into your account. It’s a strategic financing tool that requires preparation, documentation, and follow-through. Through business coaching, I’ve guided countless entrepreneurs through securing CSBFP funding and the ones who succeed aren’t necessarily the most established or well-connected. They’re the ones who approach the process strategically, using strategic goal-setting frameworks to align capital with clear growth objectives.

You’re about to get the complete roadmap. No fluff, no generic advice, just the exact checklist you need to navigate CSBFP in 2026 and secure the funding your business deserves.

Key Takeaways:

- Access up to $1.15 million through CSBFP ($1M term loans + $150K line of credit) with government backing 85% of lender losses

- Eligibility requires Canadian operation, under $10M annual revenue, and funding for approved purposes (equipment, real estate, leasehold improvements, intangible assets)

- Application timeline ranges from 2-6 weeks, with lender approval required government doesn’t lend directly or approve applications

- Total cost includes 2% registration fee plus interest (prime + 3% variable or base + 3% fixed for term loans; prime + 5% for lines of credit)

- Approval success depends on three pillars: a solid business plan with realistic projections, a complete documentation package, and demonstrated industry experience or commitment

Understanding the CSBFP: What It Is (and Isn’t)

Let’s clear up the biggest misconception right away: The Canada Small Business Financing Program doesn’t hand you government money. The federal government doesn’t review your application, doesn’t approve your loan, and doesn’t deposit funds into your account. What actually happens is more strategic and, frankly, more useful.

CSBFP is a risk-sharing partnership between the federal government and private lenders. You apply through a bank, credit union, or caisse populaire just like any conventional loan. That financial institution underwrites your application using its standard procedures, checking your credit, reviewing your business plan, and assessing your ability to repay. The difference? If they approve you and things go wrong later, the government covers 85% of their losses after they’ve exhausted all recovery options.

This fundamentally changes the lender’s math. A business they might normally view as “almost bankable but not quite” suddenly becomes an acceptable risk. Startups with solid plans but no track record, growing companies with limited collateral, entrepreneurs with great ideas but thin credit files, CSBFP opens doors that would otherwise stay closed.

The numbers tell the story. Over the past decade, Canadian small businesses have secured more than 53,000 CSBFP loans totaling over $11 billion, according to government-backed business financing data. This isn’t experimental. It’s proven, accessible, and actively supporting businesses across every sector and region.

Who benefits most? Businesses at the growth inflection point. You’ve validated your model, you have customers, and you need capital to scale but traditional lenders want more history or collateral than you currently have. That’s the sweet spot where CSBFP makes the biggest impact.

From a strategic perspective, view CSBFP as expansion fuel, not rescue funding. You’re not borrowing to survive. You’re borrowing to capture opportunity, upgrade infrastructure, expand capacity, or modernize operations. That mindset shift matters when you’re preparing your application and, later, managing the capital effectively.

CSBFP Eligibility Checklist: Do You Qualify?

Before you invest time preparing an application, confirm you meet the baseline requirements. CSBFP casts a wide net, but there are specific must-haves.

Business Requirements (The Must-Haves)

✅ Operating or about to operate in Canada – Your business activities happen on Canadian soil, even if you serve international clients.

✅ Place of business in Canada – You maintain a physical business presence here, whether that’s an office, retail location, or home office for service businesses.

✅ Assets held in Canada for business operations – The resources supporting your business live in Canada.

✅ Gross annual revenue of $10 million or less – This is the hard ceiling, according to official CSBFP eligibility requirements. Revenue above this threshold disqualifies you from the program.

✅ For-profit business model – This includes startups with revenue projections. Non-profits and charities have different programs available but can’t access CSBFP.

✅ Not a farming business – Agricultural operations fall under the Canadian Agricultural Loans Act program through Agriculture and Agri-Food Canada, which offers similar but industry-specific support.

What You Can Finance (Eligible Uses)

Understanding what qualifies matters as much as knowing you’re eligible. CSBFP supports specific growth activities, and your use of funds must align with program guidelines.

Term Loans (up to $1 million total):

- Commercial real estate purchase or improvement (land, buildings, construction, renovation, modernization)

- Equipment purchases (new or used machinery, vehicles, technology, tools)

- Leasehold improvements (renovations to leased property, fixtures, installations)

- Intangible assets (intellectual property, franchise fees, goodwill in business purchase, incorporation costs, permits, licenses, capitalized research and development)

- Working capital (up to $150,000 within the $1 million limit for inventory, payroll, operational costs)

Lines of Credit (up to $150,000, separate from term loan maximum):

- Day-to-day operating expenses when cash flow dips

- Inventory management and seasonal fluctuations

- Research and development costs

- Short-term payroll bridging

- Rent and utilities during growth phases

The line of credit option, added in recent program updates, addresses one of the biggest pain points for growing businesses: unpredictable cash flow. You’re approved for $150,000 but you only pay interest on what you actually use, giving you flexibility without unnecessary borrowing costs.

What You CANNOT Finance

Equally important is knowing what CSBFP explicitly excludes:

❌ Pure debt refinancing without asset purchases (though you can refinance as part of a larger eligible project), ❌ Purchase of shares or ownership stakes, ❌ Owner buyouts or partnership restructuring, ❌ Working capital beyond the $150,000 cap, and ❌ Farming or agricultural operations (different program)

Many businesses stumble here. They assume CSBFP works like a general business loan that can fund anything. It doesn’t. The program targets asset acquisition, physical improvements, and capacity expansion. Understanding these boundaries prevents wasted application effort and positions you to structure requests correctly.

If capital constraints are part of broader common growth barriers for small businesses, CSBFP might solve the financing piece, but strategic planning addresses the whole picture.

The Complete CSBFP Application Checklist

This is where preparation separates successful applicants from rejected ones. Lenders receive incomplete applications constantly, and those get delayed or declined simply because the foundation is missing. Use this checklist methodically.

Phase 1 – Pre-Application Preparation (Do This First)

Business Plan Documentation

Your business plan isn’t a formality. It’s your most powerful tool for demonstrating you’ve thought through what you’re building and why the capital you’re requesting makes strategic sense.

Include these components:

- Executive summary, hitting the highlights in 2-3 pages maximum

- Market analysis proving you understand your customers, competition, and positioning

- Revenue model showing exactly how you make money and what drives profitability

- Growth strategy explaining precisely how this capital accelerates your trajectory

- Management team backgrounds establish credibility and relevant experience

Skip the 50-page MBA-style plan. Lenders want clarity, not volume. They’re asking: Does this person understand their business? Is the opportunity real? Can they execute?

Financial Projections (2-3 Years Forward)

This is where many applications fall apart. Your projections must balance ambition with realism, backed by logic and market data.

Provide:

- Income statements with revenue assumptions you can defend

- Balance sheets showing how assets and liabilities evolve

- Cash flow projections (monthly detail for Year 1, quarterly for Years 2-3)

- Break-even analysis demonstrates when you achieve profitability

- Sensitivity analysis showing best case, expected case, and worst case scenarios

The sensitivity analysis matters more than most entrepreneurs realize. It signals you’ve thought through what happens if things don’t go perfectly. Lenders respect that maturity.

Current Financial Documents

If you’re an existing business, your historical performance speaks loudly.

Gather:

- Last 2 years of corporate tax returns (submitted to CRA)

- Year-to-date income statement and balance sheet

- Personal tax returns for all business owners (last 2 years)

- Personal net worth statement for all guarantors

- Business bank statements covering the last 6 months

Startups without history lean more heavily on projections, but existing businesses must show their track record, warts and all. Trying to hide challenges or embellish performance backfires when lenders verify.

Legal and Registration Documents

These prove you’re legitimate and operating properly.

Assemble:

- Business registration and incorporation documents

- Articles of incorporation and corporate bylaws

- All business licenses and permits required in your industry and location

- Lease agreements or property deeds for your business location

- Vendor quotes for equipment, renovations, or improvements you’re financing

Vendor quotes deserve special attention. If you’re requesting $200,000 for equipment, show the lender actual quotes from suppliers totaling that amount. Guessing or rounding up creates doubt.

Supporting Documentation

These fill in the remaining gaps and verify your identity and credibility.

Include:

- Proof of business ownership (share certificates, partnership agreements)

- Personal identification (government-issued ID for all owners)

- Credit bureau authorization forms (lenders will check anyway)

- Environmental site assessments if purchasing real estate

- Property appraisals for real estate transactions

Review the business credit application document checklist from major lenders to confirm you haven’t missed anything. Different institutions may request additional items, but this foundation covers 90% of the requirements.

Phase 2 – Choosing Your Lender

Not all lenders treat CSBFP applications identically. Some have robust programs with experienced officers who process these regularly. Others participate technically but lack enthusiasm or expertise.

Credit unions and smaller regional banks often show more flexibility and willingness to work with applications that fall slightly outside typical parameters. Major national banks have streamlined processes but sometimes stricter internal criteria beyond CSBFP minimums.

Your strategy: Approach 2-3 lenders with your complete package. Rejection from one doesn’t mean rejection from all. Different institutions assess risk differently, have varying appetites for your specific industry, and evaluate applications through different lenses.

Questions to ask lenders during initial conversations:

- How many CSBFP loans do you process annually?

- What’s your typical timeline from complete application to decision?

- What’s your approval rate for CSBFP applications?

- Are there specific industries or business types you prefer or avoid?

These questions reveal whether you’re talking with someone who knows the program or someone who’ll be learning alongside you. Choose the former.

Phase 3 – Application Submission

Schedule a meeting with a business banking officer rather than just dropping off paperwork. This is a relationship business, and 20 minutes of face time establishes rapport that email never achieves.

During your meeting:

- Present your proposal clearly and confidently (practice beforehand)

- Walk through how you’ll use the capital and what outcomes you expect

- Answer questions directly without defensiveness or evasion

- Demonstrate that you understand both the opportunity and the risks

- Show genuine enthusiasm for your business without veering into unrealistic hype

Submit your complete documentation package at this meeting. Incomplete submissions trigger delays while lenders chase missing items, and each delay increases the odds your file gets deprioritized.

The lender reviews your application using standard underwriting criteria, the Five Cs of credit: Character (your background and integrity), Capacity (ability to repay), Capital (your equity contribution), Collateral (assets securing the loan), and Conditions (economic factors and loan purpose). CSBFP doesn’t eliminate these standards. It just changes the risk equation, making lenders more willing to approve borderline cases.

Phase 4 – Approval and Registration

If your application passes underwriting, you’ll receive a formal offer outlining loan terms, interest rate, repayment schedule, collateral requirements, and personal guarantee expectations. Review these carefully. This is a binding legal commitment, and you need to understand exactly what you’re agreeing to.

Once you accept:

- Sign the loan agreement and personal guarantee documents

- The lender registers your loan with Innovation, Science and Economic Development Canada (ISED)

- You pay (or finance) the 2% registration fee to the government

- After ISED confirms registration, your lender disburses the funds

- You begin making scheduled payments per the agreement

The registration process typically adds 3-5 business days to your timeline. Budget for this when planning around time-sensitive opportunities like vendor deadlines or lease start dates.

Understanding the True Cost of CSBFP Financing

Transparency about costs prevents surprises and allows accurate comparison with alternative financing options.

Registration Fee: 2% of Loan Amount

This mandatory government fee applies to the total loan amount, not just what you borrow. If you’re approved for $300,000, the registration fee is $6,000. This can be financed as part of your loan, meaning you can borrow $306,000 to cover both the project and the fee.

Interest Rates for Term Loans

- Variable rate: Maximum of Prime + 3% (adjusts as the prime rate changes)

- Fixed rate: Maximum of Lender’s residential mortgage base rate + 3% (locked for loan term)

Current prime rates vary by institution but hover around 6-7% as of 2026, making maximum CSBFP variable rates roughly 9-10%. Fixed rates depend on mortgage rate benchmarks at each lender.

Interest Rates for Lines of Credit

- Maximum: Prime + 5%

The higher rate reflects the flexibility and convenience of draw-as-needed access.

Additional Lender Fees

Lenders can charge the same setup, administration, renewal, and early prepayment fees they charge for conventional loans. These vary by institution and typically include:

- Application or setup fees ($500-$1,500)

- Annual renewal fees for lines of credit

- Appraisal and legal fees for real estate transactions

- Early repayment penalties if you pay off fixed-rate loans ahead of schedule

Personal Guarantee Implications

Most lenders require personal guarantees from business owners, meaning you’re personally liable if the business can’t repay. These can be unlimited (you’re responsible for the full debt) or limited (capped at a specific amount). Negotiate this during the approval process.

Equity Contribution Expectations

Lenders typically expect you to contribute 10-30% of total project costs from your own capital. If you’re purchasing $500,000 in equipment, they’ll want to see you putting up $50,000-$150,000. This demonstrates commitment and reduces their risk exposure.

For detailed cost comparisons with alternatives, explore understanding CSBFP cost structures to evaluate whether CSBFP or equipment leasing makes more sense for your specific situation.

Common CSBFP Application Mistakes (And How to Avoid Them)

Learning from others’ errors shortens your path to approval.

Mistake #1: Incomplete or Inaccurate Documentation

This tops the list because it’s both the most common and the most preventable. Missing financial statements, outdated projections, and unexplained gaps in your business history create doubt and delays.

Solution: Use the checklist systematically. Have your accountant review everything for accuracy. Triple-check dates, signatures, and calculations. Treat this like you’re being audited, because effectively, you are.

Mistake #2: Unrealistic Financial Projections

Overly optimistic revenue forecasts, underestimated expenses, and the absence of sensitivity analysis scream “amateur hour” to experienced lenders. They’ve seen thousands of projections, and they know what realistic growth looks like in your industry.

Solution: Ground your projections in market data, industry benchmarks, and conservative assumptions. Include worst-case scenarios demonstrating you’ve thought through what happens if growth comes slower than hoped. Lenders appreciate entrepreneurs who understand risk, as identified in red flags lenders watch for.

I coached an entrepreneur who initially projected tripling revenue in Year 1 based purely on enthusiasm. Through working together, we developed projections grounded in realistic customer acquisition costs, conversion rates, and market penetration timelines. The revised projections showed 40% growth, still strong but defensible. That realism built trust with the lender, and he secured funding.

Mistake #3: Insufficient Loan Amount Requested

Entrepreneurs often calculate only the obvious costs, the equipment price tag, the construction estimate and forget installation, freight, permits, working capital buffer, fees, and contingencies. Then they run out of money mid-project.

Solution: Calculate total project cost meticulously. Add 10-15% contingency for unexpected expenses. Request enough to complete the project fully, not just to get started.

Mistake #4: Poor Credit Management Leading Up to Application

Late payments in the months before applying, maxed-out credit cards, collections notices, multiple credit inquiries, these damage your application even if your business fundamentals are solid.

Solution: Clean up your credit 6-12 months before applying. Pay bills on time, reduce credit utilization below 30%, and resolve any collections or disputes. While there’s no official minimum credit score, most lenders prefer seeing 650 or higher, according to realistic CSBFP approval timelines from experienced advisors.

Mistake #5: No Demonstrated Industry Experience

Jumping into a completely new industry without a relevant background raises massive red flags. Lenders wonder: How will you know what you don’t know? Who’s ensuring you don’t make expensive rookie mistakes?

Solution: If you’re entering a new field, bring in an experienced partner or advisor. Highlight transferable skills from previous roles. Consider starting with consulting or contract work before launching the full operation to prove you understand the space.

Mistake #6: Treating Application as Transaction vs. Relationship

Submitting your paperwork and then disappearing until the lender reaches out, responding slowly to information requests, and being defensive when asked clarifying questions, these behaviors suggest you’ll be a difficult borrower to work with.

Solution: View your lender as a partner in your success. Respond to requests same-day when possible. Answer questions openly and directly. Demonstrate coachability and professionalism. These soft factors influence decisions more than most entrepreneurs realize.

Mistake #7: Not Shopping Around

Taking your first rejection as the final word wastes opportunity. Different lenders have different risk appetites, industry preferences, and internal policies that have nothing to do with your business quality.

Solution: If rejected, understand the specific reasons, address those concerns, and approach 1-2 different lenders. What’s too risky for one institution might be perfectly acceptable to another.

What If You Get Rejected? Your Next Steps

Rejection stings, but it’s feedback, not failure. I’ve seen entrepreneurs turned down initially secure funding six months later after strengthening their applications.

Request specific reasons for denial in writing. Lenders must provide them, and vague explanations like “doesn’t meet our criteria” aren’t sufficient. Push for details: Was it credit history? Insufficient collateral? Weak projections? Industry concerns?

Common rejection reasons include:

- Inadequate cashflow to service proposed debt payments

- Credit history showing a pattern of late payments or defaults

- Insufficient equity contribution from owners

- Business plan gaps or projections deemed unrealistic

- Lack of adequate collateral or security

- Industry-specific concerns (lender discomfort with your sector)

Once you understand why, create an action plan:

- Address the specific weaknesses identified

- Strengthen vulnerable areas over 3-6 months

- Consider requesting a smaller loan amount if your ask exceeded comfort levels

- Improve your credit score if that was the sticking point

- Develop more conservative financial projections with robust support

- Gather additional documentation proving market demand

- Approach a different lender with your improved package

Alternative financing options exist if CSBFP remains out of reach, including equipment leasing, invoice factoring, alternative lenders with different criteria, and Canadian small business funding alternatives you might explore.

The timeline matters here. Don’t reapply immediately with the same package. Give yourself 3-6 months to genuinely improve weak areas. Rushing back with minimal changes wastes everyone’s time and damages your credibility.

Through resilience mindset training, you can reframe rejection as valuable intelligence about what needs to be strengthened. Every successful entrepreneur faces setbacks. What separates winners from those who quit is how they respond to those moments.

Is CSBFP Financing Right for Startups?

Absolutely yes and this distinguishes CSBFP from most traditional financing options. Startups are explicitly eligible, provided they meet program requirements. You don’t need years of operating history or proven revenue to qualify.

What startups must demonstrate:

- Viable business model with clear path to profitability

- Market validation (customer research, pilot testing, pre-sales, letters of intent)

- Realistic financial projections grounded in research, not hope

- Relevant founder experience in the industry or adjacent fields

- Advisory team or partners who fill experience gaps

- Personal financial commitment showing you have skin in the game

- Detailed use of funds tied directly to revenue generation

Startup advantages: Government backing removes the “no track record” barrier that normally blocks new businesses from traditional loans. If your plan is solid and your commitment is clear, CSBFP creates access.

Startup challenges: Higher scrutiny on projections since there’s no history to validate assumptions. Lenders may require larger equity contributions (closer to 30% than 10%) to offset uncertainty. Your business plan and founder’s credibility carry a heavier weight than they would for established businesses.

Real talk: A strong business plan with realistic projections matters infinitely more than operating history. I’ve seen startups with thorough plans secure CSBFP funding while established businesses with messy financials and vague growth strategies get rejected. Preparation beats history.

How Long Does CSBFP Approval Actually Take?

Managing expectations prevents frustration and helps you time applications around business needs.

Official Timeline: 2-6 Weeks from Complete Application Submission

Note the emphasis on “complete.” If you submit an incomplete package, the clock doesn’t start until the lender has everything they need.

Factors Affecting Timeline:

- Application completeness (biggest factor by far): Missing documents add days or weeks while you gather and resubmit items

- Lender CSBFP experience: Institutions processing these regularly move faster than those that rarely see CSBFP applications

- Request complexity: Equipment purchases process faster than real estate transaction,s requiring appraisals and environmental assessments

- Time of year: The fourth quarter can slow down as lenders prioritize year-end activities

- Your responsiveness: Same-day responses to information requests versus multi-day gaps dramatically impacts total timeline

Fastest Approvals: “Boringly Complete” Applications

The applications that sail through in 2-3 weeks share common characteristics: every document present and accurate, financial statements clean and logical, no surprises in credit history, clear and realistic use of funds, relevant industry experience evident, and prompt responses to any follow-up questions.

Strategy to Accelerate Your Timeline:

Choose lenders with established CSBFP programs. Have all documents gathered before the initial meeting. Respond to lender requests within 24 hours. Build buffer time into your business planning (don’t apply when you need funding next week).

Realistic Expectation:

Four weeks from complete submission to funding disbursement represents the typical experience for well-prepared applications. Plan for six weeks to be safe, and you’ll be pleasantly surprised if it happens faster.

FAQs

What are the maximum loan amounts for the CSBFP in 2026?

In 2026, a small business can access up to $1.15 million in total financing under the Canada Small Business Financing Program. This is divided into two parts: a $1,000,000 term loan for fixed assets (land, buildings, or equipment) and a $150,000 line of credit for working capital. Within the term loan, there is a sub-limit of $500,000 for leasehold improvements and equipment, and $150,000 specifically for intangible assets like franchise fees or intellectual property.

2. Can I use a CSBFP loan to buy an existing business or franchise?

Yes, you can use CSBFP financing to purchase an existing business or franchise, provided the funds are used for eligible assets such as equipment, leasehold improvements, and commercial real property. You can also allocate up to $150,000 for intangible assets like goodwill or franchise fees. However, the program cannot be used to purchase shares in a company; it must be an asset-based purchase to qualify for the government guarantee.

3. What is the “365-day rule” in the CSBFP program?

The 365-day rule allows Canadian entrepreneurs to use CSBFP funds to reimburse themselves for eligible business expenses made within the one-year period prior to the loan approval date. This means if you purchased equipment or paid for renovations using high-interest credit or personal savings in the last 12 months, you can transition that debt into a government-backed term loan with more favorable interest rates.

4. What are the interest rates for CSBFP loans in 2026?

Interest rates for CSBFP loans are regulated and capped to protect small businesses. For term loans, the maximum rate is Prime + 3% (variable) or the lender’s residential mortgage base rate + 3% (fixed). For lines of credit, the maximum rate is Prime + 5%. Additionally, all borrowers must pay a one-time 2% government registration fee, which can be financed as part of the total loan amount to preserve cash flow.

5. How long does it take to get approved for a CSBFP loan?

A well-prepared CSBFP application typically takes 2 to 6 weeks from the time you submit a complete documentation package to the lender. Because the government does not lend the money directly, the timeline depends largely on your bank or credit union’s internal underwriting process. To accelerate approval, ensure your package includes a solid business plan, two years of financial projections, and formal vendor quotes for all planned purchases.

Conclusion

The Canada Small Business Financing Program isn’t a lottery or a favor. It’s a strategic financing tool designed specifically for businesses at your stage, proven enough to be bankable, ambitious enough to need capital, positioned at that crucial growth inflection point where the right resources unlock exponential impact.

You’ve seen the complete roadmap: confirm your eligibility, prepare your documentation systematically, choose lenders strategically, submit complete applications, and manage the approval process professionally. The three pillars that determine success haven’t changed: eligibility clarity, documentation completeness, and realistic financial planning that demonstrates you understand both the opportunity and the challenges.

Here’s what matters most: You don’t need perfect credit, years of operating history, or extensive collateral. You need a solid plan, genuine commitment, and the discipline to prepare thoroughly. Those are skills you can develop starting today.

Access to capital isn’t a gift bestowed on the lucky. It’s a capability you build through understanding what lenders need to see, providing that evidence systematically, and positioning your business as an investable opportunity. Every entrepreneur who secured CSBFP funding started exactly where you are now, researching, planning, preparing.

If you’re ready to move forward, start with the checklist. Assess where you’re strong and where you need to strengthen. Give yourself adequate time to prepare properly rather than rushing into premature applications. Approach lenders when you’re genuinely ready, not when you’re desperate.

When you need support developing your business strategy, creating realistic financial projections, or positioning your growth plan for lender confidence, finding business coaching support can accelerate your progress and help you avoid expensive mistakes.

Your business is worth the capital required to scale it properly. The opportunity is real, the program is accessible, and the funding exists. What separates businesses that secure it from those that don’t is preparation, persistence, and strategic execution. You’ve got what it takes. Now go make it happen.

Unleash Your Power: Stand Out, Take Action, and Create the Success You Want