You’ve built your expertise. You’re ready to add coaching to your business. But navigating Canada’s legal landscape feels overwhelming, with business structures, GST/HST, insurance, and contracts. Where do you even start?

Key Takeaway:

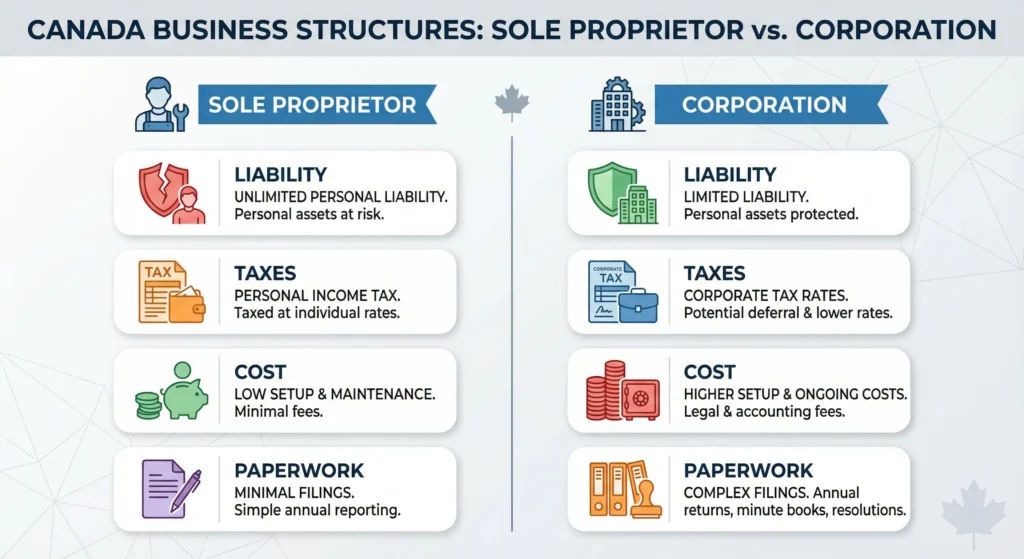

- Coaching is unregulated in Canada no specific licenses needed, but choose a business structure: sole proprietorship (simple, low cost, personal liability) or corporation (liability protection, tax benefits, higher setup/complexity); most start as sole prop and incorporate later. [1]

- Register business name provincially if not using your own ($60–$300 fees vary); obtain Business Number and register for GST/HST mandatory over $30,000 revenue (optional below for credits); file taxes on personal T1 (sole) or corporate T2, deduct expenses like insurance/home office. [1]

- Use strong written contracts (electronic signatures valid) covering services, payments, confidentiality, IP, liability limits, and termination to protect against disputes no result guarantees; strongly recommend professional liability (E&O ~$315/year) and general liability insurance (~$250/year) for risk coverage and credibility. [2]

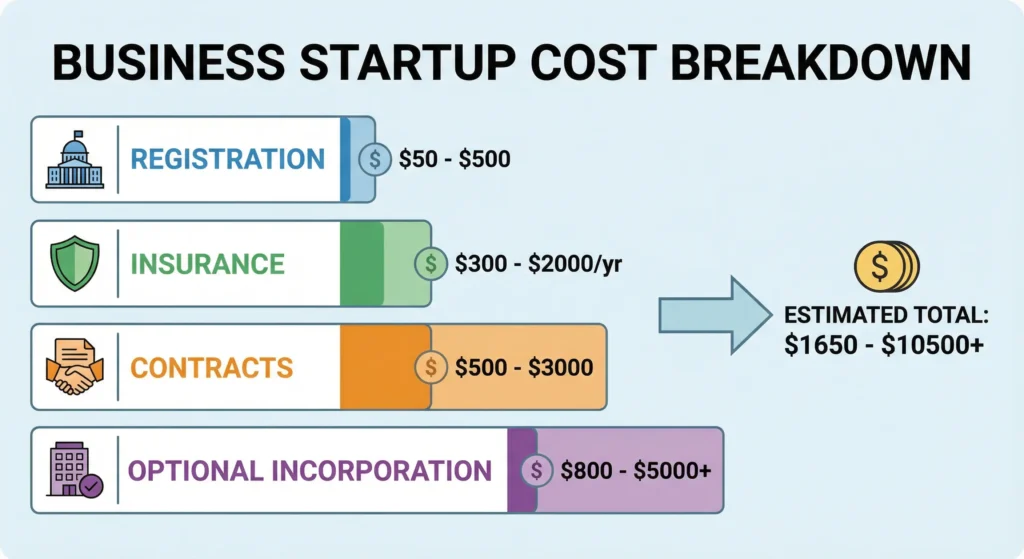

- Provincial differences mainly in name registration fees/processes; keep records 6 years; startup costs $500–$2,000; consult accountant/lawyer for taxes/contracts compliance with PIPEDA for privacy essential. [2]

Bottom Line: Start simple as a sole proprietorship with registered name, solid contracts, and liability insurance; scale to corporation for growth focus on compliance, protection, and professionalism for a thriving legal coaching business in Canada.

- Source: Unleash Your Power – Coaching Business In Canada Legally

- Source: Article Details & Recommendations

Here’s the truth: launching a coaching business in Canada doesn’t require a law degree. What it requires is clarity on the essentials, smart protection, and the confidence to move forward decisively. This practical guide walks you through every legal step to launch your coaching business in Canada with confidence, clarity, and protection.

The best part? Coaching is an unregulated profession in Canada. You don’t need government licenses or regulatory approvals to start helping clients transform their lives and businesses. What you do need is a solid legal foundation that protects both you and your clients while positioning you as a professional.

Choose Your Business Structure

Your first major decision is how to structure your coaching business. In Canada, you have three main legal structure options: sole proprietorship, partnership, or corporation. For most coaches adding services to an existing business, the choice comes down to sole proprietorship versus incorporation.

Sole Proprietorship: Simple and Cost-Effective

A sole proprietorship is the simplest way to start. You and your business are legally the same entity, which means a straightforward setup and minimal paperwork. According to Canada Revenue Agency’s guidelines, you’ll report business income on your personal T1 tax return using Form T2125.

The advantages are clear: low startup costs, easy administration, and complete control over your business decisions. You can operate under your own name without registration, or register a business name if you want something different. The trade-off? You have unlimited personal liability, meaning your personal assets could be at risk if your business faces legal claims.

Corporation: Liability Protection and Tax Benefits

Incorporating creates a separate legal entity with its own rights and responsibilities. This structure offers significant liability protection your personal assets remain separate from business liabilities. You may also access tax planning strategies that allow you to defer and potentially reduce income tax, though you’ll need to consult with an accountant about your specific situation.

The considerations: higher setup costs, more complex record-keeping, including maintaining a minute book, and the requirement to file a separate T2 corporate tax return. Incorporation makes sense when you’re earning significant revenue or want maximum liability protection.

When to Choose Each Structure

Start with a sole proprietorship if you’re testing the coaching waters or keeping things simple. Many successful coaches have operated this way for years. Consider incorporating when your annual revenue exceeds certain thresholds, you want liability protection, or tax planning becomes beneficial. You can always incorporate later, as your business grows, you’re not locked into your initial choice.

What Are the Registration Requirements for Coaches in Canada?

Registration requirements depend on your revenue and how you structure your business. Here’s what you need to know.

If you’re operating under a business name different from your personal name, you must register that name with your provincial or territorial government. Each province has its own registration process and fees, so check your specific jurisdiction’s requirements.

The critical threshold to understand is the $30,000 small supplier threshold for GST/HST. Once your total revenue from taxable supplies exceeds this amount in any single calendar quarter or over four consecutive calendar quarters, you must register for GST/HST. According to HST registration requirements, you have 29 days from the date you exceed the threshold to register.

Here’s what matters: when you register for GST/HST, you receive a Business Number that also serves as your identifier for other Canada Revenue Agency programs. You can register online through Business Registration Online, which is the fastest method and provides your number immediately.

The practical reality for many coaches starting out: if you’re earning under $30,000 annually, you’re considered a small supplier and registration is optional. However, voluntary registration allows you to claim input tax credits on business expenses, which can be financially beneficial even before hitting the threshold.

Protect Your Business with Insurance

While insurance isn’t legally required for coaches in Canada, it’s one of the smartest investments you’ll make. The coaching industry is unregulated, which means anyone can claim to be a coach but it also means you’re vulnerable to liability claims even when you’ve done nothing wrong.

Professional Liability Insurance (Errors & Omissions)

Professional liability insurance for coaches protects you if a client alleges financial loss, professional negligence, or failure to deliver services as promised. Even unfounded claims require legal defense, and those costs can devastate an uninsured business.

Premiums start around $315 annually for a $500,000 policy limit, making this remarkably affordable protection. This coverage typically includes defense costs, settlement expenses, and judgments if you’re found liable.

Commercial General Liability Insurance

This coverage protects against third-party bodily injury or property damage claims. If a client slips and falls in your office or you accidentally damage equipment at a client’s location, commercial general liability insurance covers medical expenses, legal fees, and damages. Expect premiums starting around $250 annually for $1 million in coverage.

Optional Coverage to Consider

Depending on how you operate, you might also consider cyber liability insurance to protect against data breaches, especially if you store client information digitally. Commercial property insurance makes sense if you have a dedicated office space with valuable equipment.

According to liability insurance for coaches experts, many professional associations and some clients require proof of insurance before working with you. Having coverage in place positions you as a credible, professional business owner.

Do You Need a Contract for Coaching Clients in Canada?

Absolutely. While not legally mandatory, coaching contracts are your first line of defense and clarity. They transform verbal agreements into enforceable promises that protect both you and your clients.

A solid coaching contract establishes clear expectations from day one. It outlines what services you’ll provide, how you’ll deliver them, what clients can expect, and what you need from them to create results. When expectations are crystal clear, misunderstandings disappear.

The good news about Canadian contract law: electronic signatures are legally binding. Whether you use e-signature platforms like DocuSign or a simple checkbox with hyperlinked agreements at checkout, digital contracts are valid and enforceable. This makes client onboarding seamless and professional.

Essential Contract Clauses

Your coaching contract should include several essential coaching contract clauses. Start with the scope of services, be specific about what you will and won’t provide, session frequency, duration of the coaching relationship, and communication expectations.

Payment terms need absolute clarity: total fees, payment schedule, late payment consequences, and your refund policy. Here’s something many coaches miss: in Canada, you cannot charge interest or late fees unless they’re explicitly included in your initial contract.

Confidentiality protects both parties. Outline what information remains confidential, exceptions to confidentiality, and consequences of breaches. This builds trust while protecting sensitive business and personal information.

Intellectual property clauses specify who owns the materials, frameworks, and content shared during coaching. Typically, you retain ownership of your proprietary materials while clients receive a license to use them for personal development, not to reproduce, share, or sell.

Include a limitation of liability clause. You cannot guarantee client results because transformation requires client action and commitment. This clause manages expectations and protects you from being held responsible when clients don’t implement what you teach.

Finally, establish termination terms. Under what conditions can either party end the agreement? What happens to prepaid fees? How much notice is required? Clear exit terms prevent awkward situations and protect your income.

Research shows that coaching contracts protect your business by reducing disputes, establishing professional boundaries, and creating accountability. They’re not about distrust; they’re about clarity, which builds trust.

Set Up Your Legal Foundation

Beyond structure, registration, insurance, and contracts, you need a few additional legal elements in place.

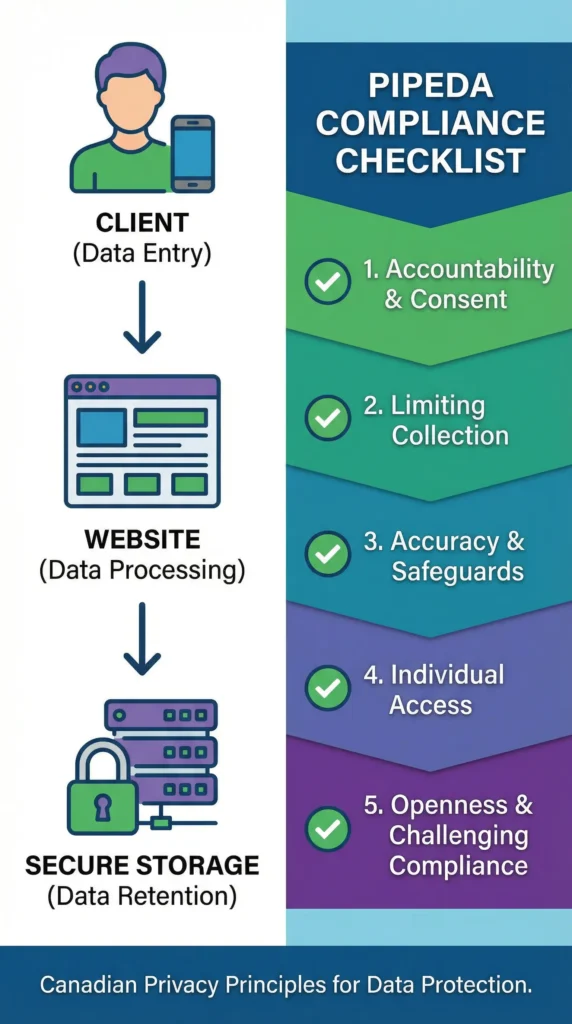

Privacy Policy and Website Requirements (PIPEDA)

If you’re collecting personal information through your website and you almost certainly are, Canadian privacy law requires a privacy policy. The Personal Information Protection and Electronic Documents Act applies when you collect client names, email addresses, payment information, or session notes.

Your privacy policy must explain what information you collect, how you use it, when you share it with third parties like payment processors or email platforms, and how clients can access or correct their information. This isn’t optional legalese; it’s a legal requirement with real consequences for non-compliance.

Terms of Service and Disclaimers

Your website should include terms of service that govern how people use your site and disclaimers that clarify your role. Make it clear you’re a coach, not a licensed therapist, financial advisor, or medical professional. Define your scope of practice and set appropriate boundaries around what coaching can and cannot address.

These disclaimers protect you from liability while managing client expectations. They’re particularly important if you work in specialized niches where boundaries with regulated professions might blur.

Record-Keeping for Tax Compliance

Maintain detailed records of all business income and expenses. The CRA requires you to keep supporting documents for at least six years. Good record-keeping isn’t just about tax compliance it helps you track business growth, claim all eligible deductions, and make informed decisions about your coaching practice.

If you’re registered for GST/HST, you’ll need to track the tax you collect from clients and the tax you pay on business expenses. Your GST/HST returns require this documentation, and proper records ensure you claim all available input tax credits.

Frequently Asked Questions

Do I need a license to be a coach in Canada?

No. Coaching is an unregulated profession in Canada with no government licensing requirements. You can start coaching clients immediately without mandatory certifications, though professional credentials from organizations like the International Coaching Federation enhance your credibility.

How much does it cost to start a coaching business in Canada?

Expect $500-$2,000 in startup costs. This includes business name registration ($60-$300), professional liability insurance ($315+ annually), and general liability insurance ($250+ annually). Incorporation adds $200-$1,000 in setup fees. These are baseline legal costs; marketing and certifications increase your investment.

When do I need to register for GST/HST as a coach in Canada?

You must register when your revenue exceeds $30,000 in one calendar quarter or over four consecutive quarters. You have 29 days to register after crossing this threshold. Below $30,000, registration is optional but allows you to claim input tax credits on business expenses.

Is coaching income taxable in Canada?

Yes, all coaching income is taxable. Sole proprietors report income on their T1 tax return using Form T2125. Corporations file a separate T2 return. You can deduct legitimate business expenses like insurance, training, and home office costs. Keep records for six years as required by the CRA.

Do I need a written contract with coaching clients in Canada?

While not legally mandatory, written contracts are essential. They protect both parties by establishing clear expectations, payment terms, confidentiality, and service boundaries. Electronic signatures are legally binding in Canada. Without a contract, you have no protection if clients dispute charges or services.

What insurance do coaches need in Canada?

Coaches should carry Professional Liability Insurance (from $315/year for $500K coverage) and Commercial General Liability Insurance (from $250/year for $1M coverage). While not legally required, insurance protects against claims of negligence, bodily injury, and property damage. Many clients and associations require proof of coverage.

Your Transformation Starts Today

You now have the complete legal roadmap to launch your coaching business in Canada with confidence. You understand the three business structure options and when each makes sense. You know exactly when you need to register for GST/HST and how to do it. You’ve learned why insurance and contracts aren’t optional extras; they’re essential protection for your business and peace of mind.

Here’s what I’ve learned in over 20 years of helping professionals start their coaching businesses: the legal foundation isn’t what stops people from launching; it’s the fear of getting it wrong. But now you have clarity. You know the essentials. You can move forward decisively.

One of our clients, Darren, came to us feeling blocked from starting his own business despite having the skills and income. Through identifying and eliminating his goal blocks, he unlocked radical shifts in his thinking and behaviors, the same mindset transformation that turns legal compliance into confident business ownership.

Take decisive action today. Choose your business structure. Register your business name if needed. Set up your GST/HST registration when you hit the threshold. Invest in insurance. Create your client contract template. Build your legal foundation properly, and you’ll attract clients with confidence rather than holding back in fear.

Your expertise deserves to be shared. Your future clients need what you offer. The legal steps aren’t obstacles; they’re the professional framework that supports your business.

Ready to elevate your coaching practice beyond legal basics? Explore our business coaching programs and professional coaching certifications to master the strategies that turn compliant businesses into thriving practices. Your transformation starts today. Take the first step.